What’s up, everyone? All right. So here we are, Monday morning, June 4th, back in the saddle, and you know what? This is part of trading. I got knocked down on Friday, and I got right back at it Monday morning.

The whole weekend I was really just … I wanted to get back in the saddle because it’s kind of one of those things where, when I screw up with something, I want to try it again right away.

It doesn’t matter what it is. If it’s skiing, going off a jump, if it’s water skiing, wakeboarding, I want to try it again, try it again until I get it. And so if I have a day where I lose money, I’m always eager to get back and just kind of get green again.

Now there’s difference between doing that and revenge trading. Revenge trading is when you’re aggressively trying to make back the loss, and that’s something you have to be careful about. Because if you have a big loss, three, four, five thousand dollars, whatever it is, 15, 20, 50 thousand dollars, you’re never going to make that type of loss back in one day.

So you have to sort of separate those two emotions. Am I trying to revenge trade, or am I just trying to get back in the saddle, back on the horse, and start making my way back up? And that’s really what it’s about for me, is I just want to start making my way back up, one step at a time. And today, green day. A thousand dollars, that’s good. I’m happy with that. And accuracy was on point. Five out of six trades were winners. So today was a solid day, and having said that, the market was still a little choppy. It’s been choppy the last week and a half, and so I’m in a market where I have to be a little bit more disciplined, a little bit more careful, and fortunately today I traded smart. So we’re going to do it again tomorrow.

But anyways, let’s break down today’s trades and today’s midday market recap.

What’s up everyone? Alright, so let’s see. Here we are, back in the saddle. Today is Monday, June 4th. So all right, P&L today, finishing the morning up $1,147.56. Not Bad. Green is good. You know, today is just a solid green day, thousand dollars. I’m happy with that. Thousand dollars for a long time was my daily goal. A thousand dollars a day. And you know, in the last six, eight months, I’ve kind of increased that daily goal to like $3,000 a day, and that’s really what I’ve been averaging almost every … Well, averaging, let’s see, as of right now, $2,763 per day this year.

So having a $3,000 daily goal is, it’s not unrealistic; however, we know that some days getting $3,000 is just not gonna happen, and other days you’re going to hit 5, or 6, or $10,000, so they all average out. So even though you might look at your averages and say, “Oh, I make X amount on average,” it doesn’t necessarily mean that you should be fixated on trying to hit that amount every single day, because some days will be better and some days will be worse, and today’s a day where I’m up a thousand, and I really shouldn’t be trying to swing for $3,000 of profit. It wouldn’t be realistic. It would be way too aggressive, and I would most likely give back the thousand dollars that I have.

So, let’s see what’s going on over here. So, anyways, I’m going to be happy with a thousand dollars. Today is the 99th trading day. Alright, day 99 of the year. So, $1,147.56. Green’s good. I’m happy with that.

And obviously I had a red day on Friday, and my only goal today was just to be green, even if it was just $500. It wasn’t to try to make 10 or $15,000, it was just to close the day green. And even though Friday was a big red day, I’ve had bigger drawdowns, and that’s the thing that’s kind of interesting. Oh, yeah, I see that. I’ll reset screen share.

Let’s see … So I’ve had bigger drawdowns, and so when I talk about drawdown, drawdown is the difference between your all time highs and the low of your pullback. So if you go from being up 100,000 on the year, and then you drawdown to 75,000, you’ve got a $25,000 drawdown, right? Because you dropped 25,000. And that could happen in one really, really bad day, or it could happen over the span of two or three weeks of choppy trading. You know, a loss here, a loss there, and just kind of slowly losing a little bit more, a little bit more each week until things turn around.

And so for me, in the last year or so, my max drawdown is right around $25,000, and that’s not an insignificant amount of drawdown. I mean, it’s a fair amount, but it was never in one trade. It was always over the course of two or three weeks of just choppy trading, where I made some profit and then I’d lose, and then one step forward and then two steps back, another step forward, two more steps back. And when you’re in that type of market where you’re just grinding, it can get very frustrating, and you can start to give into FOMO, and it can make the losses worse.

So, in any case, even though I had a good size loss on Friday, the way I’m kind of thinking of it is, “Okay, I basically ate up my max drawdown in one day, and now I have to start moving back up.” I can’t continue to drawdown. I have to just, off that level, start heading back up.

So this is my drawdown chart. So, let’s see. I had a drawn down of $20,000 in April of 2017. I’ve had drawdowns of 17,000, 15,000, 14,000. drawdown here of 22,000. drawdown here of 17,000. These are both this year, and these were almost back to back. I was down 22,000, then I bounced back, then I was down 16, 17,000, then I bounced back. So, realistically, you can see the drawdowns are getting bigger, but that’s relative to my account getting bigger as well. So as my profits have gone up, I’ve been willing to take on more risk. And so that’s, even though this looks maybe not great, it’s relative to the account growing. Because when I started this account, it was small gains. It was a very small account.

So anyways, right now, at whatever it is on drawdown, I’ve got to be careful not to let it go any further. So today’s the first day digging myself out of the hole, one shovel full, and there’s a thousand bucks. All right. Tomorrow, let’s do it again. Another thousand bucks. And then Wednesday, Thursday, Friday, and just slowly start digging myself out. And I don’t mind if I have a red day this week, as long as I don’t go deeper than the low of yesterday. So right now, basically, I could say I only have about $1,100 of profit to work with. When I’m thinking about tomorrow, I don’t want to go down more than 1,100, because then I’m going to be back to hitting my max drawdown.

So tomorrow I want to make sure I don’t risk more than like $500 on a trade, on the first couple trades. Once I started to get into the green, then I may feel comfortable taking a little bit more risk, a little bit more risk, and that’s fine. But initially, I’ve got to start a little bit small.

So, let’s see. Today actually was pretty good. I took six trades and I had five winners, and I’m happy with that. On BKYI, this loss, I was talking to John, he made money on it. He made … Actually, I don’t know how much he made, but probably around a thousand bucks, but he got in it much earlier than I did, and he sold into this squeeze. And again, I was a little aggressive on this one, getting in at … Let’s see, 350, 354, selling some at 63, some at 54, and then the rest getting stopped out.

So I got in at the half dollar, up here at 350, thinking it was going to maybe squeeze into a circuit-breaker halt. That’s what I thought, because it had just moved this much. But it didn’t, and then it dropped all the way back down to 255. What an ugly drop. It ended up rebounding a little bit, but I just was a little cautious on this. I didn’t get in until the volume was a little bit higher. By the time I was in, it was probably 300,000 shares of volume. Down here, when it first started moving, where John got in at 260 or 270, that was a good entry. I mean, that was nice. But, for me, I just chased it up a little bit.

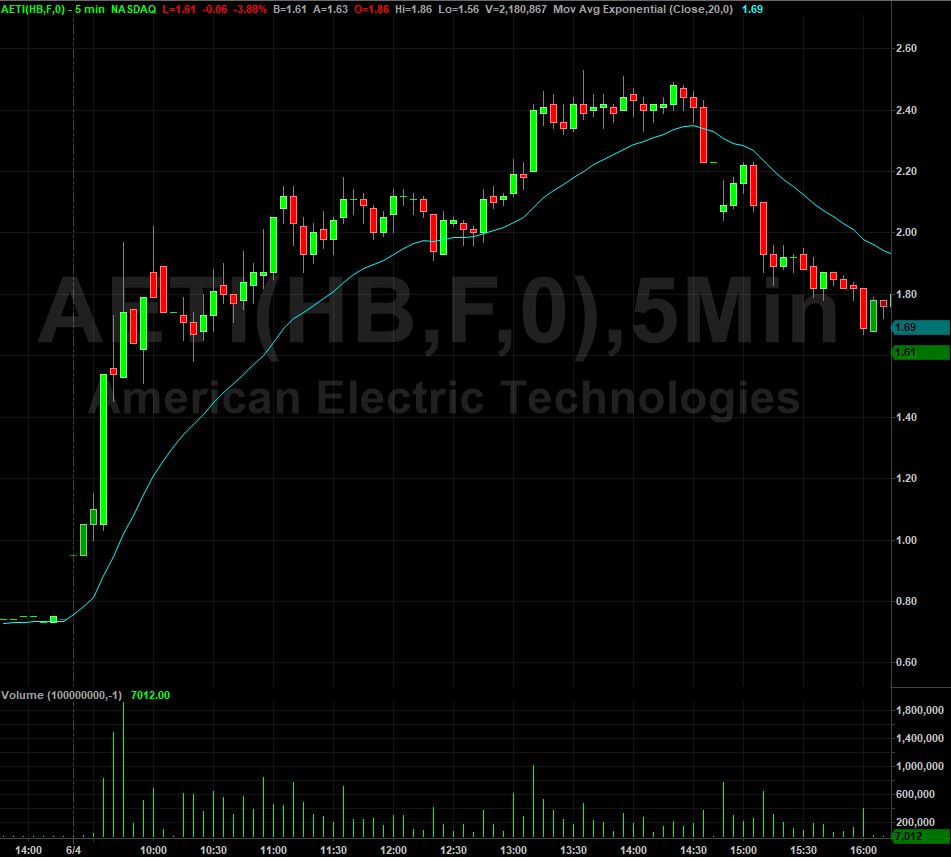

So I gave back some profit on that, $934, but when I had that loss, I already had profit on AETI. So I was already in the profit zone, which was good. So AETI, we were watching this one out of the gates, and I honestly did the same thing. I got in this at the half dollar. I got in at $1.50, and it squeezed up to 54 and was halted on a circuit-breaker. So my initial entry on AETI was not really any different than the entry on BKYI. Got it in at 47 and at 50, 7,500 shares, sold three quarters at 53. It then pops up, as it resumed from the halt, to a high of … Well, it hit a high of like 65 and then it dropped down. I sold the rest and then I got back in at 62, and I sold a 69, 71, and I think 73 … No, 72.

So made like 300 on the first trade, 200 on the second trade. Had that loss on BKYI, and then back in AETI now with 7,500 shares at $1.77, and that was as it was squeezing up right here. So I jump in at 77. It hits 92, it pulls back, I hold through the pull back, it then comes up and hits 97, and I’m scaling out into that pop. I guess I sold at 89 and 92. It wasn’t able to hold the highs of this level, so it hit 97 and then pulled back.

Small little scalp on CHNR. Easy trade, right off the scanners. Not too much to say about that one, just jumped in this one at 320. Was a little bit of resistance. I ended up selling fast because I saw a big 25,000 share seller at 325. So we got out of that quickly. $156, and then a couple more little scalp trades on AETI. In at 94, out at 202. That was on that final squeeze up through high of day. The high was two-oh … Let’s see. Oops. AETI. The high of day was 202, and I sold a 625 shares at high of day. So not bad on that one. Overall, pretty good. $1,925 profit there. Gave back a little bit on BKYI, and made a little on CHNR. And, you know, that’s kind of a low stress, thousand dollar day.

Didn’t take massive share size. 7,500 shares was the biggest size today. Certainly could have been more aggressive, but chose not to be. And this morning I did that pre-trading checklist. Did I eat well? The answer was yes. Did I sleep well? The answer was, yeah, I slept pretty well. What’s the market like today? The answer was that the market this morning looked choppy. The last five days had been choppy, and there wasn’t anything on the gap scanner that looked good. So that made me think, “All right. Well, market conditions right now are only so. Day of the week, it’s Monday. Usually Monday’s are strong, but let’s be a little bit more conservative, also keeping in mind that I had a red day on Friday I need to just kind of get myself out of the hole.”

I had a stress dream over the weekend that I lost another $20,000 today, so I’m just glad that that dream wasn’t a prophecy and that I was able to manage my risk and keep myself on the green side of the P&L line today. So a thousand dollars a day keeps the job away. I’m happy with that, and I’ll be back at it tomorrow. You know, this is the thing with trading. You just got to keep your spirits up, and you’re going to have days where you’ll lose money. That’s inevitable. You can’t get around it, but you just got to bounce back and not get too bent out of shape about it. And so here we are Monday morning, a thousand dollars. Green is good, and we’ll be back at it first thing tomorrow, Tuesday, 9:15 pre-market analysis, and then we’ll start trading as soon as the bell rings at 9:30.

All right, everyone. So that’s my game plan, and I will see you all back here in the chat room tomorrow morning. All right, see you guys then.

If you’re still watching, you must’ve really enjoyed that video, so why not subscribe and get email alerts anytime I upload new content? Remember, when you subscribe, you become a member of the Warrior Trading family.