-

Value For Investors

-

Value For Active Traders

-

Commissions & Fees

-

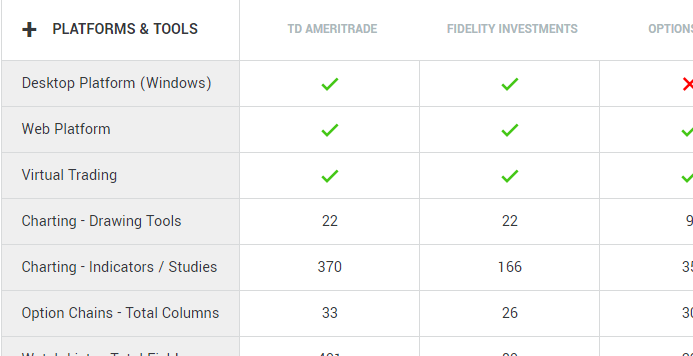

Platform & Tools

-

Customer Service

-

Order Execution

-

Mobile Trading

-

Options Trading

Summary

TD Ameritrade is now commission FREE. This is huge for investors and day traders alike. What we really like about Ameritrade is their sophisticated platform, Think or Swim, as well as their excellent customer service and sophisticated tools.

TD Ameritrade’s Thinkorswim trading platform is widely considered one of the best trading platforms available. It is a desktop application that offers access to real-time data streaming, charting, technical studies, stock scanners, research reports, and more.

It has solid educational resources, including a learning center with instructional videos, online courses and trading demonstrations.

One of the highlights is the “On Demand” feature that allow traders to test strategies and practice using the platform using actual recordings of the market action without risk. These are often considered premium features by other online brokers.

All of these tools as well as the entire Thinkorswim platform are available to all TD Ameritrade customers for free.

In 2015 Barron’s magazine rated Thinkorswim’s parent company – TD Ameritrade – #1 for Beginner Traders and #1 for Long Term Investing, and gave it top scores in the Mobile Trading, Range of Offerings, Research Amenities, Customer Service and Education categories.

Kiplinger’s Personal Finance magazine ranked it #1 for IRA accounts. SmartMoney magazine gave it a 5-star rating (the highest available) for Banking Services, Trading Tools and Research.

Where TD Ameritrade Thinkorswim Hits the Mark

Research and tools: Thinkorswim offers virtually everything an advanced trader would want in a platform, including customization of the workspace and the ability for traders to share their customizations with each other. Investors can also use scanners to filter stocks and options, view heat maps, use the company profile tool to analyze revenue and predict how it will affect returns, and access extensive third-party research.

The platform has an active trader community and forum that is used to share watch lists, charts and strategies, and streaming CNBC, Benzinga, and Dow Jones News are included. Thinkorswim also offers ThinkBack feature that permits traders to backtest strategies and access historical options prices.

Users may also perform a chance analysis for any existing or potential trade. One of the finest features of Thinkorswim is Analysis tab. It allows users to instantly view an active risk graph that will exactly show the most probable look of any trade setup. In addition to this, it will also instantly show the latest risk graph for any planned adjustments to the current trades a user might want to make.

Mobile trading: The Thinkorswim mobile app, available for Apple and Android, closely mimics the desktop platform. Investors can fund their accounts, initiate trades, watch streaming news and view charts, all from their mobile devices.

Investor education: The platform’s learning center has a wealth of instructional videos and how-to advice, there are daily “Swim Lessons” and platform demonstrations, and traders can practice trading with virtual margin accounts using the “On Demand” feature.

Executions: Historically Thinkorswim has had the reputation of slow executions and not a good platform for day traders, however the platform has Hotkeys and recently they have made considerable efforts to provide fast and seemless transactions.

Where TD Ameritrade Thinkorswim Misses the Mark

Margin rates: Traders interested in margin accounts (which have a $2,000 minimum) will be disappointed in TD Ameritrade’s margin rates, which — like their commissions — are higher than average. The base rate is currently 7.75%, with a maximum margin rate of 9%.

Short List: TD Ameritrade’s short list is almost nonexistent. If you are a short biased trader you would not be happy.

Accessibility: Newer traders could be overwhelmed by the level of information and tools available and will feel more comfortable with a more streamlined platform or even the company’s standard web trading platform.

TD Ameritrade is now Commissions FREE

Schwab shocked the trading world on October 6th when they announced that their cutting commissions on stock and ETF trades to zero. TD Ameritrade, E-Trade and Fidelity quickly followed, cutting their commissions to zero as well.

This is huge for active traders with less capital, especially for those who don’t meet the minimum requirements to skirt the pattern day trader rule. Many options are now open to budding day traders.

TD Ameritrade’s thinkorswim platform is rigorous enough to suit the needs of most new active traders with their high quality data, endlessly customizable charts, and powerful stock scanning technology.

A New Paper Trading Alternative

Zero trading commissions opens-up a new alternative to paper trading, which always suffered the drawback of “no skin in the game.” Now traders can deposit small amounts like $100 and begin trading with that. They’ll be using a great active trading platform in thinkorswim, and there will be something on the line. As they learn, they can begin to deposit more and slowly size up.

Back when commissions were $5 per trade, each trade had to be pretty big to negate the effects of the fee on your profits. This especially caused issues for those trading parabolic penny stocks, in which $1,000 can quickly turn into $500.

Of course, when trading with a very small amount of money like $100, the trading psychology challenges aren’t as present, but it’s certainly better than paper trading, especially when it comes to active trading in lower float stocks. In this type of trading, execution matters big time. Paper traders of these stocks are always surprised when they can’t get perfect fills as they did in their paper account.

Multiple Accounts

Between TD Ameritrade, E-Trade, Fidelity, and Schwab, undercapitalized traders can open multiple accounts to skirt the PDT rule, without worrying about commissions.

Best Discount Broker For Active Traders

Now that commissions are zero, I think TD Ameritrade offers active traders the best value. Their active trading platform, thinkorswim rivals some of the trading industry’s best platforms and is still used by many advanced traders.

Thinkorswim

Thinkorswim is a platform built for active traders, but it wasn’t originally developed by TD Ameritrade. They bought it from Tom Sosnoff, a name you might have heard before because Sosnoff now runs options brokerage TastyWorks and financial media outlet TastyTrade.

Thinkorswim is the main benefit of using TD Ameritrade over the several other zero-commission discount brokers competing for your assets.

Charting

Thinkorswim’s charts are like a blueprint for the financial markets. You can set up most types of charts; tick, range, heiken ashi, etc. and organize them in whichever fashion you please, for free.

Using the flexible grid, you can quickly perform top-down technical analysis on the markets.

Above is multiple market internal indicators that give me an indication of what the market is doing “under the hood,” which tells me whether a rally is supported by the majority of stocks moving up, or just a few leading names.

Here’s another grid that features weekly charts of all sector ETFs with their relative strength against the S&P 500. This allows me to identify which sectors are outperforming and trending, allowing me to find the leading stocks within those sectors to put the odds further in my favor. This is known as “trading the sector cycle.”

Stock Scanner

Regardless of the trading platform they use, active traders normally have to pay for a stock scanner like Trade-Ideas because the scanner built into their trading platform isn’t versatile enough. I think TD Ameritrade’s Stock Hacker is the strongest built-in scanner I’ve seen on a retail platform.

The most useful aspect of the scanner is you can set it up as a watchlist on the sidebar of your platform, like below.

The above watchlist is continually scanning for stocks that are down more than 10% on the day with significant volume.

Final Thoughts

Between cutting their commissions to zero, offering a wide range of products to trade, and free access to Thinkorswim, TD Ameritrade seems to be the best “bang for your buck” in the discount brokerage space right now, at least for active traders.

This is huge for active traders with less capital, especially for those who don’t meet the minimum requirements to skirt the pattern day trader rule. Many options are now open to budding day traders.

TD Ameritrade’s thinkorswim platform is rigorous enough to suit the needs of most new active traders with their high quality data, endlessly customizable charts, and powerful stock scanning technology.

I’ve always been a big fan of Ameritrade, especially for the paper trading. It’s so brilliant the way they focus on paper trading because as soon as traders are ready to go live, of course they’ll want to stay with Ameritrade.

A big part of learning is simply getting comfortable with how to use a platform.

Let us know how you feel about Ameritrade in the comments below!