Base Hits Continues to Bring Home the Bacon

Adapting to market conditions

In the last installment of my monthly recap I named April’s article “Grinding Out a Challenging Month as a Trader”. I used specific terminology when titling that article, starting it with the word “Grinding”. A way, or method, of trading that every serious trader should subscriber to. One must always grind, as when trading doesn’t become a grind, that’s the point of maximum financial risk. What this might look like if you were to draw it out, would be something like this:

Image by: The Financial Philosopher

Although this graph is not a perfect representation of what I am talking about, it actually describes the way inexperienced investors invest and ultimately lose (buying tops, selling bottoms, etc.) but, you could also look at this as when you are at the “Euphoria” stage, say you are making gains hand-over-fist, things are super easy, it’s your best month ever.

What tends to happen is “How could I have been so wrong” as depicted in the graphic above, and then your worst month ever, giving back all those easy euphoric gains. Eventually, if one is lucky enough to have enough any capital left, they reset, and come back to normally, or “the grind”.

The best way to avoid this emotional and financial roller coaster is to realize that hot streaks come and go, but when they go, you need to recognize them fast and adapt accordingly.

Presently, small-cap traders in Warrior Trading have adapted to the market conditions and are slamming base-hits every day. If you are in our chat, you see it with your own eyes. Although I had somewhat of challenging month in April, there are much worse examples outside our community who trade similar stocks.

I am not going to point them out individually, but this is where I want to talk for a moment about Twitter, a place where would-be traders relish in receiving “free trading advice” from what I will call, degenerate traders who seem to like posting massive account-blowing losses while Tweeting 20 times per day, making incessant commentary on what they think a stock will do.

Most of these traders like the exposure and gratification of other people looking up to them, but they are simply learning on the go while they give you this “free advice” via social media. They are basically entertainers. I am being very pointed here, but, you should realize that free advice has a cost, and in trading, making mistakes is very costly for a new trader. It can mean the end of your trading dreams and will solidify you a seat in your companies cubical for the foreseeable future.

I strongly recommend for anyone reading this to limit your exposure to trading commentary on Twitter, especially from traders who consider themselves “pros” or “experts” but can’t consistently make steady gains without blowing up every few months.

Being an Income Trader is about Managing Risk and being Responsible

It should be obvious by now, I consider myself an income trader, adding up the gains each day to make what at the end of the year should be, a substantial capital gain. Currently, I am averaging around $1,600 per day. It may go up or down from here by year end, but, my job is to bring in daily income while managing risk to ensure my average stays consistently high.

I don’t want to go back to the previous topic above, but I continue to see traders not caring about income. Several of those wannabe Twitter traders have almost lost all of their capital in their account. That doesn’t sound like income to me. Maybe they will make it all back one month, but maybe not. That doesn’t sound like a great strategy to me.

At Warrior Trading, traders are at different levels of experience, but they are primarily income traders. Taking home $50, $100, $500 or more per day can be life changing if done on a consistent basis. Many people outside the trading world wonder, “how can I just make $300 this week?” Or “I just need an extra $1500 this month”.

The majority out there would find that money very useful. So please, be responsible, cut loses, manage risk and live to trade another day. If you follow someone on Twitter who has posted a massive loss the size of a middle-class salary, that person is learning while at the same time trying to give you advice. Good luck with that.

Trading live in Vegas with Warrior Trading Inner Circle members

Now, I know, this is already a long article but there’s a lot of things to talk about and I only do this once a month.

During May, Inner Circle members flew into Vegas where Ross, Mike, Jeff and the rest of the Warrior Trading team hosted a really interesting private event. I got to meet a lot of people who decided to “take the bull by its horns” to become consistently profitable traders.

Nevada or Mars? One day maybe we won’t be able to tell.

Those who attended are serious people who took the time out of their busy life to give attention to something that matters to them, and I greatly respect that. After coming back I already see that those who attended the live event are more confident in what they want to do, and I think as a result, are doing better.

I traded three days while in Vegas on my laptop trading setup and I made $852 USD on the first day, $1,252 on the second day and $424 on the third with very conservative share size and a small amount of actual trading. The best thing about the time zone in Nevada is I was pretty much done by 8 AM. Talk about having the whole day to do whatever you want, and that’s pretty much exactly what I did.

Inner Circle members also have access to a private chat where I, as well as others join daily. I try to use the room to describe what I am thinking in more detail vs the main chat when I can, and members can also ask more questions and receive personal attention in general. That might sound like an up-sell if you are not in it, but trust me, it is just me explaining what it’s like.

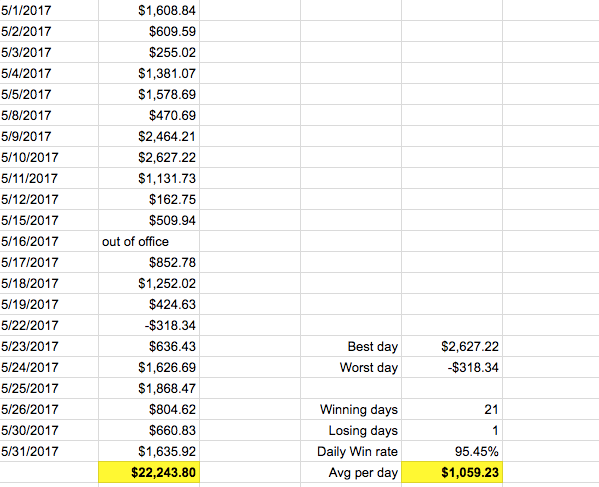

Profit and Loss recap for the month of May, 2017

Overall, I am happy with the month. Clearing $20k is not something I will snuff at, as that’s $240,000 a year, or $1,000 a day and as I always remind people that those traders who have extra sources of income, who diversify, have it even better. I have kept an income-mentality, where I am not going to get myself into any big losses. Just piling up the wins, grinding it out and maintaining predictability in my P&L.

Anyway, thanks for reading! See you in chat.