Current fiscal policies are setting the stage for a steady rise in inflation so we put together a list of assets that have proven useful as an inflation hedge.

What is Inflation?

Put straightforwardly: inflation is when the purchasing power of a currency goes down, usually because more currency is added to the supply of money.

In the last century, we’ve seen the purchasing power of the US Dollar decimated due to the United States’ adoption of Modern Monetary fiscal policy.

The Federal Reserve’s response to economic crises is basically to print more money, which by definition, reduces the value of the rest of the dollars.

So, inflation is a fact of life. It’s out of our circle of control, in Stephen Covey’s words.

If we want our wealth to increase, rather than decrease in value, we need to focus on assets that hold their purchasing power and consistently produce yields in excess of the inflation rate.

Understanding Inflation

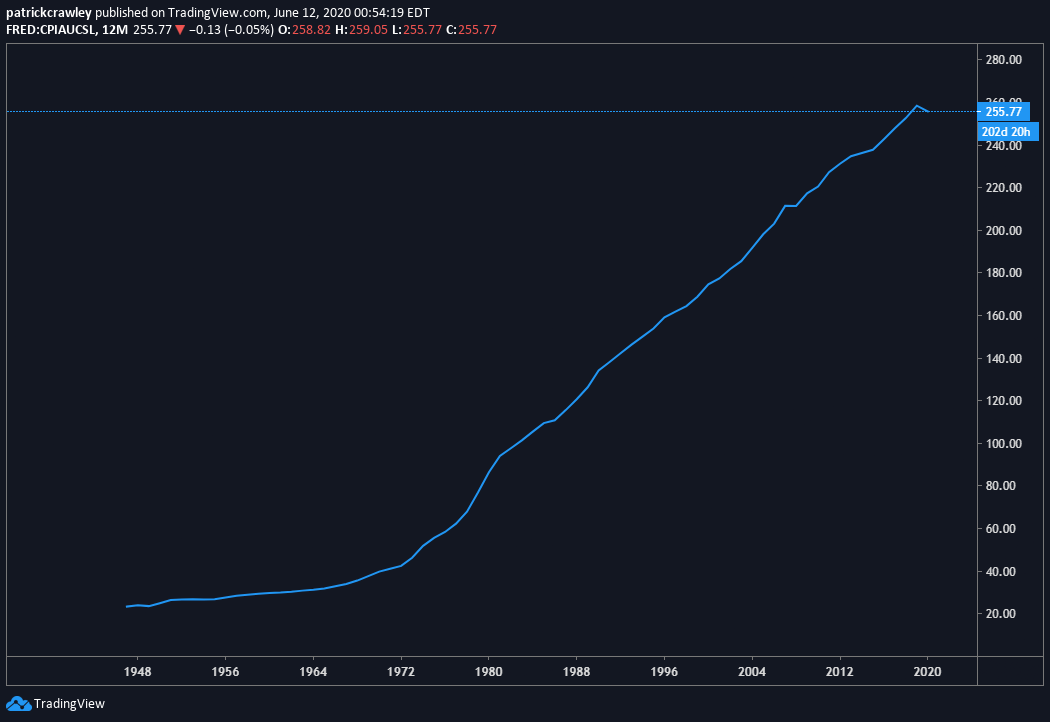

The primary method to track US dollar inflation is through the Consumer Price Index (CPI).

The CPI tells us what the purchasing power of the US dollar is throughout time. When the index goes up, the purchasing power of the dollar declines.

Below is a chart of the CPI, going back to 1948, which as far back as the Federal Reserve’s public data goes.

Over the last decade or so, the inflation rate has been around 2%, meaning the dollar loses roughly 2% in value annually. Compound that over your career; that’s why leaving cash in a savings account is a losing game.

How Do You Hedge Against Inflation?

To protect against inflation, you need one of two things but preferably both: a store of value and real yield.

A store of value means many things to many people. At the bare minimum, though, a store of value must retain it’s purchasing power over time. This means that it’s value doesn’t slowly decay over time.

Another bonus is the ability to create income. When an asset both holds its value (or even increases in value in a reasonably predictable and economically rational fashion) and creates income over time, you’re looking at one of the best inflation hedges around.

In a recent article here, we spoke about hedge fund giant Paul Tudor Jones’ big bet on Bitcoin. In the post, we outlined how Jones and his team define a store of value.

The traits serve as an excellent benchmark by which to measure potential inflation hedges.

Here’s the list, taken straight from the May 2020 investor letter:

- Purchasing Power – How does this asset retain its value over time?

- Trustworthiness – How is it perceived through time and universally as a store of value?

- Liquidity – How quickly can the asset be monetized into a transactional currency?

- Portability – Can you geographically move this asset if you had to for an unforeseen reason?

The Coming Inflation

In response to the economic fallout caused by coronavirus, the Federal Reserve pulled out all the stops. Their balance sheet has already ballooned from $4 trillion to over $7 trillion, with further contraction expected.

This is how it works: the Federal Reserve buys securities on the open market through their Open Market Operations. This adds more liquidity to financial markets and balloons the money supply.

Further, the Fed recently guided that interest rates will continue to stay near-zero until 2021, making chasing yield in risk assets and replacing cash with stores of value like gold even more attractive to investors.

Top Inflation Hedges

Below I’ll go over three inflation hedges:

- Real Estate

- US equities

- TIPS

Of course, this list isn’t exhaustive. I’m leaving out Bitcoin and gold, among several others. For a more in-depth discussion of inflation and hedging against it, I highly recommend Paul Tudor Jones most recent investor letter.

Real Estate

We’ve all heard the age-old argument on investing in real estate: ‘they can’t make any more of it.’ While this seems like simplistic advice, it serves as a real benefit to real estate as a store of value.

The primary reason why currencies like the US dollar suffer from inflation is because more dollars are constantly added to the money supply. Real estate inflation is simply impossible.

Sure, some styles of real estate go in and out of favor, but the total acreage of the world cannot change.

The Case-Shiller Housing Index reflects an annual return of 0.7% in excess of the inflation rate since 1940, meaning that as an asset class, real estate has not only proved a reliable store of value, but it also has appreciation potential. The appreciation potential is likely much higher if you buy correctly.

Remember, the index is an index; it’s reflecting the average.

In addition to serving as an excellent historic store of value, real estate has the added benefit of income. Cap rates vary based on region, property type, and neighborhood, so any broad numbers are shots in the dark.

However, for some broad strokes on the cap rates of large commercial real estate projects, check out the CBRE’s most recent Cap Rate Survey.

US Equities

With the Fed guiding near-zero rates until at least 2021, investors are forced out of safety trades like government bonds and AAA corporate bonds.

Tack on the inevitability of inflation, and you have a situation where investors are forced to buy riskier assets like stocks in the search for yield.

Buying the Nasdaq 100 or S&P 500 in the age of near-zero interest rates has become the de facto ‘safety trade’ for many investors and that seems unlikely to end in the near future.

Even though there’s scary economic news coming out each week, the stock market continues to rise. The Nasdaq Composite even made an all-time high this week.

Many credited economic reopenings across the United States as the main catalyst, and I’m sure that plays a role. But markets are future-discounting mechanisms, and it seems that more money is flowing into stocks because there’s simply nowhere else to hide.

As of writing, the S&P 500’s earnings yield is 4.65%. While that’s quite low historically, it’s still well-above the rate of inflation.

TIPS – Treasury Inflation Protected Securities

The most boring of the bunch, but hedging your non-trading cash isn’t supposed to be fun.

TIPS are Treasury Inflation Protected Securities. They’re government bonds which protect you against rising rates of inflation. When inflation rises, your interest payments will be larger to adjust for that inflation.

Let’s contrast that with a traditional treasury bond. Perhaps the coupon rate is 4% and the current rate of inflation is 2%. This results in a 2% ‘real’ yield, or your inflation-adjusted yield. If inflation were to one day rise to 4%, that bond’s real yield would now be 0%.

Traditional bonds offer no security against inflation, which is what makes TIPS so attractive to some investors.

TIPS have a fixed real yield. This means that regardless of the stated inflation rate, your return above inflation will still be the same.

While any form of US government bond is pretty boring, if you’re a retirement investor trying to protect your assets, having knowledge of TIPS in today’s market can benefit you immensely.

Bottom Line

Most of us traders don’t give inflation much of a thought in our day-to-day trading. It, still however, affects. We still hold our uninvested cash in our local currency, which loses a tiny bit of value each day.

With global central banks turning to money printing as their crisis response, understanding how inflation affects our wallet is becoming increasingly important.