Most day traders often start out with a small account. Then over time, they build not only their skills but their bankroll as well. Starting out small is a great way to limit your losses and gain the experience you need to be confident.

If you are one of these traders, you have come to the right place! Today, we are going to cover 4 excellent tips that will help you trade a small account with ease.

Tip 1 – Only Trade the Best Setups

When trading with a small account, you really don’t have room for error. So when planning out your daily strategy, make sure that you pay attention to your setups. Make sure that you trade the best setups and stay away from those that might be a risk.

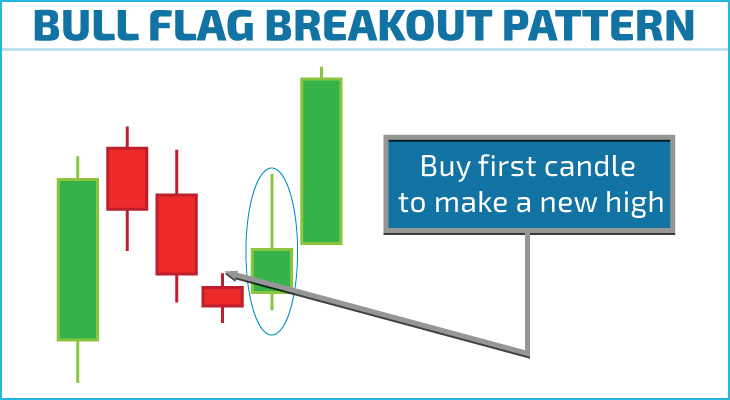

Some setups we look for are:

This will help protect your account and ensure that you turn over more profits. Remember when trading small accounts, you should not risk more than 1% of your total trading account to limit your loss.

In a small account you have to exercise extreme patience while waiting for your setup to evolve and trigger a buy/sell signal. Trading just to trade will almost certainly grind your account down to nothing with losses and fees eating away at your capital. Remember, trade the best, leave the rest!

Tip 2 – Know Your Strategy Like the Back of Your Hand

No matter if you are trading butterflies, iron condors, or selling short or buying long penny stocks, make sure that you know your strategy like the back of your hand. Spend at least a few hours every week going over your strategy. This will help you learn it backwards and forwards and all the variations of it.

Also, make sure to spend some time using a trading simulator before risking real capital. Using a simulator will help you learn more about your strategy, and you will be able to see if its working or not. This will help you gain the skills you need without risking a single dime.

Tip 3 – Exercise Discipline

With a small trading account, discipline is highly important. Knowing when to get out of a trade and cut your losses before they become too large is vital. Additionally, make sure to manage your trades just how you have them outlined in your trading strategy.

Going into uncharted waters with a small account can cause you a major loss that could potentially wipe out your entire balance. Not being disciplined could cause you to lose any gains and it may take you a week or even months to recover.

It’s a good idea do write down a detailed trade management plan that outlines how you will manage your trade for a specific setup with risk parameter and profit targets. This will be your guideline going forward and something that you will need to review regularly until it is ingrained in your trading.

Tip 4 – Set A Stop Loss Amount Every Day

As you all know, setting a stop loss is an important part of day trading. But with a small account, this function is of the utmost importance. At the start of each trading day, make sure that you not only set up a stop loss for each trade but for your small trading account as well.

Remember to only risk the predetermined amount that you figured out before trading. When you hit your target stop loss on a trade you have to stay discipline and take the loss. A good way to avoid taking a bigger than expected loss is by placing the stop as soon as you get into a trade. That takes the emotion out of the trade.

It’s also a good idea to set a stop loss for the day. For instance, if you have a $50 risk amount per trade, then set your day stop at $150. That means if you lose on 3 trades it’s time to call it a day.

This will keep you from revenge trading to try and make up the losses. Even the best traders will have bad days so it’s important to recognize that and move on to the next day. Remember that there is always another day of trading in the future and taking a small loss is much better than losing your entire account.

Final Thought On Trading A Small Account

These simple trading tips will help you better manage your small account. Also, remember to cut your losses by setting stop losses and learn the most you can about your strategy. With a little bit of discipline, you can turn your small trading account into something much bigger.