Watch Full Video Here: Stock Float Explained and Why it Matters

Before I take a single trade, I check the float. It’s automatic at this point. If you’ve watched me trade, you’ve probably heard me say something like, “Float matters because it tells me how fast this thing can move.” That isn’t an exaggeration. The float can completely change the personality of a stock.

A lot of traders skip this step because they’re focused on the chart, the news, or the gap. But understanding the float gives you a huge advantage. It tells you whether a stock has the potential to move quickly or whether it’ll grind along like it’s stuck in mud.

What Is a Stock Float?

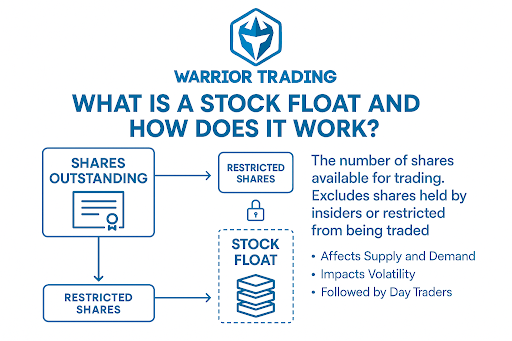

The number of shares available to trade is the float. When you pull up a stock and see “shares outstanding,” that number usually includes insider shares, restricted shares, and anything that’s locked up. I don’t care about those. I only care about the float.

A lot of traders mix these numbers up, so here’s the real breakdown:

- Outstanding shares = all shares that exist

- Restricted shares = insider or locked shares that can’t be traded

- Float = outstanding minus restricted, which equals the real supply that traders like you and I can buy and sell

If a company has 60 million shares outstanding but only 12 million floating, those 12 million shares are what matter to me. That’s the liquidity I’m actually working with.

How Stock Float Works in the Market

The float affects how a stock behaves intraday. A limited supply of tradable shares means the stock can move with far less volume. A large supply has the opposite effect.

Here’s what the float directly influences:

- Liquidity: Low float stocks can feel jumpy. High float stocks feel more stable.

- Volatility: Small float often means bigger moves in a shorter amount of time.

- Slippage: The lower the float, the bigger the slippage risk when entering or exiting.

- Spreads: Low float names often have wider spreads, especially premarket.

When I’m trading momentum, these details matter. I’m not looking to sit in something for three hours while it drifts aimlessly. I want something that can move. Float is often the first clue. Limited supply with heavy demand can create an explosive situation.

Low Float vs. High Float Stocks

Not all floats are the same, and they definitely don’t trade the same.

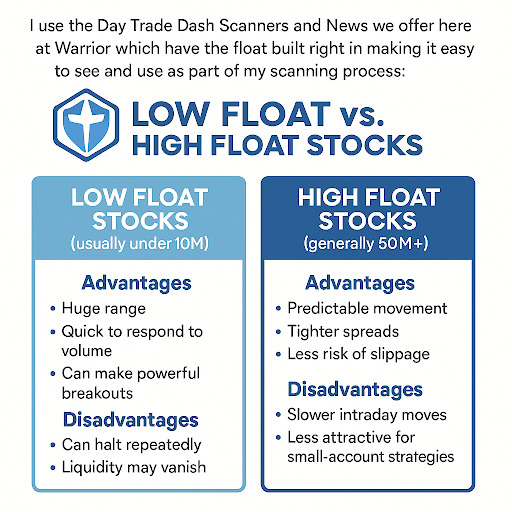

Low Float Stocks (usually under 10M)

These are the names that can rip 50% or even 100% in a single session. They move fast because the supply is tiny. A small amount of buying pressure can send them into circuit breaker halts.

What I like about low float stocks:

- They offer huge range

- They respond quickly to volume

- They can form powerful breakouts and squeezes

What I don’t like:

- They can halt repeatedly

- Liquidity can vanish mid-move

- One bad entry can put you deep red before you can react

High Float Stocks (generally 50M+)

High float names behave completely differently. They’re smoother, more controlled, and harder to push around. Institutions prefer these stocks because they can buy millions of shares without causing chaos.

Advantages:

- Predictable movement

- Tighter spreads

- Less risk of slippage

Disadvantages:

- Slower intraday moves

- Less attractive for small-account momentum strategies

If I’m looking for a quick breakout or a clean ABCD setup, I’m usually focusing on the low float world. But knowing the float size helps me match the strategy to the right type of stock.

How I Use Float in My Day Trading Strategy

A low float stock tends to move like it’s had three energy drinks too many, which is exactly why traders like me watch floats before placing a trade. When a stock has a tiny number of shares available to the public, any surge in buying can push it into wild moves.

I use float as a quick gauge of how aggressive I need to be. If it’s low float, I expect faster breakouts, sharper pullbacks, and less forgiveness when I mistime an entry.

Float also helps me decide position size and risk. A low float name gets a smaller size because the volatility can smack you around if you’re careless. Higher float stocks feel heavier and usually require cleaner patterns before they move.

By checking floats before anything else, I know what kind of behavior I’m dealing with and whether the trade deserves precision scalping or a calmer approach.

How To Look Up a Stock’s Float

Whenever I’m preparing to trade, checking the float is one of the first things I do. Most trading platforms list it right in the stats panel, usually next to volume and market cap. I use the Day Trade Dash Scanners and News we offer here at Warrior which have the float built right in making it easy to see and use as a part of my scanning process:

You’ll notice that different sites sometimes show slightly different float numbers. That’s normal, because they pull from different data sources.

I just look for the general range. If one platform says 5 million and another says 5.4 million, that’s close enough. If the numbers are wildly different, I dig deeper to see whether the company recently priced an offering, announced a split, or made some other change that affects the share count.

Once you’ve checked the float often enough, it becomes automatic. You glance at a stock, look at the Price action, and your eyes go straight to the float because you know exactly how much it will affect volatility and potential trade setups.

Common Mistakes Traders Make With Stock Float

New traders usually learn about float the hardest way possible: by buying something without realizing it has a tiny float and watching it rocket in the wrong direction.

Here are the common problems I see:

- Assuming a low float always means a big mover: It doesn’t. Low float stocks can also be complete duds if volume isn’t there.

- Ignoring dilution: Companies can increase float through offerings, which changes the entire setup.

- Chasing late: If a low float stock is already extended and crowded, you’re probably the liquidity for someone else’s exit.

- Overvaluing float and undervaluing volume: Float tells you potential; volume tells you what’s actually happening.

- Trading a low float with a slow hand: If you’re not decisive, you’re going to get steamrolled.

Float helps you understand the risk profile before you trade. That alone makes it worth your attention.

Final Thoughts

Understanding float doesn’t make you a profitable trader by itself, but it gives you a realistic read on how a stock is likely to behave. Float helps me anticipate volatility, manage my entries, and avoid stepping into something too dangerous for my account size.

The more you trade, the more obvious it becomes that float shapes everything: the speed of the move, the stress level during the trade, and your strategy choices.

Add float to your daily routine. You’ll be surprised how many bad trades disappear just by paying attention to this one metric. If you want to see me handle this live, grab my free day trading strategy guide.

And remember: trading is risky. Most beginners lose money. Always start in a trading simulator until you’re confident.