-

Value For Investors

-

Value For Active Traders

-

Commission & Fees

-

Platform & Tools

-

Customer Service

-

Mobile

Summary

We were really impressed with M1 Finance’s Pie method of investing. It’s easy to put a large number of stocks in a Pie and set target allocations. In essence, it’s possible to construct your own fund. However, this is not a broker for day traders.

Pros

- Fractional shares can be traded.

- Free Visa debit card.

- No commissions.

- Easy to avoid the broker’s inactivity fee.

- Ability to build your own Pies.

- IRAs are available.

- Good margin rate.

Cons

- Only two trading windows during the day.

- Shorting is not possible.

- Day trading is almost impossible.

- Software is very rudimentary.

- No advanced trading tools.

- Charting is almost absent.

- $10,000 is required for margin.

- Many investment vehicles are missing.

Brief Overview

M1 Finance is a recent entrant into the brokerage world. Targeting Millennials, it brings with it a unique style of investing, combining features of robo investing and self-directed trading. Will M1 Finance be able to shake up the brokerage industry the way Robinhood did?

Let’s have a look.

Services Offered

M1 Finance’s specialty is Pie investing. A Pie is a basket (technically not a fund) of securities. Each Pie has a certain theme, such as:

- Retirement: Every Pie has a target date and a level of risk: moderate, conservative, and aggressive.

- Income: These Pies invest in bond ETF’s.

- Socially Conscious Investing: As the name suggests, these Pies invest in securities that pass environmental, social, and governance standards.

- General Investing: Self explanatory, with a range of risks.

- Hedge Fund: The Pies attempt to replicate the performance of popular hedge funds.

- Domestic and Global: These Pies are available in both value and growth versions.

Every Pie is managed according to Modern Portfolio Theory. This means the investment will try to keep an ideal balance between risk and reward. M1’s software program rebalances all the broker’s Pies quarterly.

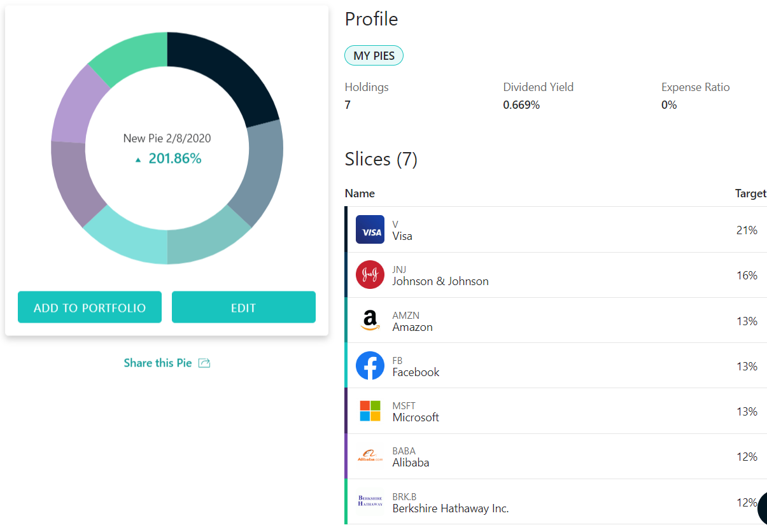

If you don’t care for any of the company’s Pies, it’s possible to build your own. And what can you put in a Pie? At this point, just stocks, ETFs, and closed-end funds. M1 Finance does not currently offer trading in options, forex, futures, cryptocurrencies, precious metals, warrants, or any other asset.

In order to trade the three securities M1 offers, you first have to place the asset inside a Pie. Nothing can be traded outside of a Pie at M1. One Pie can have just one security. So if you want to trade just one stock, it’s possible. M1 Finance limits an account to no more than 500 individual positions.

If you do decide to build your own Pie with multiple securities, you’ll be responsible for rebalancing it. M1’s robot only rebalances the broker’s Pies.

One great advantage M1 Finance offers is the ability to trade whole dollar amounts. This means you can trade fractional shares of Pies, and therefore, fractional shares of stocks and ETFs.

Cash Management Tools

Besides its Pie method of investing, M1 Finance also has been advertising its banking tools quite a bit. So we should take a look at them.

M1 offers a separate checking account that can be linked to a brokerage account. The checking comes with a free Visa debit card and FDIC insurance (through Lincoln Savings Bank). There is no annual fee for the account, but it pays no interest. M1 reimburses one ATM fee per month.

A second account is available that pays interest (1.5% currently). Called M1 Plus, it reimburses up to four ATM fees per month and pays 1% cash back. The downside is that there’s a $125 annual fee.

Day Trading

Now we come to an issue that is going to be somewhat troublesome for M1 Finance. The broker has a little rule that puts a huge damper on day trading. It only submits orders to the exchanges once per day at 10:00 am, EST. Clients submit order requests to M1, and M1 then sends all orders at once.

Moreover, these are market orders. There are no limit or other advanced orders at M1. This makes the situation for day traders all the more unworkable.

There is one workaround, though. M1 Plus customers get a second trade window during the day. This one is at 3:00 pm, an hour before the market closes. So M1 Plus clients can buy at 10 am and sell at 3 pm.

But don’t ask for other times. It’s not possible.

Buying Power

It is possible to buy securities using margin. The broker-dealer does require a balance of at least $10,000 (not $2,000) to qualify, though. On the positive side, loans only cost 3.5% right now. And M1 Plus customers get a 0.25% discount. The program is called M1 Borrow.

Maintenance margin is 25% on most ticker symbols. Some securities will have a higher requirement. M1 issues a margin call whenever an account’s equity slips below 30% of account value.

Besides buying securities, M1 Finance permits M1 Borrow customers to make cash withdrawals using existing holdings as collateral.

Shorting securities is not possible at M1 Finance. The workaround here is buying inverse ETF’s.

Pricing

And what does M1 Finance charge for its services? As it turns out, not much at all. Trades of Pies are commission-free. Deposits and withdrawals are always free. And there are no software fees.

M1 Finance does have an inactivity fee. It’s $20. Traders can avoid it simply by having an account balance of $20 or more. Alternatively, placing a trade every 90 days will evade the fee.

There are a few miscellaneous charges. For example, closing an IRA costs $100; and an outgoing wire is another $100 charge.

Software

M1 Finance does not have a desktop program. It also doesn’t have a browser platform or trade bar. Its website is the primary trading environment. Let’s take a look at it.

Website

The M1 Finance website is easy to use, in part because there’s not much on it. In the top menu, there’s a row of tabs. The “Research” tab is where Pies are built.

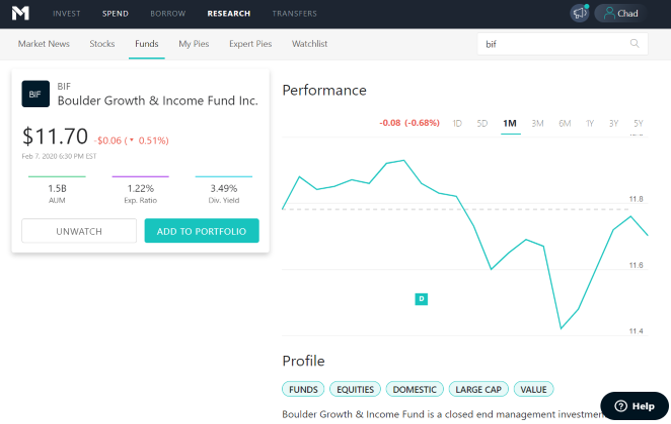

To start, you’ll want to browse through stocks and funds. You need to find some assets to put in the Pie you plan to build. This is accomplished with the broker’s stock and fund screeners. They are found by clicking on “Stocks” and “Funds” in the sub-menu.

Both screeners are similar in layout and search variables. Unfortunately, there aren’t many criteria to choose from. It is possible to choose a sector or fund classification. If you already know the security you’re interested in, just put the ticker symbol in the search box.

On an asset’s profile, click on “Add to Portfolio” to begin the process of adding it to your Pie. M1’s software will allow you to set the target percentage. Each security in a Pie can have an allocation anywhere from 1% to 100%.

It’s possible to create multiple Pies if you want. Just go to “My Pies” and click on “Create New Pie.”

If you would rather trade a Pie that M1 has created, click on “Expert Pies.” A Pie’s profile page will show you the investment’s holdings. Target-date Pies are mostly composed of Vanguard funds, but other fund families do make an appearance.

A Berkshire Hathaway Pie is invested completely in stocks, the same stocks that the holding company invests in. Apple, Bank of America, and Coca-Cola are the current top holdings.

Whether you build your own or go with a broker-constructed Pie, M1’s website will show you its return history. This is based on the underlying assets and is displayed in a graph. Up to 5 years of price history is calculated.

When you’re ready to buy your Pie, you simply need to click on “Add to Portfolio.” Doing so will add it to your current holdings. Remember that there’s no shorting here. Also remember that you must do this by 10:00 am, EST, to get the purchase in that day. If you’re an M1 Plus customer, you have until 3:00 pm.

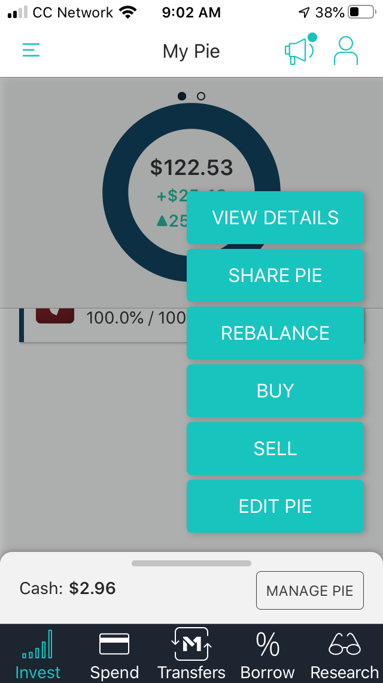

Mobile App

M1’s mobile app has a lot of the same features that the website has. Under the “Invest” tab (located at the bottom this time), a self-created Pie can be rebalanced at any time. It’s also possible to add a new holding to the Pie or adjust the original target allocations. Just tap on “Edit Pie” and follow the instructions.

If you want to share your Pie on social media, tap on “Share Pie.” A short URL will be created.

A stock’s profile has the same limited information as the website presents. These data points include:

- Market cap

- P/E ratio

- Dividend payout

- Price history

- Company profile

In order to get a graph to display, you have to tap on the graph icon. It’s located in the upper-right corner of a security’s profile. Alternatively, you can just rotate your mobile device.

Final Thoughts

During our examination, we were really impressed with M1 Finance’s Pie method of investing. It’s easy to put a large number of stocks in a Pie and set target allocations. In essence, it’s possible to construct your own fund. At this broker, you are the fund manager.

Bottom Line

If you want to buy a $1,000 stock for $30, this is a great firm to choose. If you want to day trade, you should go elsewhere.