- My Early Trading Routine: Back Then vs. Now

- Only Trading the Open

- Why I Skipped Pre-Market

- Lessons From the Afternoon

- Why Mornings Create the Best Opportunities

- How the Pandemic Shifted Market Timing

- Moves Started Earlier Than 9:30

- High-Frequency Trading’s Role

- Why I Had To Adapt My Routine

- Pre-Market Trading: Risks and Rewards

- The Role of Micro Pullbacks in Early Trading

- My Current Trading Window: Best Hours for Me

- Consistency Over Chasing Every Session

- Conclusion: Finding Your Best Time To Day Trade

Watch Full Video Here: The best time of day to Day Trade #daytrading

One of the most common questions I get is simple: “Ross, what’s the best time to day trade?” The short answer is that mornings are usually the most profitable. But like most things in trading, there’s more to it than a one-liner.

In this article, I’ll walk you through how I learned this lesson over the years — the hard way — and how I structure my trading window today.

My Early Trading Routine: Back Then vs. Now

When I started out, my trading looked very different. I stuck to the open, avoided pre-market, and learned some tough lessons about afternoons.

Only Trading the Open

When I first started trading more than 10 years ago, my day always began at 9:30 a.m. when the opening bell rang. I didn’t touch the pre-market back then. For me, the first 90 minutes after the bell was the entire trading day. That was my “sweet spot,” and I stuck to it religiously.

Why I Skipped Pre-Market

Part of the reason I avoided pre-market was that it simply wasn’t practical at the time. Brokers didn’t always allow it, platforms weren’t as advanced, and volume was usually too thin to bother. A stock might only have 150,000 shares traded before the open, and that wasn’t enough to really move the needle.

Lessons From the Afternoon

The other big lesson I learned was the hard way: afternoons cost me money. I’d stay past my window, convinced I could squeeze out a little more profit, and instead I’d give back what I made in the morning. I was consistently losing money trading in the afternoon, and “Power Hour” never felt powerful for me. That taught me to know when to stop.

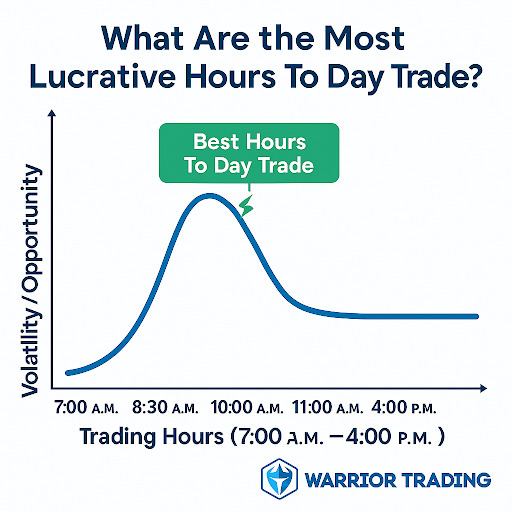

Why Mornings Create the Best Opportunities

The biggest reason mornings work so well comes down to one thing: news flow.

Most headlines that move stocks drop before the open or right after the bell. At 9:30 a.m., all the traders who’ve been waiting suddenly flood the market. A stock with 150,000 pre-market shares can rip to 500,000 in the first minute after the open.

This is when liquidity and volatility peak. And if you’re a momentum trader like me, that’s the perfect storm.

As I’ve learned over the years, I’ve found the most consistent profits in the first two hours of the day.

How the Pandemic Shifted Market Timing

The pandemic didn’t just change which stocks were hot. It changed when the action happened. Moves I used to see at the open started happening earlier.

Moves Started Earlier Than 9:30

By 2020, breakouts were no longer waiting for the bell. Stocks started moving at 9:25, then 9:15, sometimes even before 9:00. Waiting until 9:30 meant I was late.

High-Frequency Trading’s Role

Algorithms were a big reason. They hit headlines instantly, driving stocks higher before retail traders could react.

Why I Had To Adapt My Routine

I resisted at first, but I kept missing opportunities. If I didn’t step up to trade at 9:25, I was missing the move. That pushed me earlier and earlier — now I’m often watching by 7:00AM.

Pre-Market Trading: Risks and Rewards

These days, pre-market can offer great opportunities, but it’s not without challenges.

- Volume between 4:00 and 7:00 a.m. is usually thin.

- Some brokers don’t allow trading before 7:00 a.m. (like Robinhood and TD Ameritrade).

- European traders often create sudden surges right at 4:00 a.m.

I don’t usually wake up at 4:00 a.m. anymore, though I did during the GameStop frenzy. For me, the sweet spot begins around 7:00 a.m. That’s when enough brokers come online, volume builds, and real setups start forming.

The Role of Micro Pullbacks in Early Trading

One of my favorite morning strategies is trading micro pullbacks.

Here’s how it works:

- A news headline hits.

- High-frequency algorithms instantly push the stock higher.

- Retail traders like you and me digest the news.

- The stock pauses, pulls back slightly, and then tests the high.

- If it breaks that level, we’re off to the races.

Micro pullback trading is my favorite way to get in a strong stock as early as possible. That’s why mornings matter so much: the best micro pullbacks form right after breaking news.

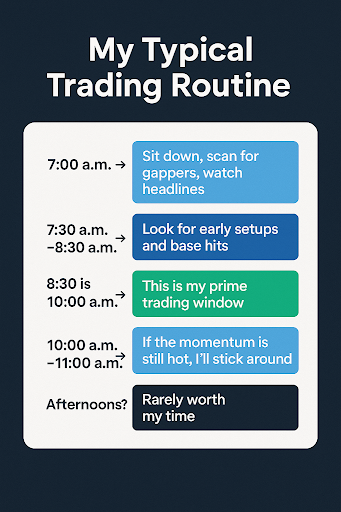

My Current Trading Window: Best Hours for Me

After years of trial and error, I’ve found my most lucrative hours of day trading are between 8:00 a.m. and 10:00 a.m.

Here’s my typical routine:

- 7:00 a.m. → Sit down, scan for gappers, watch headlines.

- 7:30 a.m. – 8:30 a.m. → Look for early setups and base hits.

- 8:30 a.m. – 10:00 a.m. → This is my prime trading window.

- 10:00 a.m. – 11:00 a.m. → If the momentum is still hot, I’ll stick around.

- Afternoons? Rarely worth my time.

That’s my two-hour window where I do the most trading.

Consistency Over Chasing Every Session

Consistency is the real key. If you know your best hours, stick to them.

I compare it to professional athletes: they give everything during game time, and then they rest. They don’t play two games back-to-back and expect the same performance.

If your schedule only allows you to trade from 10:00 a.m. to 2:00 p.m., then own that window and do the best you can. But be careful about dabbling outside of your rhythm. That’s when results turn inconsistent.

When you dabble outside your best hours, you’ll get inconsistent results.

Conclusion: Finding Your Best Time To Day Trade

The best time to day trade is the time that works for you. For me, it’s 8:00 to 10:00 a.m. Stick to your window, practice in a simulator, and build consistency one trade at a time.

The takeaway? Timing is everything. Find the hours that fit your day trading strategy, stick to them, and don’t chase every move outside your rhythm.

And, as always, remember: practice in a trading simulator before risking real money. That’s how you’ll build confidence and consistency.