- Emotional Volatility Is Your First Enemy

- Overtrading and Revenge Trading

- Market Volatility and Unexpected News

- How Sudden Volatility Traps Traders

- Managing Risk During Unpredictable Moves

- Lack of a Defined Trading Plan

- Poor Risk Management

- Ignoring Long-Term Sustainability

- Final Thoughts — Respect the Risks, Master the Process

Watch Full Video Here: How Much Risk Should I Take?

Day trading looks exciting from the outside, with fast moves, big profits, and a sense of control. But the truth is, it’s a grind. I’ve been at this for years, and I still face the same challenges that trip up beginners every day. The market doesn’t reward overconfidence. It punishes it.

Even when the market is cooler, we can still have stocks that make substantial moves.

So, let’s talk about the real risks of day trading that can drain your account, your focus, and your motivation if you’re not careful.

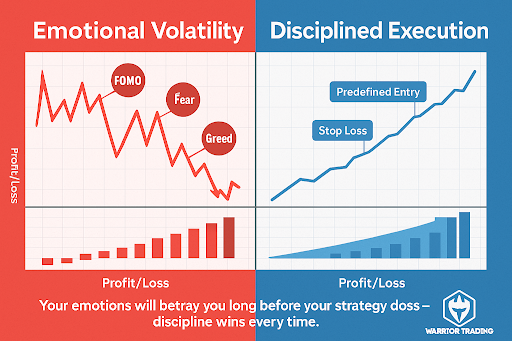

Emotional Volatility Is Your First Enemy

Your emotions will betray you long before your strategy does. Fear, greed, hesitation, FOMO — every trader meets them. I’ve blown trades not because I lacked skill, but because I lost discipline for 10 seconds.

You see a stock spiking, you jump in late, and suddenly, you’re the exit liquidity for smarter traders. I’ve done it. I still fight the impulse. The worst trades I’ve taken were emotional reactions, not planned setups.

When I prepare for the market, I already know what I’m looking for: specific setups, specific entries, and clear exits. That’s what keeps me grounded when things move fast. Emotional control is one of the least-discussed but biggest risks of day trading, and mastering it is a lifelong process.

Overtrading and Revenge Trading

The market gives opportunities every minute, but that doesn’t mean I need to take them. Overtrading is when I start chasing movement just because I’m bored or frustrated. It’s dangerous because I stop respecting my rules.

Revenge trading is worse. You take a loss, get angry, and jump into the next setup just to “make it back.” That’s when small red days turn into big ones. The market doesn’t care that I’m down a few hundred — it’ll take more if I let emotion take over.

Here’s what helps me stay in control:

- I limit the number of trades per day.

- I step away after a red trade.

- I write down what triggered the impulse.

The goal isn’t to trade more. It’s to trade better.

Market Volatility and Unexpected News

Even after years of trading, the market still finds ways to surprise me. Breaking news, halts, or sudden rotations can flip a strong setup into a mess in seconds. Volatility gives opportunities, but it also exposes every weakness in your plan.

How Sudden Volatility Traps Traders

I’ve watched tickers surge 30% in minutes, halt mid-run, and reopen far lower. Anyone who chases gets crushed. I’ve been there. One morning, a low-float stock I traded halted twice before dumping on the third open — lesson learned.

That’s one of the biggest risks of day trading: you’re always one headline or imbalance away from being caught on the wrong side of a move.

Managing Risk During Unpredictable Moves

My only defense is preparation. I cut position size, widen stops slightly, and stay alert to catalysts. If a stock feels out of control, I’m fine sitting out.

Sometimes, the best trade I take all day is the one I skip. Surviving volatility is one thing. Knowing exactly what to trade and when is what separates amateurs from professionals.

Lack of a Defined Trading Plan

How do we decide when to buy, when not to buy, and how much risk to take on any given trade? This all comes back to the concepts of stock selection. If you don’t have a plan before the bell rings, the market will make one for you, and it won’t be pretty.

In my early days, I’d open my charts, see a few gappers, and start guessing. Sometimes I’d get lucky, but luck doesn’t build a career. A real trading plan defines my entries, exits, share size, and stop loss before I ever click the buy button.

My daily plan includes:

- Pre-market watchlist

- Entry and exit levels

- Max loss limit

- Emotional check (am I clear-headed today?)

Without structure, emotion drives everything. With it, I can focus on execution.

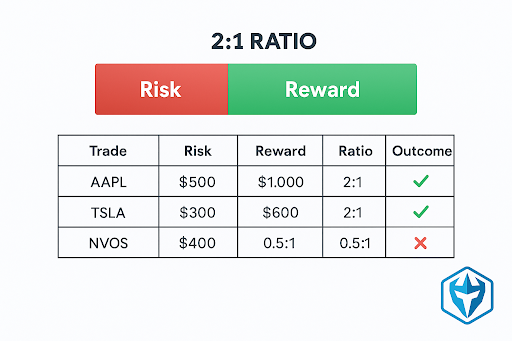

Poor Risk Management

This one ends most traders before they ever find consistency. Poor risk management isn’t just about losing but losing too much, too often.

If I’m risking $500 on a trade that can only make me $300, I’m already setting myself up to fail. I aim for at least a 2:1 reward-to-risk ratio. That means if I’m wrong half the time, I can still come out ahead.

Some quick personal rules I stick to:

- Never risk more than 1–2% of my account on a single trade.

- Never increase position size to “win it back.”

- Respect my daily max loss. When I hit it, I walk away.

I’ve broken those rules before. Everyone does. But every time I ignored them, I paid for it. Discipline isn’t optional.

Ignoring Long-Term Sustainability

Day trading is a marathon disguised as a sprint. It’s not about one big win. It’s about thousands of small, smart decisions over time.

Burnout is real. Trading for eight hours a day, staring at screens, analyzing charts — it wears you down. When I’m tired, my focus slips, and mistakes follow.

So, I’ve learned to protect my mental capital the same way I protect my financial one. That means taking breaks, sticking to my schedule, and avoiding overexposure. You’re not just protecting your capital but your focus, too.

Final Thoughts — Respect the Risks, Master the Process

Day trading isn’t a game. It’s a profession that demands emotional discipline, patience, and respect for risk.

The biggest risks of day trading aren’t hidden. They’re in your habits: ignoring your plan, chasing losses, or trading out of boredom. I’ve made every one of those mistakes at some point. The difference now is I recognize them faster and cut them quicker.

If you’re serious about trading, focus on education first. Learn how to think like a trader before trying to act like one. That’s what keeps you in the game long enough to actually get good.

Day trading isn’t easy — it’s a skill built through consistency, education, and discipline. Only time will tell, but I’ll be here. I’m in the trenches every day, side by side with you guys.

Join me at Warrior Trading, and learn the same strategies I use to navigate volatile markets.