The Pattern Day Trader (or PDT for short) rule is one of the most frustrating things people encounter when looking to day trade. A lot of the information can also be hard to understand, so even if you know what the PDT rule is, it might be hard to know what to do about it.

We’ve assembled this handy guide with all of our PDT resources for you.

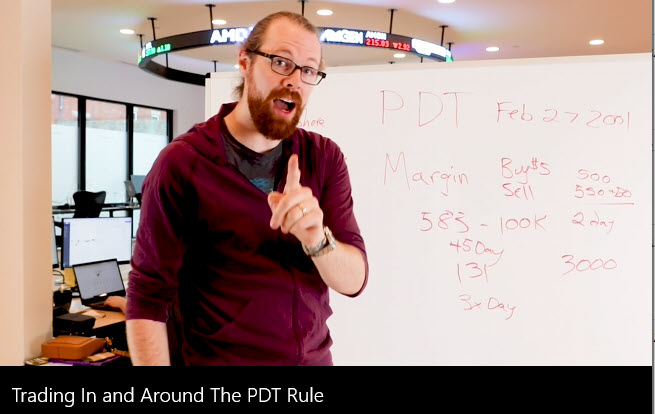

As an exclusive bonus, you can stream a video lesson that helps break down the math on different strategies for dealing with the PDT rule. See Ross cover the details of using a cash account versus a margin account, discussing offshore brokers who don’t enforce the rule and more.

Enjoy!

Stream Now: Trading in and Around the PDT Rule

Enter your email to stream this exclusive video breaking down how to trade in and around the PDT rule.

You don’t have to have $25,000 to day trade!

One of the biggest misconceptions people have when they discover the PDT Rule is they think that it automatically means they can’t day trade until they have $25,000 or more. That’s not the case!

Make sure to watch the video above, and check out our resources. You’ll see that there are plenty of options for trading with less than $25,000- many of our students start with brokerage accounts with $500-$5000.

The Pattern Day Trader Rule applies to traders making more than three day trades in a margin account at a US based broker – you can see a summary from FINRA here, and more documentation on PDT from the SEC here.

The most common ways people day trade with less than $25,000 are:

- Using an offshore broker who is not bound by the PDT rule

- Using a cash account rather than a margin account

- Using a margin account, but staying at 3 trades or less within each 5 day period

- A combination of the above options- using both a cash and margin account

- Trading futures or options which are not bound by the PDT rule

In the exclusive video (enter your email above to watch!) Ross will break down the risk and reward of each option, laying out the math so you can figure out which may be best for you.

Ultimate Guide to our Top Resources on the Pattern Day Trader Rule

- The Pattern Day Trader (PDT) Rule Explained: “Pattern Day Trader (PDT) rule is a designation from the Securities and Exchange Commission (SEC) that is given to traders who make four or more day trades in their margin account over a five business day period. A day trade is when you purchase or short a security and then sell or cover the same security in the same day.” Continue reading full guide here…

- How To Get Around the PDT Rule without Using An Offshore Broker: “The pattern day trader rule, often referred to as the PDT rule, is one of the most misunderstood stock market terms amongst many beginner traders. Today, we are going to focus on the rule, including some of the things you can do to get around it without using an offshore broker.” Continue reading full article here…

- Understand which type of brokerage account is best for you- a cash account or a margin account.

- Determine how much money you need to day trade for the financial goals you have in mind with this video lesson and blog post– a favorite among our students.