The cannabis industry was a big-time winner in the 2020 elections.

Full recreational adult use was on the ballot in four states and it passed in all of them.

Don’t be surprised if you hear politicians stressing this issue more in the future as the results are clear: cannabis legalization is a winning issue.

This news significantly expands the legal cannabis market in the United States, which is bound to help listed companies who serve the US market like Liberty Health Sciences, Trulieve, and Curaleaf Holdings.

The State of Cannabis Legalization in the United States

Each state has unique cannabis laws, full of asterisks and such. Thus, comparing interstate laws isn’t apples-to-apples.

As it stands as of the 2020 elections, here is where each state stands with regards to cannabis legalization. All data is sourced from DISA’s map of cannabis legality.

These four states passed initiatives to fully legalize marijuana for recreational use:

- Arizona

- Montana

- South Dakota

- New Jersey

This brings the total number of states with fully legalized cannabis to 15, with roughly one in three adults living in a state with legalized recreational marijuana.

Additionally, Mississippi legalized medical marijuana in the 2020 elections.

How the Cannabis Industry Reacted to the 2020 Elections

The major cannabis stocks naturally advanced as results of the cannabis ballot initiatives passing became clear.

Using the only notable cannabis ETF, $MJ, you can see that the industry made two significant gap-ups, only to fail at it’s June 2020 highs.

The failure tells us less about whether or not this rally has legs, and more about the way cannabis stocks trade. This is an industry dominated by retail investors and day traders.

As such, many are chasing breakouts and buying out of the fear of missing out on the next big run in cannabis stocks. When cannabis stocks are in play, they whipsaw like no other.

However, we’re looking at an ETF here, a basket of 37 companies in different sub-industries of the marijuana and many operating several businesses.

Let’s boil down to those stocks which most benefited most from the legislative actions in the states which just legalized recreational marijuana: Arizona, Montana, South Dakota, and New Jersey.

Historically, most of the eyes have been on Canada-centric companies like Tilray and Aphria. With the US elections opening up a larger portion of the US market, it might be time to reevaluate some US-centric cannabis companies.

Curaleaf Holdings

Curaleaf Holdings is one of the larger producers of marijuana in the United States. They’re one of the few major cannabis companies that have been able to form something of a brand.

They also hold the highest retail market share in New Jersey, and the second highest in Arizona, both states which legalized recreational cannabis use in the 2020 elections.

Curaleaf is as close to what you can call a “pure play” on the growing recreational cannabis market in the United States.

So, how did it react?

Below is a chart of Curaleaf ($CURLF) compared to the $MJ ETF (orange line). As you can see, Curaleaf’s price action tells the same story as $MJ, albeit underperforming.

How is the Legal Cannabis Industry Performing?

According to Arcview Market Research, the legal cannabis market in the United States was $12.4 billion, growing 36.5% from the previous year.

They project the market to grow at a compounded annual growth rate (CAGR) of 18% until 2025, at which point the market will be $34 billion.

Of course, these are market research projections, mainly sold to the industry so they can cite them to prospective investors. However, nobody can deny that marijuana is a hot commodity.

It’s in a unique spot right now because the primary friction at the moment is legislative.

According to a new Gallup poll, 68% of Americans support cannabis legalization, a record high for this poll.

Assuming this trend of Americans favoring cannabis continues, the legal market will continue to expand.

With that in mind, it’s no surprise that retail investors are piling into cannabis stocks, as it looks like a market that is virtually assured to continue its growth.

However, industry growth doesn’t always materialize into stock price gains. Valuation matters.

Valuations of Cannabis Stocks

It should surprise no one that valuations in a brand new growing industry are sky-high. Compounding this is the “buy what you know” effect of retail investors investing in cannabis stocks because they’re cannabis users themselves.

The chief reason for these high valuations is the near-guaranteed future growth of the industry.

The illegal market for cannabis is huge in the United States, as most users are still purchasing it on the black market. As the legal market is gradually opened, the industry is poised to grow and take market share from the black market.

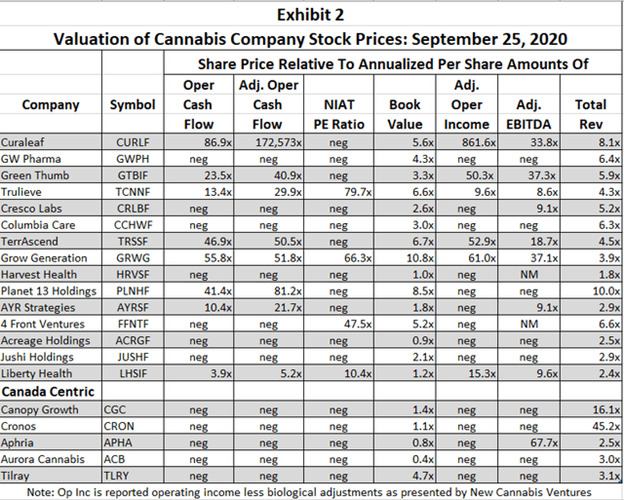

Here’s an excellent spreadsheet produced by SeekingAlpha’s James V. Baker:

As you can see, the majority of listed cannabis companies don’t even produce cash flow from their operations. This means they are forced to rely on debt and equity financing to continue as their operations eat their cash.

Not only will this raise their leverage, but equity financing will dilute current shareholders. As a general rule, companies that regularly dilute their stocks, don’t just stop once things improve.

Their behavior should serve as an indication of their respect to their shareholders percentage ownership.

Baker’s analysis found that seven of the 20 cannabis stocks he analyzed have operating expenses in excess of their total revenue.

Talk about an uphill battle. It’s difficult enough when your profits can’t keep up with expenses, but sales?

What is the Future of the Legal Cannabis Industry?

Not everyone is convinced of the marijuana industry’s investment viability.

The primary critique is that marijuana is a commodity like wheat or rice. Once the market is legally open to everyone, there’s a race to the bottom in prices. Only those who can create novel products and strong name brands will thrive.

It’s inspiring to look to the alcohol industry, where another commodity is repackaged at a steep premium. But, cannabis has never had name brands.

The tradition for all of time has been to grow it or purchase it from a local drug dealer.

Many doubt the industry’s ability to sell consumers on the idea of a premium branded product overnight.

Even so, of all the cannabis stocks out there, what are the chances that your favorite will end up as the Coca-Cola of marijuana?

Bottom Line

While the total addressable market of cannabis just skyrocketed in the United States, don’t be so quick to buy shares of your favorite cannabis company just yet.

As detailed earlier in this article, it’s clear that significant profitability is still an uphill battle for this industry.

As the speculative fervor wears down, don’t expect the market to reward an industry with such problems producing profits with lofty premium valuations.