ETRADE Review

-

Value For Investors

-

Value For Active Traders

-

Commissions & Fees

-

Platform & Tools

-

Customer Service

-

Order Execution

-

Mobile Trading

-

Options Trading

Summary

E*Trade is a quality broker that has a lot to offer, but for day traders, it may not be the best option.

Pros

- Several trading platforms to choose from

- Good commission schedule

- Discounts for active traders

- Wide selection of tradable instruments

- Impressive banking tools

- Web-based margin calculators

Cons

- E*Trade eliminated its forex service several years ago

- No electronic short locating

- No maker-taker fees

E*Trade is best known for its funny commercials. But the broker has some serious trading tools that day and swing traders should be aware of. Moreover, E*Trade is a financial conglomerate, so there are many more resources available.

Brief Overview

E*Trade got its start in 1982 in Silicon Valley as a brokerage startup. Since then, it has gradually mushroomed into a financial conglomerate with banking operations, wealth management, advanced software, and more. In early 2020, it was purchased by Morgan Stanley.

Services Offered

From its start as a small tech startup, E*Trade has grown to offer a lot of investment services. Today, it’s one of the few discount brokers to offer a self-employed Roth 401(k) plan. It also provides the Traditional solo 401(k) and the following account types:

- Several IRAs

- Profit-Sharing Plans

- Taxable joint and individual accounts

- Coverdell Education Savings Account

- Custodial accounts

- Managed accounts (human and robo options)

- Bank products, including checking, savings, and lines of credit

The bank accounts come with FDIC insurance. One of the checking options offers free checks and unlimited ATM fee rebates.

For self-directed trading, E*Trade has the following instruments:

- Equities (including over-the-counter and penny stocks)

- Options

- Bonds

- Closed-end funds

- ETFs

- Mutual funds

- Futures

Notable assets on the list are options and futures. These products can be day traded without pattern-day trading regulations.

The other investment vehicles do require an account equity of $25,000 to day trade. But the penny stock and OTC offerings do catch my attention.

Day Trading with Etrade

Because E*Trade is based in the United States, it must enforce FINRA’s PDT rule. Despite this slight inconvenience, the company does offer several features day traders will want to see. These include:

- Powerful desktop software with advanced charting

- Short locate service over the phone

- Direct-access to market venues

- Level II quotes

Leverage

E*Trade’s general policy on borrowing is that it follows the Reg T guidelines. This means initial margin for both long and short positions is 50%. Maintenance is 25% for long positions and 30% for short.

The broker does provide up to 4:1 leverage for day-trading purposes. Some securities, like leveraged ETFs or low-priced securities, will have less leverage than the numbers stated here.

None of E*Trade’s platforms have a short locate feature. The standard procedure to short a stock is to enter a sell short order and see if it goes through. If it does, then obviously the stock is shortable.

If it doesn’t, then you’ll need to call in and talk to the firm’s trade desk. They will try to locate hard-to-borrow stocks, which of course carry additional fees.

Stocks under $1 cannot be shorted at E*Trade.

Margin Calculators

There are three margin calculators on E*Trade’s website. All of them can be located by clicking on the ‘Accounts’ tab in the top menu, then selecting ‘Portfolios.’ You’ll see ‘Margin’ in the sub-menu.

The first resource we want to look at is the house margin look-up tool. Enter any symbol in the search box, and a pop-up window will appear. It will contain maintenance margin requirements for long and short stock positions and naked options. Additional ticker symbols can be added to the window.

The second margin tool is a margin analyzer. Found further down the page, this analyzes margin on current positions.

The third and final tool is a margin calculator. Found next to the margin analyzer, this one shows the impact on margin from a hypothetical trade. Both stock and option trades can be used. Some of the numbers shown include:

- Margin Equity

- Margin Maintenance Requirement

- Margin Maintenance Excess

- SMA

- Margin Available for Withdrawal

Futures Trading

One method E*Trade provides to circumvent the PDT rule is futures trading. Because futures aren’t securities, they don’t carry the $25,000 account equity requirement.

The broker offers trading on ICE US, CFE, and CME exchanges. Contracts include:

- Bitcoin (/BTC)

- 30-year Treasury bonds (/ZB)

- Gold (/GC)

- British Pound (/6B)

- Crude Oil WTI (/CL)

- E-mini S&P 500 (/ES)

- Micro E-mini S&P 500 (/MES)

- Micro E-mini Nasdaq 100 (/MNQ)

- Nikkei 225 (/NKD)

Commissions

E*Trade responded to the 2019 broker price war by lowering its equity commission all the way to $0. Futures still cost $1.50 per contract, per side.

Although option trades have no base charge, there is a 65¢ fee per contract. There is a 15¢ discount for active traders. To qualify, E*Trade requires 30 trades per quarter. There are additional fees for index options.

Accounts at E*Trade come with no annual fees or other on-going charges.

Software

For order submission, account management, and security analysis, E*Trade offers several platforms. We’ll start with the desktop program:

E*Trade Pro

Day and swing traders will definitely want to check out Pro. The software offers many sophisticated tools, including:

- Another margin calculator

- Video news

- Economic calendar

- Market movers

- Time & sales data

- Several option tools

Charts on E*Trade Pro come with some professional-level features. During my research, I found roughly 40 drawing tools. Company events can be displayed over price action. And I was able to quickly add any of roughly 130 technical studies.

Charts have the following graph styles:

- Candles

- Hollow candles

- Colored bar

- Heikin Ashi

- Line

- Mountain

With a right click of the mouse, it’s possible to access Pro’s order form. It also exists on the software’s default layout within a discrete window.

There are several order forms within this one window. The one I found most useful was the ‘Total Trade Ticket.’ It can be accessed by clicking on the appropriate tab within the default trading window.

The Total Trade Ticket offers trading in both equities and options simultaneously. Up to four legs can be added to one trade. An analyze button will create a profit-loss diagram for the proposed trade.

Also on the order ticket is a destination field. Just four market venues can be selected (for stock orders only). They are:

- ARCA

- NYSE

- NSDQ

- IXE

The default choice is AUTO. There also is an option for extended hours.

E*Trade does require a $1,000 account balance and a subscription to real-time quotes to use Pro. There is no charge to sign up for the latter requirement.

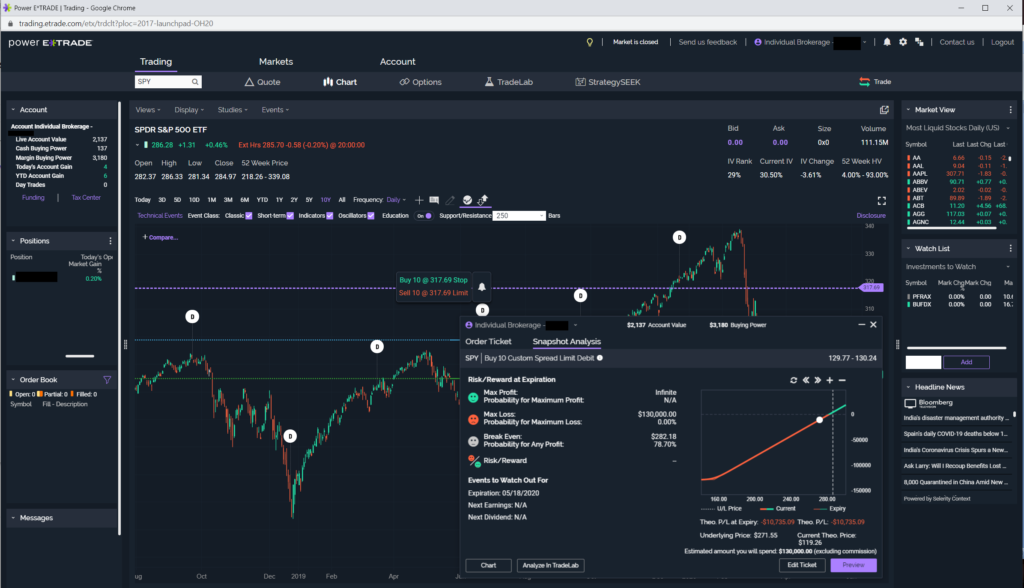

Power E*Trade

Up next is Power E*Trade, the firm’s browser platform. Launched from the website, it packs quite a punch, delivering the following features:

- Live webcasts Mondays and Tuesdays

- Simulated trading mode

- Pre-installed multi-leg option strategies

- Advanced trade ticket

Charts on the browser platform offer many of the same tools found on Pro. These include technical indicators and company events. One advantage that Power has over its desktop cousin is a larger selection of display styles. Display choices not found on Pro but available on Power include:

- Baseline Delta

- Wave

- Heikin-Ashi

The order ticket on Power offers some really nice features. ‘Snapshot Analysis’ is a profit-loss tab that shows maximum profit, maximum loss and break-even points. Just enter the legs and click on the tab. The software does the rest.

Power offers several order types, including:

- 3-leg bracket stop

- Trailing stop limit

- OCO stop

- Stop limit on quote

- Hidden

- Reserve

Website

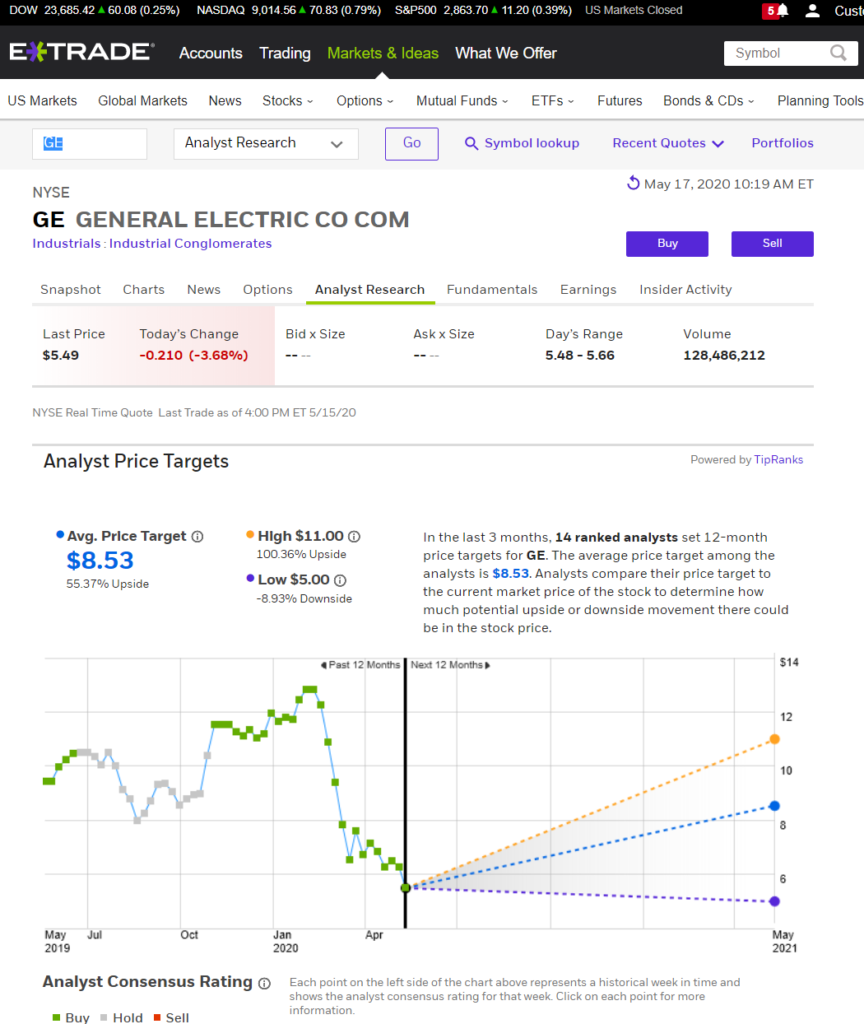

Although Power and Pro offer plenty by themselves, E*Trade’s website offers additional resources. Here, you’ll be able to find a great deal of security research tools. These include:

- Stock screener with many search variables

- Free stock reports in pdf format

- Bloomberg video news at no charge

- MarketCaster with streaming quotes

- An IPO hub for upcoming launches

- Price targets on some stocks

And of course there is a self-service center with many account management functions. These include dividend preferences and an online chat feature.

Mobile App

If you’re away from your desk, E*Trade has you covered. With its user-friendly mobile app, you’ll find:

- Charting with some tools

- Order ticket with advanced options

- Mobile check deposit

- Mutual fund and options trading

The trade ticket for options permits up to 4 legs per order. However, there are no pre-installed strategies. You have to build your own. If you want strategies pre-installed, you’ll need to use the Power app.

Power App

E*Trade didn’t stop at just one app. It offers a second, which has fewer features in some areas, and more in others.

To access option spreads, just tap on the ‘Trade’ icon in the bottom menu. Next, select a strategy from the drop-down strategy menu.

Besides options, futures can also be traded on the Power app.

Bottom Line

E*Trade has a lot of resources for day and swing traders. Long-term investors will also find many advantages with this full-service financial powerhouse. Although its desktop platform isn’t advertised as heavily as its browser system, short-term traders will definitely want to use Pro.