Hey all, John L10 here!

Over the course of my trading career, I have had the opportunity to meet both virtually and in person, equity traders who consistently make a few thousand per day. All of these traders that I’ve met have had different techniques on how they attack the market.

Some relied on semi-automated systems (systematic trading) that takes advantage of short-term arbitrage opportunities, some were mid to large-cap long/short traders, and the rest were either simply discretionary traders going long or short small-caps. Most of the small-cap traders were either very long-biased, or very short-biased. I chose the long side; now allow me to explain why.

Small Cap Stocks

Each day, there are always companies on the stock market putting out good news and as a long biased trader, that’s the kind of action we gravitate to. The market in general, is a machine driven to just keep going up, even though if it looks like small caps have a hard time keeping up, the jobs of the executives at these companies are to get their stock to go up (although in the worst companies, and in penny stocks, their jobs are to sell shares! Which is why we don’t trade OTC stocks).

So, if the market is meant to go up – why fight it? As a long-biased intraday trader, I can take advantage of short-term price action and not be burdened with holding a stock over time. Traders who choose to short small-caps, which by the way, is a perfectly acceptable strategy, have to abide by a different strategy. They have to babysit their position on a longer time frame to make sure it doesn’t blow up their account.

That’s not only a risk that I am not interested in, but I just don’t feel like being at my computer all day, especially in pre or post market to ensure the position doesn’t go against me. That doesn’t even count any random news that might get released over the weekend or social media nonsense.

Monthly Day Trading Profit Targets

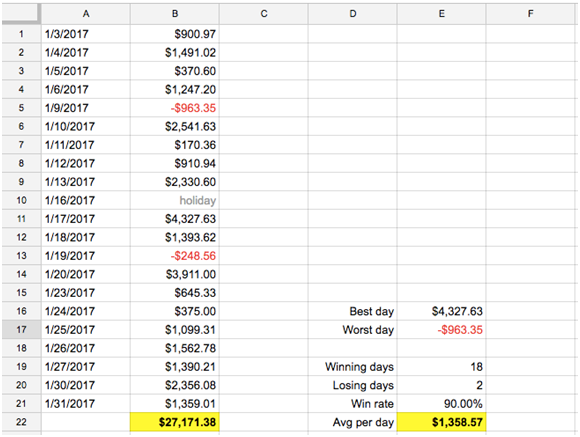

The reality is, I am closing up January, of 2017, with $27,100 and Ross just achieved a $40,000 month and we’re both trading small cap stocks. Both of us only trade the first few hours of the open. Would we both like a $60,000 month, a $100,000 month in trading profits? Of course, but, we have to first admit that, it may not necessary, and, maybe it shouldn’t be necessary.

I am one of those people out there who stresses diversification of income. I don’t want to rely on trading only, and I don’t want 99.98% of my income to come from trading. Two hours after the market open, I am flat on all my positions, and I work on my other ventures. I have two other things I am involved with that churn out income and they are both growing.

I am up about $47K on the month between all income streams. So why am I telling you all of this? Because trading is just the first step to financial freedom! First you are losing, then you are breakeven, and then you are making some crumbs and lunch money.

Soon, you are substituting a meager salary and then exceeding your own salary. You can guess what comes next, but it isn’t a full time job! What comes next is freedom, choice of working on what you want, growing real wealth. Some traders have a goal of making an extra $200 a day, while others are looking to escape the rat race entirely. Either goal is worthy to achieve and trading can help you get there.

I’ve decided to post my P&L for this month, but I doubt I will continue to do so due to the additional pressure. I admire Ross because he has immense pressure to succeed in real time and puts out hard goals for everyone to hear. For me, I don’t have any “goals” for the month other than to not lose money! Again, I respect all trading strategies but each of us needs to know which strategy is best for our current life circumstances. If you have any questions about this topic, I am available inside Warrior Trading’s Inner Circle chat.

John L10’s January 2017 Small Cap Stocks Gain & Loss Statistics

Whether your strategy is to trade large-caps or small-caps, these numbers are achievable and I hope that it provides inspiration to you. If you are in the regular WT chat room, but haven’t done any of the education, you are doing yourself a disservice. That isn’t even a pitch it’s just a fact. The faster you learn the better off you are and I can’t stress that enough. See you tomorrow!