-

Value For Investors

-

Value For Day Traders

-

Reliability

-

Cost

-

Customer Service

TAS Market Profile is a renowned leader in market intelligence, proprietary technical analysis as well as the training of day traders. The company was founded with the following objectives in mind – to develop industry leading charting and financial tools that allow market professionals to gather market intelligence and perform in-depth analysis.

According to TAS Market Profile review, the tools are used by experienced traders, asset managers and banks to learn how the market is performing thus aiding in better decision making. Market professionals can utilize gathered market intelligence thus pinpointing opportunities and allowing traders to profit.

The company was founded by Steve Dahl, a revered expert of the Market Profile trading method. He has steered the company over the years resulting in partnerships with Bloomberg, a company that also provides financial software that mine, structure and deliver financial insights and news to traders. TAS Market Profile has three flagship products: TAS Charting Indicators, TAS Profile Scanner and The EDGE.

Today, Steve Dahl can be found at WeTradeDesk where he leads a commodity futures community. Not only that, he speaks at international trading venues around the world.

TAS Products

TAS Charting Indicators (www.MarketProfileIndicators.com)

According to our TAS Market Profile review, TAS Indicators are available as premium add-ons which allow traders to have access to industry leading platforms. The indicators can be used to improve decision making for different securities including stocks, ETFs, commodity futures and forex. Available TAS Indicators include:

- TAS Market Map

This indicator is designed to provide the most visual appealing Market Profile in color-coded horizontal histograms. It helps to reveal volume accumulation, gaps and critical value areas. Users have the ability of customizing the interface thus displaying multiple maps and analysis period among others.

- TAS Boxes

This option helps to alleviate the ambiguity of the Market Profile. It delivers explicit levels that help to reveal High Value Areas, Low Value Areas and Point of Control. The indicator also allows real time adjustment of levels and can be used to set stop losses, target entries and exits.

- TAS Vega

TAS Vega provides clarity allowing traders to know when the market is bullish, bearish and at balance zone. For example, when the market is bullish, the price bars are green in color and when it’s bearish, they are red in color. This helps to ensure traders know what side of the market is in play.

Other indicators include TAS Navigator, TAS Ratio and TAS Price Compression Levels.

The EDGE (www.MarketProfileInternals.com)

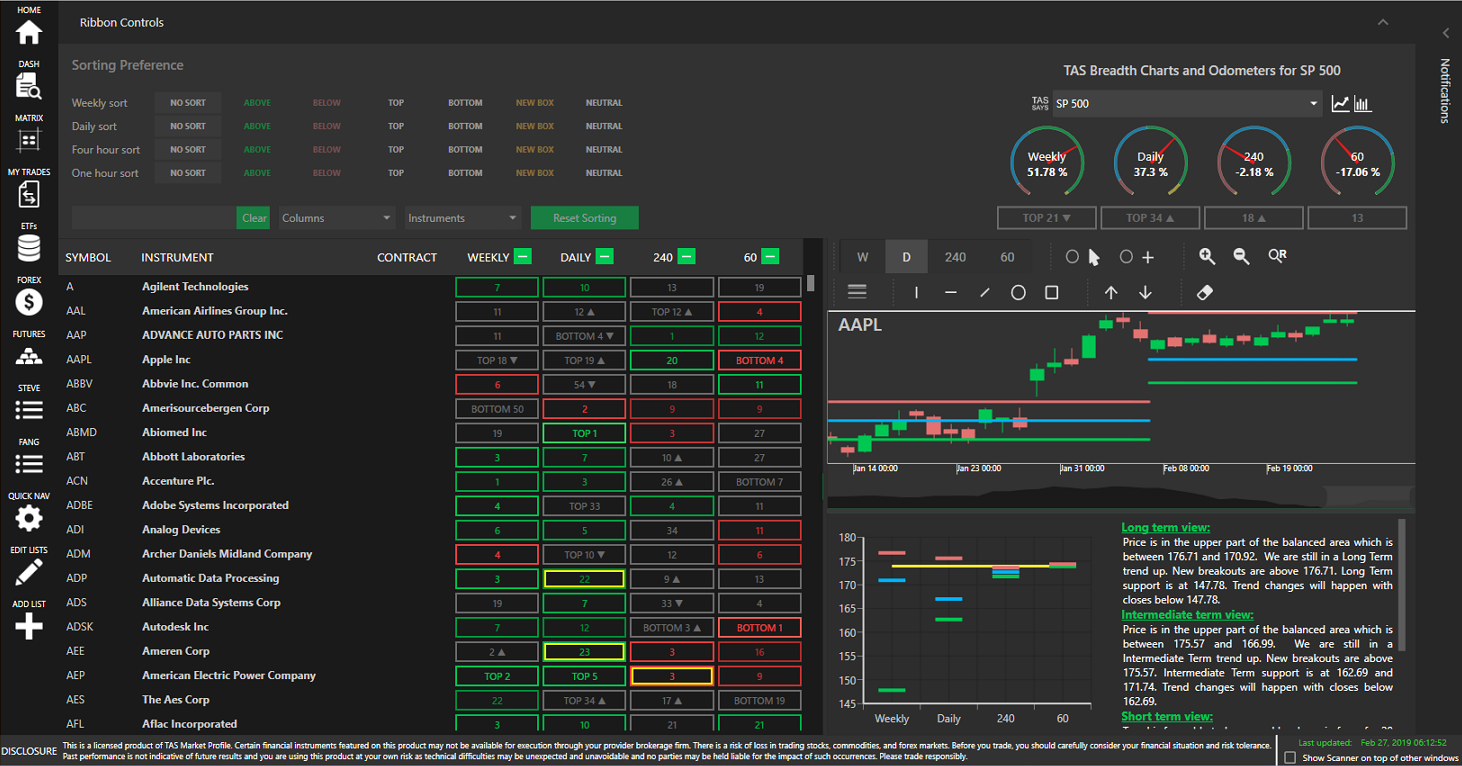

The EDGE is a trading tool that has the ability of gathering market insights and data thus providing professional traders with market centric derivatives that enable one to make better decisions. The EDGE provides a Breadth Meter, Breadth Stats, Volatility Gauge and a simplified chart that tracks Market Breadth Internals. Essentially, it’s like simultaneously tracking every stock in the SP 500 to determine what percentage are bullish (green), bearish (red) or neutral (blue). It’s like always knowing the chip count of the poker game between the market bulls and bears.

TAS Profile Scanner (www.MarketProfileScanner.com)

The first thing a trader does once he or she sits in front of a computer monitor is to fire up the stock screener and begin searching for profitable stock ideas. Stock scanners are vital time-saving components in a day trading strategy. The TAS Profile Scanner uses a unique analysis method derived from Market Profile. This theory was forwarded in 1980s around Chicago by renowned market professionals.

The scanner has access to different markets thus providing traders with information that allows them to trade with various financial instruments. It has an intuitive interface which can be customized to suit the user. This ensures comfort.Plans and Pricing

To ensure traders are able to enjoy TAS Market Profile financial tools and their features, the company has created plans with affordable pricing. They include:

- TAS Charting Indicators- $297 / month (or SAVE OVER 33% INSTANTLY as a Warrior Trader Student for only $197/mo)

The EDGE- $147 / month

TAS Profile Scanner- $197 / month

For more information, visit TAS Market Profile.

Some Pros and Cons

Pros:

- Accurate in many different types of markets such as stocks, ETFs, commodity futures and Forex

- Available on a large selection of charting platforms including: Bloomberg, eSignal, Tradovate, TradeStation, NinjaTrader, MetaTrader, Sierra, GAIN Capital, and Trade Navigator.

- Top notch customer service

- Ability to use the same tools as institutional traders

- Advanced scanning tools

- Robust educational videos, online knowledge base and webinars

- Works with several different market types and instruments

Cons:

- Expensive for new traders looking to minimize overhead

- Can be complex to setup and understand, there is a slight learning curve

- May not work with every trader’s style, but can be adapted for most

- Works best on liquid markets with good volume

Summary of TAS Market Profile

In summary, there is no silver bullet when it comes to trading. Most traders will learn early on, that there is no such thing as a one size fits all, tool of all tools to simply print money. So, finding that balance between the right combination of tools and overhead cost is critical.

TAS Market Profile fills a unique role for traders who are looking to pay a little money to avoid having to do a bunch of heavy lifting. I have been using TAS indicators for a couple years now and would hate to even imagine what trading without them would be like.

As with anything, make use of the free educational tools that accompany the products, so that you can get the most out of them.