Forget the 40 Hour Work Week, How Does $2,614 Dollars a Day Sound?

Hey all, John L10 here!

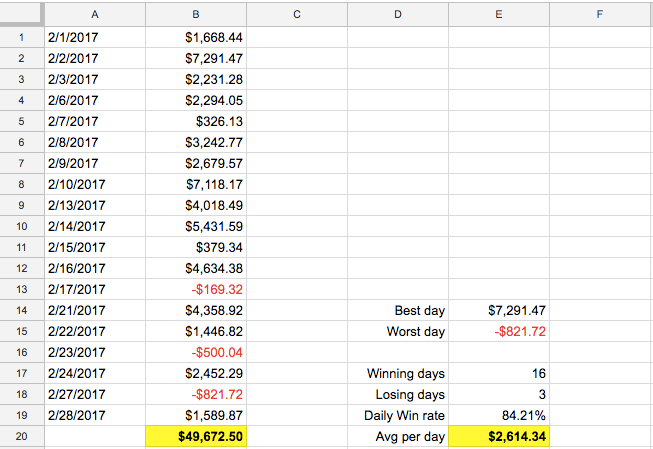

The last article I published was on Jan 31st, where I did a recap of my trading profits for the first month of 2017. I also gave my general thoughts on why I trade small caps. I mentioned in that article that I probably wasn’t going to share anymore monthly recaps but as February comes to a close today, I feel obligated to share with you my best month to date.

As traders, we must take what the market gives, and as soon as we push it a little too far, the market takes everything back. It’s under this philosophy of why I don’t have any specific “trading goals” per day or even per month. I just trade, and the results produce themselves. It’s a lot less stressful too, and I will explain that in this post.

February 2017 win/loss recap

So far for the exception of the last week of Feb, it has been really good for small cap traders, both long and short. As we were getting closer to the end of February, I was noticing that I was doing some silly mistakes during a choppy market. For example, not settling for several hundred dollars of profit on a slow day, or giving back gains by not reducing share size throughout the day. Really basic stuff that I say all the time in Warrior Trading, but you can forget easily when you are “in the moment”. There really isn’t anything more frustrating than being up a significant amount of money and then giving it back. It’s even worse than just being down from the get go in my opinion. Moving on, let’s talk about my gain/loss for February.

Locking up green days and walking away

An important metric that I want to discuss here is that I had 3 losing days, which were actually avoidable. It might be hard for someone new to trading to understand how you can only have 3 red days in a month but I know traders who have had less than 5 red days in a whole year. It’s possible only if you keep losses minimal and if you can find ways to crawl back to green in other setups. If you cut a loser quick and move on to the next best setup, there is no reason why you can’t turn a losing day around.

There were a few days where I went red on the day and bounced back. Controlled losses are very important. The 3 days where I lost were on dead slow days with a lot of chop and I just threw in the towel. Consider this, a small loss is actually a win for your account. A big loss is actually a real problem that you need to deal with for sometimes multiple days. Capital preservation is key to staying in this game.

Also, you will notice my win rate per day seems relatively high, due to only 3 losses in the entire month. I only track my win rate on a daily basis; I don’t track my win percentage per trade because at a certain point, when you are no longer “new” to trading, and understand risk vs. reward, the win/loss per trade doesn’t matter as much as the win/loss per day.

Share size is relative to your personal risk tolerance

Another metric that isn’t shown in the above screen shot is my share size, which I do not actually track but I can tell you it ranges from as little as 1500 too as high as 8000 shares, depending on the setup. I may trade 2000, and add 2000 for 4000. Or start off with 4000 and double for 8000. When I am trying to just put pocket change in my account after a good day, maybe I am only trading 1500 to 2000 shares. Small wins add up.

The last day of the month, Feb 28th, I had several small wins in the range of $200 to $300, which netted $1,589 for a couple hours of work after the market open. It’s important to understand that the amount of shares does not cross over from person to person. Each one of us has our own risk tolerances and everyone needs to do their own thing with respect to share size. I am not trading the same share size as Ross, and I don’t expect a new person to trade the same share size as me.

You can see the pattern there. It takes time to become aggressive. First you win consistently, and then you focus on increasing those wins.

Let’s talk a bit about my biggest winning days

The two elephants in the room: two $7,000 dollar days. Those were fun, not much can ruin your day after netting $7k before lunchtime. Let me explain how those happened. It’s hard to know before it happens, but experienced traders can tell when days are hot. It’s the back-to-back opportunities that come and they run hard. On these days you have to push it, as they will help when it eventually becomes slow.

On Feb 2nd, I had two trades that netted over 2k, one that netted 1k and three smaller trades. Again, this is an example of wins adding up. They may not be “small” wins, but small becomes relative after awhile. On Feb 10th, I had just one trade, and it netted the full gain of $7.1k. I think I walked away from my computer at that point! Some days with the combined skill that you acquire as a trader, you just get lucky. You may be disappointed that I didn’t include charts to better explain these two trades, but if you look back on the video recaps Ross did on the same dates you can get an idea of what I traded.

Believing that trading is possible

I’d like to add that I realize perhaps not everyone is going to believe in such gains, maybe you think they are fake. I can add broker statements, which people would claim are photo-shopped, but at the end of the day, you either believe or you don’t. That’s the choice you have. When I started this journey, I believed there were people making stupid amounts of money each day while I made $500 a day as a decently paid, according to societies employment statistics, wage slave.

I have seen people claim to make over 100k for the month; do I believe that they did? Yes, I really do. So the choice is yours, you can sit and be mad, or you can show up to trade everyday, devour the education and actually experience the opportunities that the market gives first hand.

It doesn’t stop there – you can make even more income

It’s funny because, that’s not where the story ends. In my prior blog post I mentioned that trading profitably in a consistent manner could allow employees to become entrepreneurs. Since at Warrior Trading I am not tied to my desk, trading every hour until the market close, I am running different businesses. Some are more time consuming than others but for the most part, I am very busy almost all day and night and like the title of this post “Forget the 4 Hour Work Week…” I am working a lot more than 4 hours, building up wealth and different sources of income.

If you thought making almost $50,000 on the month was impressive, how about a combined income of $106,000 to date by Feb 28th? I am not even counting my wife’s salary either. I expect she will not want to work soon! If you can get successful at trading, you can start to diversify and do different things. Say goodbye to your employer reliant income and say hello to work wherever you want, the only boss is yourself! If that isn’t motivation I don’t know what is.

I hope you all enjoyed my recap and that you can grow alongside me in the Warrior Trading chat as well as the Inner Circle, where I give a bit more insight by answering more involved questions from my personal experience.

That’s all for now, thanks for reading.

John