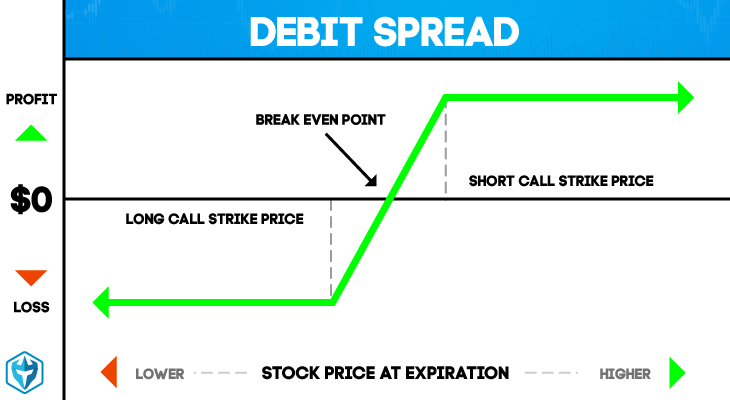

A debit spread is an options strategy that seeks to maintain maximum profit. It achieves this by capitalizing on the difference from the premium paid for long component of the spread less the premium paid for short component of the spread. It involves two options – call or puts.

One option has a lower market price where the holder sells while another has a higher market price which an option holder buys. The difference between the high and low market prices is what is referred to as the debit spread. This is a greater gain for the investor.

How Debit Spreads Work

Spreads are achieved by taking positions on both long and short sides. The long side refers to buying the option while the short side refers to selling the option.

When it comes to long options, they offer unlimited potential profits with limited risks which is measured in form of premium paid for the option. The short option is the reverse of the long option – unlimited losses with limited potential profit.

Here are the characteristics of long calls and puts:

Long calls (bullish) and puts (bearish)

a. You have to pay premium to purchase

b. Funds are debited to account

c. Limited risk

Short calls (bearish) and puts (bullish)

a. Sell option and collect premium

b. Account credit

c. Unlimited risk

d. Margined.

Since debit spreads refer to options spreads where the net debit has to be paid to put on, it means the short legs in the spread are unable to generate enough premium to offset the price of the long legs.

This means the investor will end up paying money to own such options.

Types of Debit Spreads

There are two major types of debit spreads

1. Vertical

2. Non-directional

1. Vertical debit spreads:

Two options are available under the vertical debit spreads. They include:

- i. Bull debit spread

This is an option strategy employed when the option trader is bullish on the underlying security. What does this mean? It simply means that the strategy is employed when the price of an underlying asset goes up moderately in the near term.

It can be used when buying at-the-money call options while writing a higher striking out-of-the-money call option. This should be on the same underlying security and the same expiration month.

- ii. Bear debit spread:

This trading strategy is implemented when the trader thinks the price of the underlying asset will lower moderately.

It can be used by buying a higher striking in the money put option and selling a lower striking out of the money put option of the same underlying security.

By doing so, it lowers the cost of establishing the bearish position but it forgoes the chance of making a large profit. This may happen if the price of the underlying asset plummets.

2. Non directional spread:

This strategy can be used by an option trader who does not care which way the underlying price is headed. Instead, the option trader is interested on betting on the volatility of the asset. Two types are available:

- i. Bullish on volatility

In Bullish on Volatility, the option trader can choose to implement either the reverse iron condor or reverse iron butterfly if the price of an underlying asset is expected to swing wildly.

- ii. Bearish on volatility

With the Bearish on Volatility, the option trader expects the price to remain steady allowing him or her to select one of the following strategies: butterfly spread or condor.

Advantages of Debit Spread

a. There is a pre-determinable maximum profit and loss

b. Option traders have a better return on investment than outright positions in moderate trends

c. No margin is required

d. Lower account level is needed

e. There is limited loss potential

Disadvantages of Debit Spreads

a. Option traders are required to pay cash to trade

b. It can result in lost profit potential

c. There is limited profit potential

Final Thoughts

Debit spreads are purchased to reduce risk. On the other hand, they are bought to share both risk and potential reward with another person.

They don’t have to be vertical spreads only; they can also be non directional. Others include calendar spread which is referred to as a time spread or horizontal spread.

The good thing about debit spreads is that no margin is needed, there is limited loss potential and lastly, lower account level is required.