Small Account Challenge – How to Start Day Trading with $500

My Last Small Account Day Trading Challenge

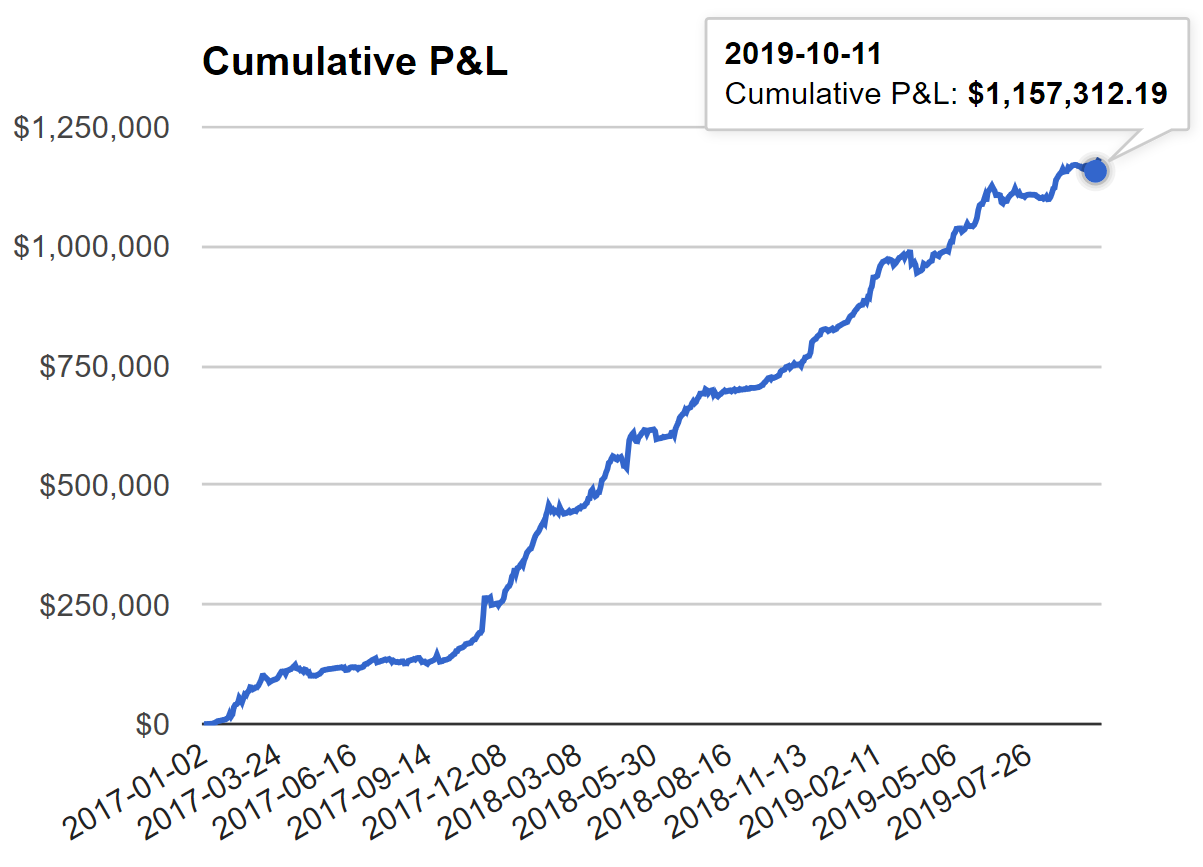

During my last small account challenge I started with $583.15 and turned the account first into $100k, and then into $1million (watch recap here). Those who are skeptical, you’re welcome to checkout my audited trading track record. Towards the end of that challenge, as my account grew, I started swinging for home runs. In fact, on March 20th, just 6 weeks before crossing the $1mil mark, I took the 2nd largest loss of my trading career, -$28k (that recap is on YouTube here). So it’s safe to say, I started trading like a bit of a cowboy. I was being extremely aggressive, looking for a big home run to push me across the finish line.

In the 6+ months since completing my challenge, I’ve continued to trade extremely aggressively. I’ve been in a bit of a cycle of big losses, then needing big winners to bounce back, then taking another big loss. Year to date, I was up $325,639.64 as of the end of September. It’s been a great year, but my P/L has been on a roller coaster. As you can see from the Cumulative Drawdown graph, as my account grew, I took larger amounts of risk. The peak draw down of -$46k was in March. That means I lost $46k during a cold streak before I started going back up again. This is the rollercoaster I’d like to avoid.

My NEW Small Account Day Trading Challenge

During this small account challenge, I’m going to show you again how to start day trading with $500, but I want to approach things a little differently. Instead of setting an aggressive goal of turning the account into $1mil, I’m going to focus on being consistent. I’m going to trade for income. In other words, my goal will be to turn a profit everyday. This is the same mentality I had when I got started nearly a decade ago. I simply wanted to make $200/day from the market. After all, that’s an extra $50k/year.

So during this day trading challenge, I’m going to draw the account back down anytime it starts getting so big that I begin swinging for the fences. I want to be focused on trading this account as if it were the last $500 I had to my name.

Budget Analysis

While I complete my application to open my new day trading account, I want to lay out the budget for a beginner trader. I can’t pretend to be a beginner trader, but I can work with a beginner traders budget! I’m going to layout two budgets. The Starter budget is for a trader with a tight budget, but wanting to get started. The Pro budget is for a trader ready to dive in. During my upcoming videos, I’m going to be talking about the ways I raised money for my first trading accounts, including selling things on craigslist, freelancing, fixing up an old car, and cutting my cost of living.

As you review the budgets below, let me ask you a question I asked myself when I was getting started. How much of a paycut are you willing to take in order to live a life you love? A life where you have financial freedom? Financial freedom is a lot easier to achieve if the goal is $200/day vs $2000. Being realistic about your goals from the market will help you establish a good budget. I generally say if you have a daily goal of $50 you’ll want a $500 account, daily goal of $100 =$1k account, and so on.

The “Starter” Budget: $1.6k

Trading Account: $500 starting capital

Trading Station: $500 for Computer Equipment (I’m going to break down this in a future video)

Education: $997 Warrior Starter Course

The “Pro” Budget: $3.5k

Trading Account: $500 starting capital

Trading Station: $500 for Computer Equipment (I’m going to break down this in a future video)

Education: $2.5k Warrior Pro

As you’ll see from my budget breakdown above, education is the most expensive, and also the most valuable. Let’s be real, regardless of whether you want to learn from me, or anyone else, here’s the value of education. You will learn a PROVEN strategy, so you don’t have to spend you hard earned money on trial and error, trying to figure out how to be profitable.

If you haven’t already heard my story of getting started day trading, in my first 18 months I lost tens of thousands of dollars, accumulated tens of thousands of dollars of debt, and all because I didn’t educate myself on a strategy that had been back tested and proven to be profitable. That was avoidable. I encourage you to not make the same mistakes I made. Although you may think I’m bias towards education, I can tell you that I had the same accessibility to YouTube, books, and other free information sources when I was getting started, and it still took me nearly 2 years before I turned a profit.

The problem for me was information overload. I couldn’t sift through all the resources to actually know which strategy was worth me dedicating my time to.

Practice, Practice, Practice

The only way you can start trading with real money, is to first prove you can be profitable in a paper trading simulator. Being profitable in a simulator can take a few months of practice. That’s okay, but my problem during my first 18mo was two fold.

First, I traded with real money because I was impatient. As a result of trading with real money, the loses made the emotional stakes higher.

Secondly, I was trying a dozen different strategies all at the same time because I didn’t know if any of them were actually profitable strategies. As a result of trading multiple strategies, it was hard to know whether or not any one of them individually would be profitable.

In an upcoming video I’m going to share the startegy I’ll be using for his next small account challenge. You will see that the startegy I’ll be using has been proven to be profitable. My only job is to follow the rules of the strategy. If I stick to the rules, profits will follow.

Stay tuned for the next episode!