Pelton (NASDAQ: PTON) stock last Thursday was a bloodbath, dropping 24% on the day after several volatility halts, bringing the stock’s YTD return to a whopping -80%, dropping below it’s IPO price of $29 in trading on Friday.

It’s yet another victim in the ongoing carnage of stay-at-home pandemic stocks, which were Wall Street darlings just a year ago.

CNBC got a hold of some internal Peloton documents which showed the company’s plans to pause production of their Bikes and treadmills.

According to the CNBC report, Peloton will pause production of their Bikes until April, their Bike+ until June, their Tread until March, and their Tread+ until 2023 (as a result of the safety issues leading to recalls).

It’s worth noting that Peloton CEO John Foley dismissed these claims from CNBC as false.

When the data was released around noon on Thursday, the stock took a nosedive resulting in several volatility halts. Watching this unfold live looked like true market panic.

Peloton 30-minute chart from January 17, 2022, to January 14, 2022.

This comes as a consequence of economies reopening and economic stimulus declining, which destroys demand for expensive stay-at-home gadgets like Peloton.

The company’s target clients in ordinary times are affluent urban consumers. But their total addressable market temporarily exploded when everyone was locked at home, flush with pandemic helicopter money and nothing to spend it on.

One on hand, it shouldn’t come as a huge surprise that demand at Peloton is declining. It’s pretty unfair to compare their results now to those of a time when gyms were shut down and people couldn’t leave the house. Many took the dive into Peloton because they had few other practical fitness options.

But the reason we make these comparisons is because in some way, the stock price does that. When the stock is pricing in massive, pandemic level growth into the future, we have to ask the common sense questions like “is it reasonable to expect pandemic growth for a stay-at-home stock after the pandemic?”

The Slow Death of Stay at Home Stocks?

The start of the pandemic and the ensuing price action in 2020 created a tale of two markets. Those who are connected to the real world economy and mobility like industrials, airlines, restaurants, etc., and those whose businesses were augmented by people staying at home like Peloton, Netflix, and Doordash.

Now that most economies are getting back to full capacity and have lifted nearly all restrictions, stay-at-home stocks are under immense pressure. Here’s a graphic from AllianceBernstein representing a portfolio of going long the Goldman Sachs “stay at home” basket of stocks and short “go out” stocks, which are stocks that are hurt by lockdowns like travel, airlines, restaurant, etc.:

Source: AllianceBernstein

And in 2022 we’re really seeing the veil lift on some of these elevated valuations, as a Visual Capitalist article published Friday shows:

Source: Visual Capitalist

Not only are these companies threatened by the pandemic trends they benefited from waning, but with economic stimulus declining, inflation soaring, and rising interest rates make it difficult for high-growth firms to survive.

Most are unprofitable and unable to earn their cost of capital. In good times they can simply get low-interest rate financing or issue equity at high valuations to fund their operations. But when things go bad, loans get expensive and difficult to service without issuing more equity, but at that point shareholders are forcing the company to get more disciplined and not dilute their ownership with continued equity raises. So they become cash-strapped and have to cut costs, meaning they don’t have the money to invest in their growth. But their growth was the one thing keeping their valuation lofty.

This exact cycle has happened several times in growth stocks and typically ends in the same fashion.

Other Warning Signs at Peloton

Insider Buying

In response to the price decline on Thursday, a number of commentators have noted that corporate insiders at Peloton have been signaling to the market throughout the stock’s entire bull run that the price is simply too high by insider selling.

According to data from Insider-Monitor, insiders at Peloton sold a cumulative $455 million in stock in 2021, compared to their $117 million in purchases.

This is significant because there’s high quality academic research suggesting that the activities of company insiders are strong signaling mechanisms to the market, and every type of corporate insider outperforms the market. For this reason, substantial imbalances between insider buying and selling is worth noting in the future.

Activist Investor Causing Trouble

Much to the likely dismay of the Peloton board, an activist investor called Blackwells Capital took a substantial (but <5%) stake in Peloton to argue for changes at the company. Namely, the ousting of CEO John Foley and to seek an acquisition from a strategic buyer like Disney, Apple, Sony, or Nike.

And investors seemed to like Blackwells’ plan, as the stock jumped 10% on Monday after the activist hedge fund released their requests.

Stagnating Growth

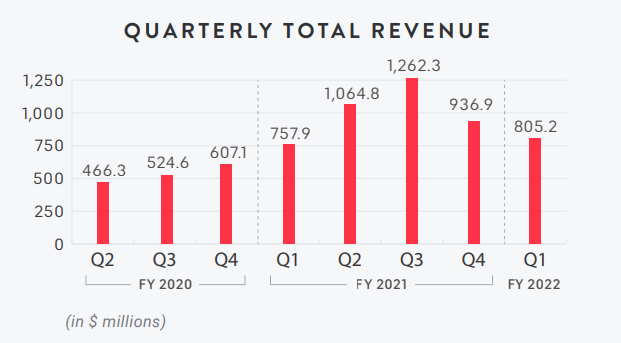

Like many of its growth stock peers, Peloton is not a profitable company. Their once-high stock price and arguably still high valuation represent investors’ enthusiasm about future growth at the company and their ability to turn that into earnings.

When it comes to these types of stocks, revenue growth is everything. If they can keep growing the top line, it shows that they haven’t fully penetrated the market yet and are still in a growth phase. The thinking goes that once they reach a more mature status within their industry, they can reduce investment into growth and start producing actual earnings for shareholders.

But Peloton committed the original sin of growth investors: their top-line not only didn’t grow, but it declined!

At a time when the company is aggressively pursuing a ‘growth at all costs’ mindset in lieu of producing earnings, it’s alarming to see revenue growth decline. And it suggests that the skeptics’ biggest criticism of Peloton just might be true: that it’s a fad stock.

Raising Prices Amid Demand Destruction

When confidential insider presentations talk about how demand for their high-end fitness equipment is declining and facing a “significant reduction,” that’s probably not the time to raise prices.

But that’s Pelton’s plan, at least for now. The company is adding on a $250 and $350 delivery fee to their Bikes and Treads, respectively.

On one hand, this makes total sense. Supply chains are constrained and we’re experiencing inflation across nearly all goods in the economy.

But basic supply and demand tells us that you probably shouldn’t respond to declining demand with raising prices, inflation be damned.

Heaps of Bad Press

Peloton is best known for their Bike, but they make treadmills, too. Unfortunately, many are only familiar with the company’s fitness-connected treadmills due to recalls and safety concerns.

In May 2021, the company issued a recall for both the Tread and Tread+ treadmills after several injuries and even the death of a child. Not only did Peloton have to issue tons of refunds and pay for repairs, but the reputation of the Tread products and the company as a whole were obviously harmed.

Things got worse when two TV shows loved by Peloton’s key demographic of urban affluent and older consumers: Billions and the Sex and the City reboot, both made jokes about show characters having heart attacks from using Peloton products.

Nearly all headlines so far this year for the company have been negative, speaking of layoffs, price hikes, demand problems, and supply chain constraints.

Bottom Line

Peloton certainly has potential to become a “busted growth stock,” joining the cemetery with countless fad stock peers like Beyond Meat (BYND) or Lemonade (LMND).

However, if right now isn’t peak bearishness on Peloton, you have to wonder what is? Sifting through Twitter, or the comments on any article seems to be a giant victory lap for the skeptics and shorts, seeing it as a foregone conclusion that Peloton “was” a fad stock, only to fade into obscurity.

Putting the obvious problems at the company aside, one thing is for sure: Peloton’s customers love their products and that shows in their usage data.

The average Peloton user did 20 workouts a month in Q4 2021, and their number of subscribers has grown steadily, even while their revenue growth has stalled: