- What Is the Risk/Reward Ratio?

- Why Risk/Reward Matters in Real Trading

- Why Risk Is Non-Negotiable

- Why Reward Alone Isn’t Enough

- Why Math Has to Work in Your Favor

- How I Personally Use Risk/Reward

- My Step-by-Step Process

- Why a 2:1 Ratio Isn’t Always Enough

- How Risk/Reward Helps Me Walk Away on Red Days

- Common Mistakes Traders Make With Risk/Reward

- Conclusion

Watch Full Video: I risked $2,500 to make $76,112.42. Here’s how I did it.

When I first started trading, I didn’t even think about risk/reward. I just jumped into every setup, hoping the stock would go my way. But after running through red days, where I’d lose big and struggle to recover, I realized that knowing your risk/reward ratio in trading is the foundation of consistent trading. It’s not flashy, but it keeps your account alive.

Let me show you what it is, how I use it, and why it matters more than probably anything else in your trading plan.

What Is the Risk/Reward Ratio?

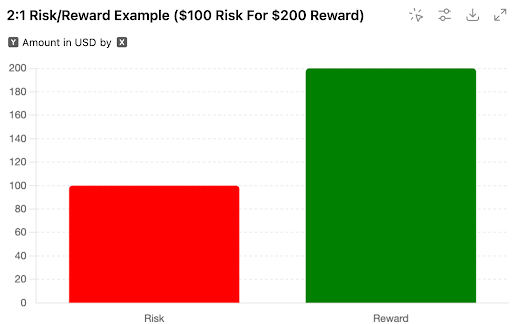

The risk/reward ratio is simply how much I’m risking versus how much I can gain on a trade. Risk is the difference between my entry and stop-loss, while reward is my profit target above entry. For example, if I enter near $10 and set a stop-loss at $9.90, I’m risking $0.10 a share. If my target is $11, I aim to make $1, so that’s a 10:1 reward-to-risk ratio.

If I risk $100, I want to make at least $200. That’s a 2:1 ratio. The key isn’t to win every trade but to win enough big so that even losses feel small. That’s the heart of compounding profits while limiting your downside.

Why Risk/Reward Matters in Real Trading

Why Risk Is Non-Negotiable

I’ve learned the hard way that risk is the only part of a trade I can control. The market’s going to do what it wants.

But if I know exactly how much I’ll lose if I’m wrong, I can stay in the game long enough to be right more often. You can’t control how much a stock moves, but you can control how much you lose.

Why Reward Alone Isn’t Enough

Too many traders focus on the upside and forget to ask what it’ll cost them if the trade fails. I’ve done that. I jumped in thinking, “This thing could run to $12!” without setting a proper stop. That’s a fast way to blow up. Reward is meaningless if your risk is undefined.

Let me tell you — I have done this before, and it is infuriating. There’s nothing more frustrating than getting stopped out and watching a stock rip without you.

Why Math Has To Work in Your Favor

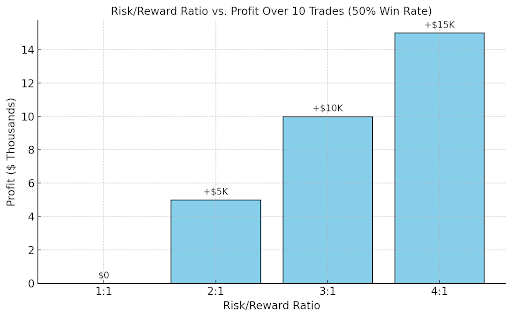

I don’t need to win 80% of the time. I just need the math to favor me. With a 2:1 ratio, I only have to be right 50% of the time to stay profitable. That’s what gives me consistency. If you’re not doing the math, you’re not really trading — you’re gambling.

How I Personally Use Risk/Reward

My Step-by-Step Process

Here’s how I incorporate risk/reward into every trade:

- Identify entry point: For me, that’s often a dip on a one-minute chart off a bigger move.

- Set stop-loss: Decide exactly where I’ll cut losses.

- Pick target: Usually at the next resistance or psychological level.

- Do the math: Is it at least 2:1? If it’s 3:1 or better, even better.

I look for those A+ setups — the ones where I can get in early and risk $0.10 for a $0.30 move. That precise ratio gives me confidence to size up while knowing my downside is controlled. I broke the ice with this first trade.

One recent example: I risked $2,500 on my first trade of the day. When it hit my $7.50 target, the return was over $8,000 — roughly a 3:1 win. That type of payoff on winners allows me to stay profitable even if only 65% of my trades pan out.

Why a 2:1 Ratio Isn’t Always Enough

A 2:1 ratio is a great starting point, but it’s not always enough, especially in choppy markets or with lower conviction setups. I’ve had trades where the pattern looked decent, but the volume wasn’t there or the breakout was too extended. In those cases, 2:1 might not cut it.

If I’m only getting 2:1, I better be really sure the trade is clean. Otherwise, I want more — 3:1 or 4:1. That higher ratio gives me a margin of safety in case the stock doesn’t move as fast or as far as I hoped.

Experienced traders adjust their expectations based on market context. When I’m dealing with sketchy price action or mid-day chop, I won’t settle for a low payoff. I either hold out for a better entry or skip the trade entirely.

How Risk/Reward Helps Me Walk Away on Red Days

- If I don’t see a clean 2:1 setup, I don’t trade.

- Choppy or slow markets often lead to forced trades.

- Risk/reward acts as my filter — it keeps me out of trouble.

- Staying in cash on bad days has saved my account more than once.

- Red days are less about losses and more about protecting discipline.

- It’s okay to have small red days. Small red days are healthy.

Common Mistakes Traders Make With Risk/Reward

Even with the best ratios, traders make mistakes that ruin their edge. Here are a few of the most common ones I’ve seen or made myself.

- Chasing trades without calculations: You see momentum and just jump, stop-loss be damned.

- Letting losers run: You don’t tighten up your stop after you’re up.

- Holding past target: I’ve done it. I’ve let trades ride past the plan and paid for it.

- Ignoring volatility: A $0.10 stop on a choppy stock isn’t the same as one on a smooth mover.

I used to get in and figure I’d just see what happened — but that’s how you blow up accounts. If you don’t define your risk, the market will define it for you.

Conclusion

The market is hot, and the best time to learn how to trade was five years ago. The next best time is today. The risk/reward ratio in trading isn’t a guideline — it’s the rule.

If you know you can make twice what you lose, you only need to be right half the time to break even. Compound that over multiple trades, and you build real momentum in your account.

I use it in every trade I take — I start small, calculate risk versus reward, and only pull the trigger when the numbers add up. And if you’d like to see how this works in real time, come watch me trade live in the Warrior Trading chat room.

Risk warning: Trading carries significant risk. Use a risk/reward framework — and stick to it — if you want to stand a chance in this game.