-

Value For Investors

-

Value For Active Traders

-

Commission & Fees

-

Platform & Tools

-

Customer Service

-

Order Execution

-

Mobile Trading

Summary

As far as full service brokers go, Fidelity is one of the best. They have all the shoots and whistles for investors but if you are an active trader then you may want to look elsewhere like Tradestation or Lightspeed who offer better commissions and a more powerful platform.

Pros

- Good desktop platform

- Excellent pricing

- Good selection of learning materials

- Unbeatable customer service

- Penny stocks and OTC securities

- Foreign equities are available

- Whole-dollar investing

Cons

- No futures or forex

- Commissions on global stocks are high

- No browser platform

- Limited selection of routes and technical indicators

Although Fidelity isn’t regarded as a premium day-trading broker, it does deliver multiple services that short-term traders should consider. These are in addition to the broker’s other great services, which can be used alongside Fidelity’s day-trading tools.

Brief Overview

Founded in 1946, Fidelity started with mutual funds for long-term investors. But it has this amazing ability to adapt as the world around it changes. Today, it offers trading in stocks, options, and ETFs with advanced software at unbeatable pricing. And if one share of a particular security is too expensive for you, Fidelity has something for that, too.

Services Offered

Fidelity offers many account types. They include:

- Individual and joint accounts

- IRA’s

- Business accounts

- Cash management accounts

- Self-employed 401(k)’s

- Robo accounts

- Custodial accounts

There are several investment vehicles Fidelity customers can trade:

- Stocks

- Bonds

- ETF’s

- Closed-end funds

- Options, including index options

- Mutual funds

To trade these financial instruments, Fidelity provides a website with a pop-up trade ticket. The broker-dealer also has a mobile app and a desktop platform.

Fidelity offers a wide range of managed account services in both robo and human formats.

For cash management needs, the broker offers its customers (at no charge) a Visa debit card and checks. Additionally, Fidelity offers unlimited nationwide ATM fee rebates.

Fractional-Share Trading

Another highlight on Fidelity’s very long list of brokerage services is whole-dollar investing. Launched in 2020, this service allows traders to buy and sell whole-dollar amounts of stocks and ETF’s. Instead of paying over $2,400 for one share of Amazon, for example, you could trade exactly $100 of it. Even better, Fidelity charges nothing extra for this great service.

Global Stock Trading

Fidelity is one of the few brokerage firms in the United States to offer trading in foreign stocks. They can be traded directly on international exchanges. In total, there are 25 exchanges. Some examples include:

- New Zealand

- Switzerland

- Poland

- Italy

- Hong Kong

- Canada

- Australia

A separate account does not have to be opened to trade global equities. The service can be added to a regular Fidelity account.

Trades can be settled in an exchange’s local currency or in U.S. dollars. There are 16 currencies in total.

Besides access to international markets, Fidelity also provides real-time data on global securities. This of course is a requirement for day trading.

Fidelity also offers trading in American Depository Receipts (ADR’s). These are eligible for whole-dollar trading. Foreign stocks, however, are not eligible for fractional-share trading.

Day Trading

Fidelity operates out of Boston. As such, it must adhere to America’s pattern-day trading rule. This means you’ll need $25,000 in account equity to day trade regularly. You won’t have to meet this requirement if you use a cash account instead of a margin account. Alternatively, you could place 3 or fewer day trades in a rolling five-business-day interval.

Some of the amenities Fidelity offers day traders are:

- Desktop platform with full-screen charting

- Short locate service

- Trade ticket with direct-access routing

- Level II quotes

Leverage

Fidelity generally follows the Fed’s Reg T requirements for margin trading. This means initial margin is 50% on long and short positions. Maintenance requirements will be lower and will vary by security and side. Long positions are generally 30%, while maintenance on short positions is typically 35%.

Stocks below $3 automatically have a 100% maintenance requirement. Stocks between $3 and $10 have above-normal requirements.

Fidelity requires an account value of $50,000 to day trade index options.

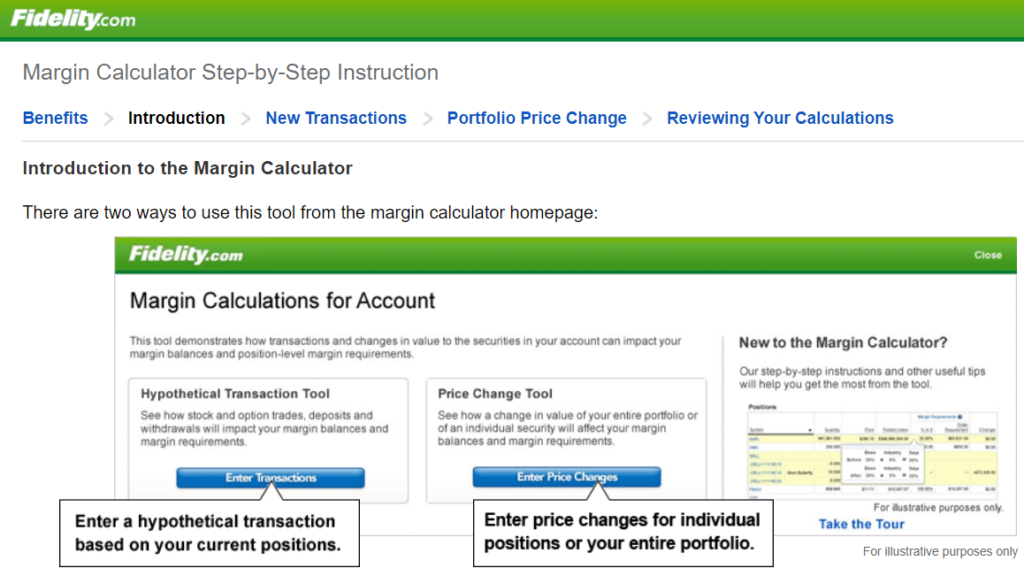

The brokerage firm offers a very useful margin calculator on its website. To access it, you’ll first need a margin account. Cash accounts aren’t able to use it.

The calculator is able to display the margin requirements of any entered ticker symbol. It can also determine the impact on margin that a hypothetical trade would have. Up to 5 trades can be entered at once.

The tool can also estimate the number of shares that need to be sold to meet a margin call.

Customer Service

Fidelity is known in the industry for its great customer service. With 24/7 support over the phone, the broker can help traders any time of the day or night.

There is a robo chat feature on its website, and human agents are on standby. For non-urgent issues, there is an internal messaging center inside the site.

Fidelity has a global trade desk that can assist customers with international trades.

If none of Fidelity’s digital channels will work for you, there are brick-and-mortar locations. We counted more than 100 in the U.S.

Fees and Commissions

And what does all of this cost? Surprisingly little.

Fidelity charges $0 for online US stock and ETF trades. This great commission applies to whole-dollar trades as well. Option trades cost 65¢ per contract with a $0 base charge.

Trades placed over the phone, either in automated mode or with a live rep, do have surcharges.

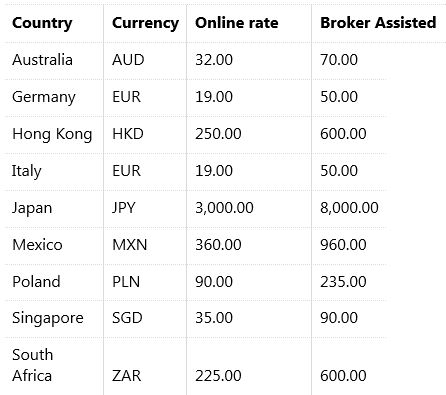

While the broker’s online rates are really fantastic, they only apply to US securities. Global stocks do have commissions, and they can be rather steep. Here’s a selection:

There are no software fees of any kind at Fidelity.

Trading Technology

Day and swing traders at Fidelity have multiple tools to trade with. We will start with the most powerful:

Active Trader Pro

Fidelity’s desktop platform is Active Trader Pro. It’s not too difficult to learn and provides a lot of features that swing and day traders will want. For example, the software has:

- Conditional orders

- Level II data window with order ticket

- Advanced charting

- Option chains for calls/puts and spreads

- Direct-access routing with an auto option

- Multi-order ticket

- Several advanced order types, such as OTO, OCO, and OTOCO

By default, ATP includes a chart window in the standard layout. This can be moved around, saved, printed, deleted, or expanded into full-size mode. Features worth mentioning include:

- Support and resistance lines

- Right-click trading

- Comparisons

- Many chart styles, including point & figure

- Color customization

- About 60 technical indicators

There are multiple order tickets on Active Trader Pro. The default one sits in the standard layout. It offers market, limit, stop, stop limit, and 4 trailing order types. Right-clicking on a graph and selecting buy or sell will generate this ticket on top of a chart.

Other order tickets can be found by clicking on the ‘Trade & Orders’ tab in the top menu. Drop-down selections include conditional, extended-hours, and multi-trade tickets.

The number of market venues I found on the platform’s routing system varied by security and order type. The maximum was 9 and the minimum was 4.

To identify shares for shorting, just scroll down to the very bottom of the quote window. You’ll find a ‘Show’ link next to the ‘Shortable Shares’ entry. Clicking on this link displays the number of shares of the entered ticker symbol that are available for shorting. If shares cannot be located, a message will be displayed requesting the user to call Fidelity’s trade desk.

The option-trading window on Fidelity’s software offers calls and puts by default. In the upper-left corner, a drop-down menu provides more alternatives. I found:

- Butterflies

- Strangles

- Vertical spreads

- Condors

- And more

A toggle switch inside the options window adds or deletes an options order ticket. Another nice feature is the ability to exclude contracts that don’t meet volume or open interest requirements.

Mobile App

If simplicity is what you’re after, Fidelity has you covered with its uncomplicated and effective mobile platform. This is where whole-dollar trades must be placed.

The order ticket offers two options: shares or dollars. A whole-dollar order can be set up as a market or limit order. Bid and ask prices automatically stream on the ticket.

Fidelity’s mobile app has a lot of other great features including:

- Horizontal charting with tools

- Mobile check deposit

- PayPal transfers

- Bill pay

- Bloomberg video news

Website Trading

If you don’t care for the broker’s mobile app or desktop software, there is always the website. It offers good charting and a pop-up order ticket. Clicking on a trade button anywhere on the website automatically generates the trade ticket. It offers:

- Stop-loss and trailing orders

- Real-time bid and ask numbers

- Several duration choices

Options cannot be traded on the pop-up ticket, its primary weakness. More advanced order types, such as conditionals, must be placed on web pages designed for the purpose.

Charts on the Fidelity website offer 1-minute candles with a trade button in the upper-right corner.

Bottom Line

Fidelity isn’t your grandparents’ brokerage firm anymore. It has good software at unbeatable prices. Combined with several services short-term traders need, Fidelity is now stiff competition for traditional day-trading firms.