- The Technical Truth About Small Accounts

- Why I Think It’s Good To Start Small

- Tools and Strategies I Used With a $100 Account

- When It Becomes Frustrating

- My Honest Advice If You’re Starting With $100

- Start Slow and Be Patient

- Focus on Learning, Not Earning

- Track Every Single Trade

- Gradually Add Funds If Possible

- Is It Worth It?

- Final Thoughts — What I Learned

Watch Full Video Here: ????IT’S BACK????How to Grow a Small Account with ZERO Experience (Full Training)

When I first started day trading, I didn’t have a ton of money. I remember wondering if it was even possible to start with just $100. A lot of beginners ask this same question, and I totally get it.

The answer? Technically, yes. But let me walk you through what it really means, because it’s not as simple as opening an account and expecting to turn $100 into $1,000 overnight.

The Technical Truth About Small Accounts

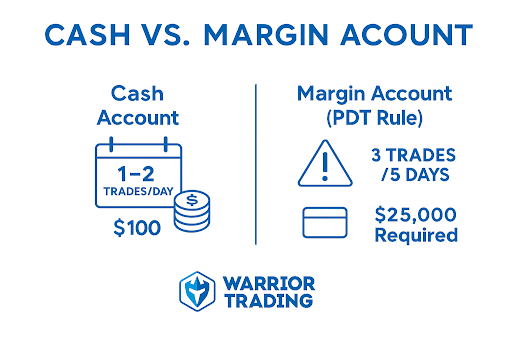

Here’s the deal: you can open a brokerage account with $100. Some brokers, like Webull or Robinhood, make it easy to get started. But when you go that route, you’re opening a cash account, not a margin account, which means you’re limited in how often you can trade.

If you try to make more than three day trades in a five-day period in a margin account under $25,000, you’ll get flagged under the Pattern Day Trader Rule. That restriction can feel like a wall when you’re just getting started.

But with a cash account, I could place one trade per day or maybe two, depending on how quickly funds settled. That forced me to slow down and really think through every trade. Honestly? That was a blessing in disguise.

When I was trading with a small account, I wasn’t swinging for the fences. I was just trying to get one good trade a day — that’s it.

Why I Think It’s Good To Start Small

Trading with a small account taught me some of the most important lessons of my career. I didn’t have room for mistakes. Every dollar mattered.

I had to think carefully about risk management, position sizing, and entry points. There was no safety net. And because I was limited in how many trades I could take, I learned to be selective, which is one of the best habits any trader can build.

That tiny account forced me to respect the market in a way a paper trading account never could.

There’s something humbling about risking your actual money, even if it’s just $10 or $15 at a time. I know a lot of people get bored with paper trading or feel like it’s not real. And they’re right. Trading real money, even a small amount, changes your mindset completely.

Tools and Strategies I Used With a Small Account

Let’s talk practicality. What worked when I was starting with a small account?

- I focused on momentum stocks that moved quickly with strong volume. I didn’t have time to sit in on trades all day.

- I aimed for just one A+ setup per day, usually a quick scalp with tight risk.

- I used basic tools, like free charting software and simple brokers. No hotkeys, no advanced scanners.

There was no need to overcomplicate things. My goal was to grow slowly, protect capital, and stay in the game.

I wasn’t trying to hit home runs. I was bunting for singles. That’s how you grow a small account.

And every trade had to be high probability. I didn’t have the luxury of “trying things out.” If I lost $20, that was 20% of my account, which was unacceptable.

When It Becomes Frustrating

Look, I won’t sugarcoat it. Trading with a small account is hard. Really hard. And it can get frustrating fast.

Here’s why:

- Commissions and fees eat into your gains (even if they’re small)

- You can’t afford to be wrong; there’s no margin for error

- Scaling up is slow, even a 20% win is only $20

- You start second-guessing trades because the risk feels bigger than the reward

I remember days when I made $12 and felt like I climbed Everest. But I also remember the $18 losses that wiped me out emotionally.

There’s also this myth out there that you can turn $100 into $1,000 in a few weeks. Can it happen? Maybe. But realistically, you’re more likely to blow up that $100 before you ever get to $200.

My Honest Advice If You’re Starting With $100

Let’s get real. This is not an easy path. But if you’re doing it to build skill, test strategies, and learn discipline, there’s a lot of value here.

Start Slow and Be Patient

You won’t get rich overnight. Focus on execution, not profit. One green trade at a time.

Focus on Learning, Not Earning

Think of your first $100 as tuition. You’re here to learn, and every trade — win or lose — teaches you something.

Track Every Single Trade

Journaling helped me spot what was working. Patterns, timing, and mistakes all went into the journal.

Gradually Add Funds If Possible

Once a trader sees consistency, they can consider adding funds. It gives the flexibility to grow confidence and skills without risking a huge chunk of money.

A $100 account isn’t about making money fast. It’s about proving that you can follow the rules, stay patient, and survive.

Is It Worth It?

In my opinion, yes, if you go in with the right mindset.

No, if you expect to make a living, or even a serious side income, right away.

That tiny account was like a dojo. It sharpened my skills. It taught me patience, discipline, and how to wait for the right trade. Every dollar felt like ten, and that pressure forced me to level up fast. I learned how to cut losses quickly, protect capital, and read momentum without hesitation.

It wasn’t about how much I made but how I traded.

By trading with a small account, I learned lessons I wouldn’t trade for anything. That experience shaped the trader I am today. Starting small built the foundation for trading bigger later with real confidence and a rule-based approach.

Final Thoughts — What I Learned

If you can learn to trade well with $100, you can develop the skills to trade with a larger account before risking $1,000 or $10,000. The size of your account doesn’t determine your success. Your discipline does.

The biggest thing I learned? It’s not about how much you start with. It’s about how well you manage what you’ve got.

So, can you day trade with 100 dollars? Yes, if you treat it as a learning tool, not a lottery ticket. If you’re ready to build real skills, not just chase quick profits, Warrior Trading has everything you need to start the right way.