Watch Full Video Here: How I Nailed Trading with the MACD Indicator (Step-by-Step Guide)

When it comes to indicators, one of the most common questions I get from traders is this: What are the best MACD settings for day trading?

I hear it in my chatroom, I see it in my emails, and it comes up all the time during live streams. And the truth is, my answer might surprise you, because I don’t overcomplicate it. The MACD works great with the standard settings it comes with.

In this article, I’ll break down what MACD is, the exact settings I use, how I apply it to day trades, and some common mistakes to avoid. By the end, you’ll see why keeping things simple often gives you the best results.

What Is MACD and Why I Use It

If you’ve been trading for a while, you’ve probably come across MACD before. It stands for Moving Average Convergence Divergence. It’s an indicator that tracks the relationship between two moving averages and helps measure momentum.

When I add MACD to my chart, I get three main components:

- The fast line (based on the shorter moving average).

- The slow line (based on the longer moving average).

- The signal line (a moving average of the fast/slow difference).

I like using it because it gives me a quick read on when momentum is shifting. For day trading, I’m often in and out of trades within minutes or hours, so I want confirmation that a move has strength before I jump in. MACD is one of the cleanest ways to see that.

My MACD Settings for Day Trading

Here’s the part everyone asks me about: Ross, what are your MACD settings? My MACD settings are standard. They are default. I do not change them.

That means:

- Fast length: 12

- Slow length: 26

- Signal length: 9

- Source: Close

That’s it. These are the values you’ll see when you first add MACD to your chart. I don’t go in and start tweaking the numbers to find some secret formula, because there isn’t one.

Default settings strike a balance between sensitivity and reliability. They’re not so fast that you get whipsawed by every tick, and they’re not so slow that you miss meaningful intraday moves.

Some day traders experiment with shorter settings like 8-17-5 to try to capture quicker signals. That can work in certain situations, but the downside is more noise and more false crossovers. In my experience, sticking with defaults keeps me consistent.

How I Apply MACD in Day Trades

Now, let’s get into how I actually use MACD when I’m day trading.

First off, I never rely on MACD alone. It’s a supporting tool, not the main driver of my decisions. Price action, chart patterns, VWAP, and volume are always front and center. MACD simply gives me an extra layer of confirmation when I’m looking to time entries or exits within the same session.

On shorter timeframes, I watch for crossovers. When the fast line crosses above the signal line, it tells me momentum is picking up intraday. When it crosses below, it suggests weakness. In day trading, I want that confirmation before I commit to a trade that might only last minutes.

I also pay close attention to divergence. If a stock is pushing to new intraday highs but the MACD is sloping down, that’s a red flag that momentum is fading. Divergence often signals an upcoming pullback or reversal, which can help me avoid chasing or even set up a short opportunity.

Here’s a quick example. Suppose I’m watching a stock breaking out of its morning range on the 5-minute chart. Price is consolidating near highs, volume is steady, and it looks ready to move. Before I take the trade, I glance at the MACD. If the fast line is crossing above the signal line and trending higher, that gives me extra conviction to jump in.

It doesn’t guarantee the trade will work, but it improves my probability and helps me stay aligned with intraday momentum.

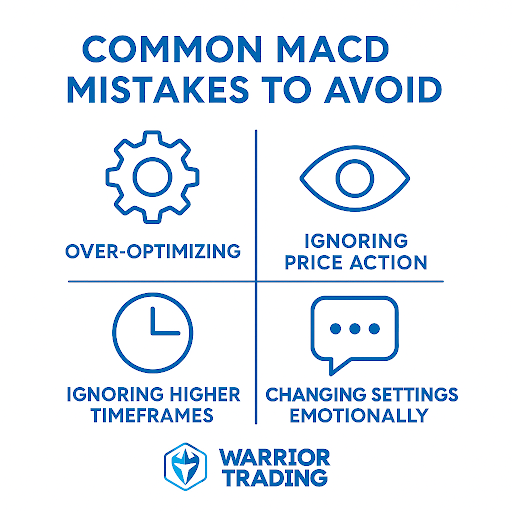

Common Mistakes Traders Make With MACD

Even though MACD is straightforward, I see traders misuse it all the time. Here are the most common mistakes to avoid:

Over-Optimizing Settings

A lot of day traders waste time tweaking inputs to 7-19-6, 8-17-5, or other variations, hoping to find the perfect combination. All they’re really doing is curve-fitting to past price action. When the market changes, those settings usually stop working.

Trading MACD in Isolation

Another big mistake is relying only on MACD without looking at price action, VWAP, or volume. Indicators should support your analysis, not replace it. If you’re just chasing crossovers, you’ll miss the bigger picture.

Emotional Tinkering

This one is subtle but dangerous. After a string of losing trades, some traders start changing their MACD settings out of frustration. That usually leads to inconsistency and poor results. The better approach is to stick with defaults and focus on discipline and execution.

Final Thoughts: Keep It Simple

Day trading is already fast-paced and stressful enough without adding unnecessary complexity. When it comes to MACD settings for day trading, I stick with the defaults: 12, 26, and 9. They’ve been tested for decades and continue to work today.

The real key isn’t in tweaking indicators but in building skill, gaining experience, and sticking to proven setups. Every time I trade a breakout, pullback, or VWAP reclaim, I’ve seen that pattern hundreds of times. That repetition is what builds confidence.

So my advice is this: don’t waste your energy searching for the perfect settings. My MACD settings are standard. They are default. I will not change them. Instead, focus on practicing, reviewing your trades, and staying disciplined.

Join me inside Warrior Trading to watch live trades and learn the strategies that keep me consistent.