-

Value For Investors

-

Value For Active Traders

-

Commissions & Fees

-

Platform & Tools

-

Custome Service

-

Order Execution

-

Mobile Trading

-

Options Trading

Summary

thinkorswim is Charles Schwab’s flagship trading platform that offers a plethora of sophisticated charting tools, customization features, and much more. We were very impressed with the quality and reliability of this platform, however, it does have a learning curve as there is a lot to know about it.

Pros

- Level II quotes

- Direct-access routing

- Professional-level charting

- Futures, options, and forex capability

- Compatibility with Mac

- Simulated trading for extra practice

- Several screeners and educational tools

- Ability to customize the platform

- Free streaming of CNBC

Cons

- Software is difficult to learn

- Other video feeds like Bloomberg and tastytrade are absent

- Program is slow to launch

- Option tools aren’t very user-friendly

- No profit-loss diagrams

Have you been paying lots of commissions and software fees for your day trading? If so, you really need to check out what Charles Schwab offers with its flagship platform thinkorswim.

The broker has updated both its commission schedule and its software fees. And the result is that this regular brokerage firm now delivers more than your day-trading firm probably does.

thinkorswim Review

Although not marketed as a day-trading program, short-term traders nevertheless will find a lot to like about it. thinkorswim is a desktop platform, which means the first step is to download the software and install it.

Charles Schwab offers thinkorswim downloads for Windows, Mac, Unix, and Linux. It is one of the few brokers we know of to offer this range of compatibility.

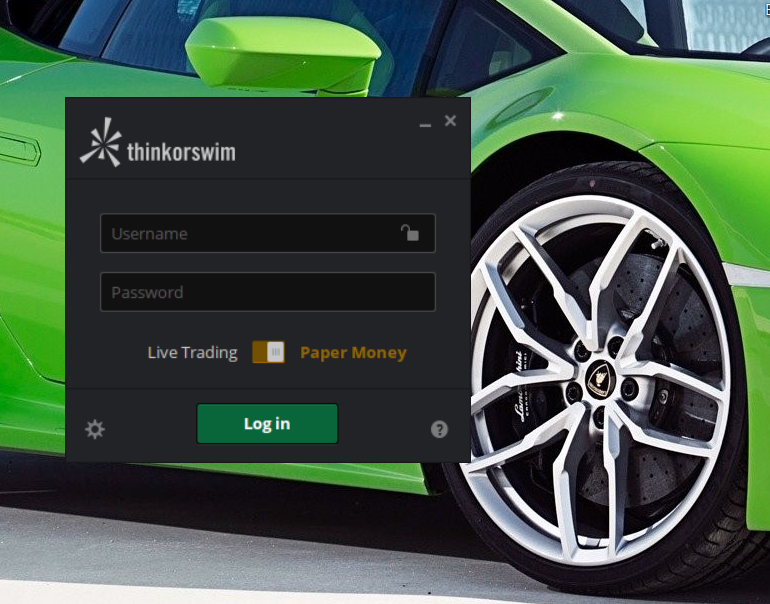

thinkorswim’s login screen has a switch that allows the user to choose between live trading and a demo mode. The simulated side is a great way to learn the software, which is a little complex in some areas.

The default layout has a left-hand column of windows that provide a variety of functions. A watchlist, a chart, a video screen, a news window, and account data all make an appearance.

At the top of the platform sits the main menu. Scan, trade, charts, and education are popular choices.

In the bottom left-corner of thinkorswim is a plus (+) sign. If you click on it, you’ll get a selection of other windows that can be added to the software. A currency map, a Level II window, and time & sales data are popular choices. There are even a few video games.

A wide range of assets can be traded on thinkorswim. These include ETFs, closed-end funds, equities, options, futures, and forex.

Software and Data Fees

In the not-so-distant past, thinkorswim was restricted to active traders only. Today, these restrictions no longer exist. There are no account minimums, trading requirements, or required fees to use the software.

Perhaps even better, commissions on many of the assets that can be traded on the platform have been lowered.

- Stocks, ETFs, and closed-end funds now cost $0 per trade.

- Options have no base charge; although there is a 65¢ fee per contract.

- Futures cost $2.25 per side, per trade.

- And forex is priced on the bid-ask spread.

Market data is a slightly different story. Level II quotes are free for both professionals and non-professionals.

However, pro accounts do have to pay data fees in other areas.

For example, professional traders must pay $45 per month for NYSE quotes.

Day Trading on thinkorswim

Although Charles Schwab is not often considered a day-trading firm, thinkorswim competes with any platform out there. The Level II window needs to be added to the layout. This is a simple task with the + sign in the bottom corner. The same is true for time & sales data.

Because Charles Schwab is based in the U.S., it does require a $25,000 account balance to regularly day trade. This is defined as placing more than 3 day trades in any rolling 5-business-day period.

Charles Schwab calculates day-trading buying power based on an account’s value at the close of business the previous day. The broker’s margin requirement for day trading long stocks above $1 is 25%.

For short positions, the requirement is 30%. Some equities will have more stringent requirements. In all cases, the maximum day-trading buying power at the brokerage firm is always 4:1.

Charting

A good place for short-term traders to start on thinkorswim is with the software’s very powerful charting program. We counted several hundred technical indicators. This is the largest number we have seen on any platform. Examples include:

- SVE Pivots

- TTM Squeeze

- Breakaway

- Disparity Index

- Morning Doji Star

And Charles Schwab hasn’t forgotten about drawing tools, either. Some of our favorites include:

- Trendlines

- Fibonacci retracements

- Regression lines

- Cycle brackets

A chart can be detached from its small window and blown up full-screen. This allows for better viewing. A graph’s interval can be set anywhere from tick to year. During our testing of the software, we saw that Ford went all the way back to 1985.

thinkorswim offers several chart styles. Although candlesticks will be the most popular, other choices include:

- Monkey Bars

- Monkey Bars Expanded

- Seasonality

- OHLC bars

- Candle Trend

- Heikin Ashi

- Line

- Area

- Equivolume

Charts have almost unlimited customization options on thinkorswim. There are millions of colors, choices for scaling, and options for company events and so many other features.

Perhaps the best feature on thinkorswim’s charts is a right-click menu, which offers both alerts and an order ticket.

Order Submission

Speaking of thinkorswim’s order ticket, it has a lot of great features day and swing traders will use. Equities, funds, and options can be sent to specific venues. There are many complex order types, including:

- Market

- Limit

- Stop

- Trailing stop

- Trailing stop limit

- Market-on-close

- Limit-on-close

- Blast all

- OCO (order cancels other)

- And more…

We warned you this program is just as advanced as the platform you’re currently using at your day-trading broker. If we haven’t convinced you yet, keep reading.

Another advanced feature on the ticket is a toggle switch that allows users to lock and unlock limit orders. When the switch is in the unlocked position, the limit price will adjust as the market price changes.

Order can be tagged to submit at specific times and cancel at specific times.

How to Use thinkorswim

Futures and Forex

Underneath the “Trade” tab are “Forex Trader” and “Futures Trader” sub-tabs. Dealing boxes in these two locations make trading currencies and futures contracts a straightforward process. The sell button is red, and green is for buy. Clicking on either one automatically populates the platform’s trade ticket.

In each dealing box, a contract’s title is displayed for whatever ticker symbol is entered. For example, when we typed in “/NGM20”, the title was “Natural Gas Futures, June 2020.”

Small charting windows are also displayed under the futures and forex sub-tabs. With these tools, it’s possible to look at an asset’s price action next to its dealing box. During our trial of the software, we found this setup to be very conducive to trade placement.

As with stocks and funds, alerts can be set up for currencies and futures. We were able to do this by left-clicking on a product’s price change in the graph box. A drop-down menu appeared, and we selected alerts.

It’s also possible to setup alerts by left-clicking on the symbol name on the order ticket.

Research

If you’re not sure what you want to trade, thinkorswim has you covered there as well. Under the “Analyze” and “Scan” tabs in the top menu, there are lots of great search tools. “Stock Hacker” is the platform’s equity screener. It can look for trades based on several criteria. For example, we found:

- Put/call ratio

- Volume

- % change

- Sizzle index

- Industry

- Bid and ask prices

- And much more…

Options also have search tools. A “Spread Book” offers trade possibilities for a variety of stocks and funds. A “Spread Hacker” looks for option spreads based on many different search variables. These include Greek values.

Important economic data releases are integrated in thinkorswim. Here, it’s possible to find recent releases on:

- Producer price indexes (PPI)

- House price indexes

- Interest rates

- Employment statistics

- And more

A probability analysis tool estimates the percent possibility of a stock rising or falling to a specific level. And a backtesting tool has almost 10 years of derivative trade data. Using it, it’s possible to enter hypothetical trades and see their results.

Technical Analysis Education

If you need to brush up on your technical analysis skills, thinkorswim has a section just for you. Found under the “Education” tab in the top row, this learning hub offers a lot to day traders.

There are resources on how to use all of the drawing tools on the platform, including every Fibonacci tool. Each technical indicator on thinkorswim has a detailed description in the learning center.

Another great resource in this center is candlestick patterns. The lesson goes over events like abandoned baby, engulfing, and bet hold.

Finally, there are instructions to build your own technical indicators if you’re so ambitious.

Bottom Line

Thinkorswim rivals any platform on the market today that day and swing traders are using. Combined with $0 commissions on several assets, Charles Schwab is hard to beat.