-

Value For Investors

-

Value For Active Traders

-

Fees

-

Platform & Tools

-

Customer Service

Summary

TradingView provides an affordable alternative to the various desktop-based charting software. with powerful tools and features. We like it as an alternative to more expensive charting software like eSignal.

Pros

- Many features available at no cost

- Social networking tools

- Multiple platforms, including a new desktop system

- Asset and market research tools

- Simulated and live trading through partnered brokers

- Excellent charting tools

Cons

- Small list of compatible brokerage firms, especially for trading equities

- Customer service is lacking

- Many features are unavailable without a subscription

- Lack of concentration on ETFs

TradingView isn’t a brokerage firm (although its platform does integrate with a few brokers to produce trading capability). Instead, it offers powerful research, charting, and discussion tools.

Among the highlights, I really like:

- Over 100,000 technical indicators from TradingView customers

- Many other charting tools, including a replay mode

- Watchlists and screeners

- Streaming and on-demand videos of trading action from other users

- News articles

- Market summaries

- Community forums on almost any topic

- Trades can be placed directly from the charting screen

Brief Overview

Founded in 2011, TradingView has grown enormously in one decade. It now has a desktop platform, and the number and quality of other trading tools have also increased. This is definitely one trading service worth checking out.

Services Offered

TradingView focuses on social networking, asset research, and charting. Trading is of secondary concern. It is possible to submit trades via a few brokerage firms that can be linked to a TradingView account.

These brokers include:

- Gemini (crypto)

- Tradovate (futures)

- OANDA (currencies)

- TradeStation (stocks, futures, and cryptocurrencies)

- AMP Global (futures)

- Alpaca (stocks)

- Optimus Futures (futures)

Options cannot be traded with a TradeStation account through TradingView. API software can be used on the TradingView platform.

Desktop Platform

The best trading experience typically won’t be found using a web browser. For this reason, TradingView has rolled out a desktop program. It is faster than the company’s browser platform and functions on multiple monitors simultaneously. It is compatible with Linux, Windows, and Mac.

During my test drive of the desktop system, I was immediately impressed by the sheer number of features. At the top, it’s possible to create multiple tabs. This allows for the tracking of many assets at once.

On the left-hand side is a vertical menu of drawing tools. On the right-hand side, there many non-charting tools. Ones I found especially useful include:

- Hotlists, with many choices, including one that tracks foreign assets

- Details on the stock in the chart, including earning history, 52-week range, volume, and more

- News articles on the entered ticker symbol

- Economic calendar

- Current chats from other TradingView customers

- Alerts

- Ideas Stream, which are illustrated trade ideas from other users

- Streams, which are videos from other users

Everything from this right-hand vertical menu gets populated into a vertical window right next to it. It’s really easy to use the information right next to a chart.

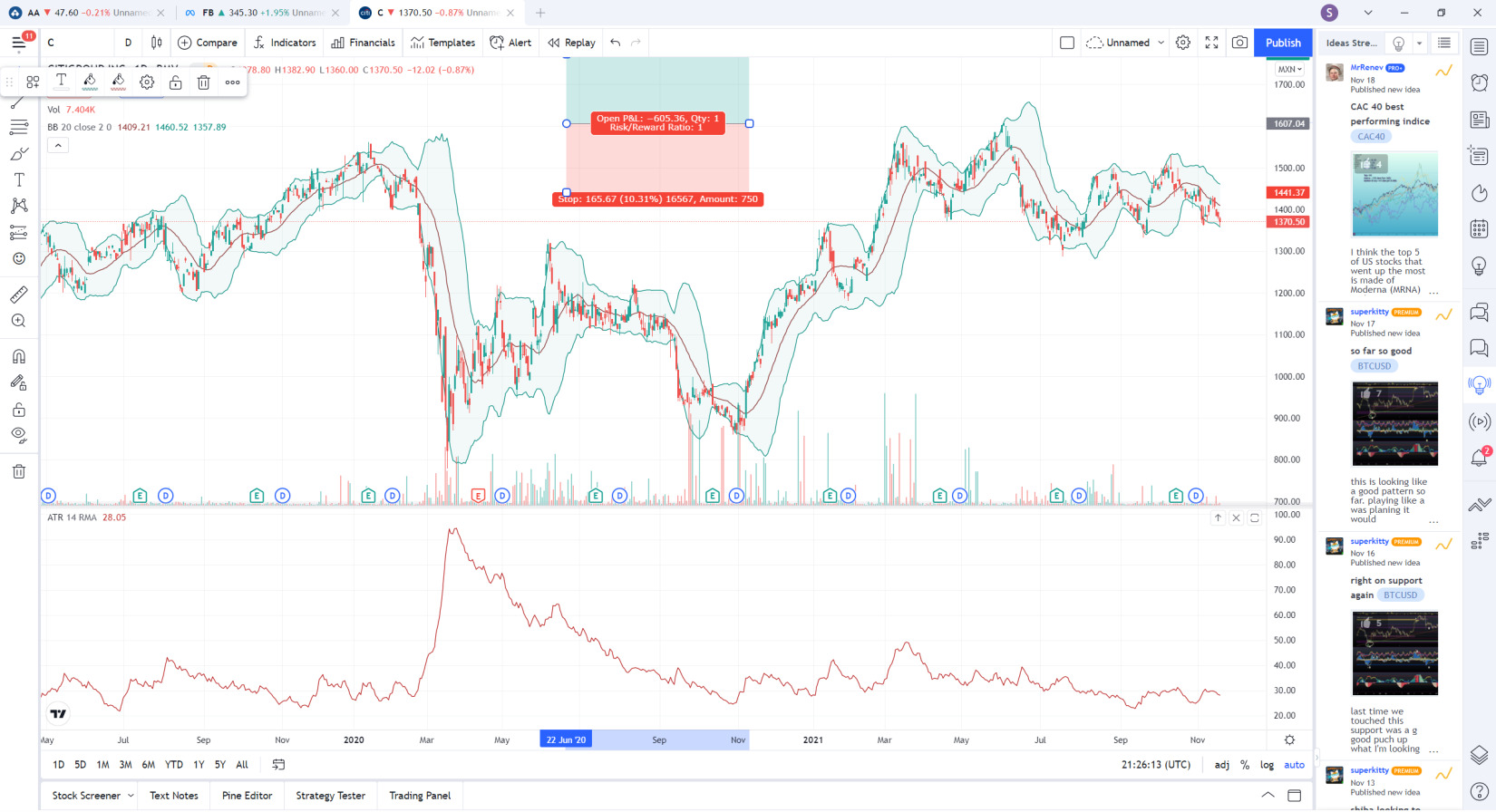

A graph sits in the middle of the screen, and here I found lots of great tools. Some of the highlights include:

- Right-click menu with trade choices

- Replay mode with selectable timeframes

- Very customizable with the ability to save layouts

- Complete full-screen mode that removes a chart’s borders

- Snapshot tool to screenshot a graph and export it

- Ability to set alerts with many available parameters

- Financial metrics can be added to a graph

- Comparisons to assets and indices

- Twelve display styles, including point & figure

- Publish button to share trading ideas with the TradingView community

On the left-hand side sits TradingView’s graphing tools. Examples include:

- Ruler

- Ghost feed

- Fixed range volume profile

- Three drives pattern

- Elliot double combo wave

- Time cycles

- And many more…

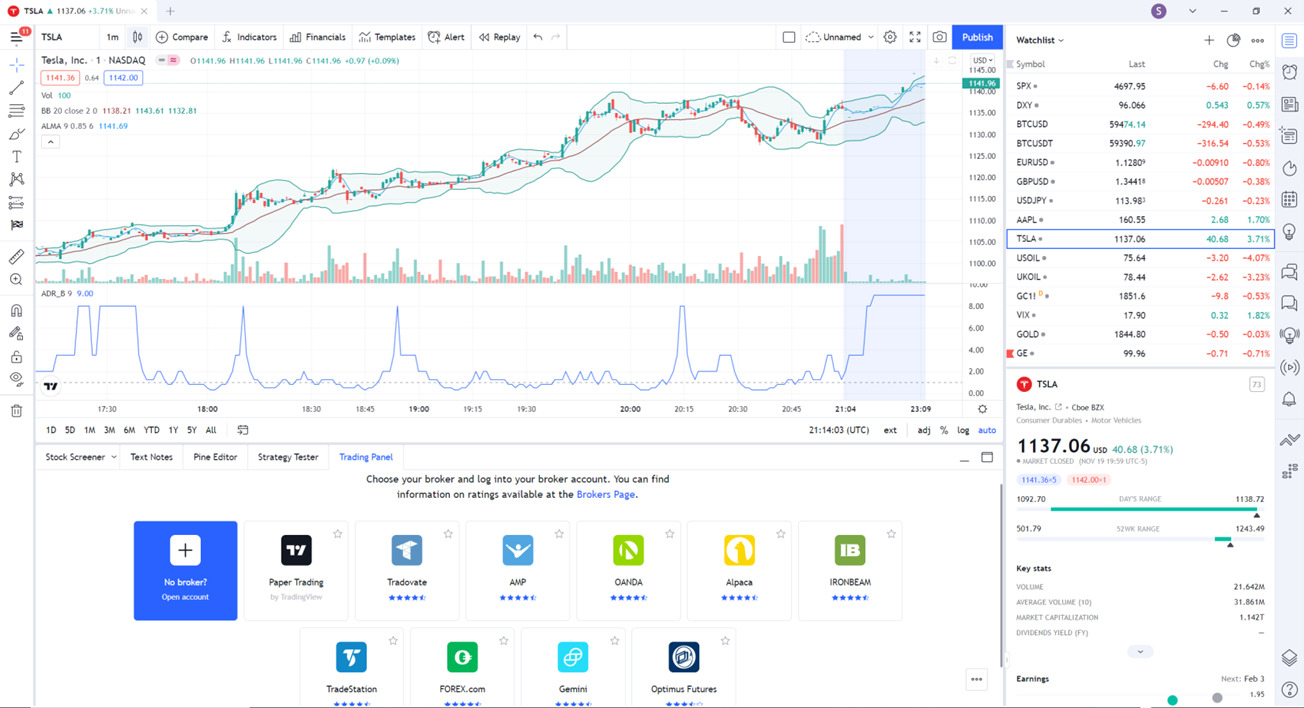

Order Submission

To place a trade through the TradingView platform, you first need to open an account with a compatible broker. TradeStation offers the most number of tradable assets.

At the bottom of the TradingView platform, you’ll see a Trading Panel link. This is where you’ll find broker icons with login capability. Once logged in, you can place a trade directly from a chart with a right click of the mouse.

Day Trading With a TradeStation Account

If you plan to day trade using a TradeStation account, be aware that you’ll need to maintain $25,000 in account equity. In return, you’ll get:

- 4:1 day-trading leverage

- 2:1 overnight leverage

- Maker-taker fees

- Level II quotes

- Extended-hours trading

- Direct access to market venues

Browser Platform

TradingView’s software platform is also available through a web browser. As mentioned above, this does result in reduced functionality. Nevertheless, the same tools are there. During my testing of the browser platform, I found it easy to use and plenty powerful.

As with the desktop system, the browser platform has two color themes: light and dark. Just click on the menu icon in the upper-left corner to switch between the two.

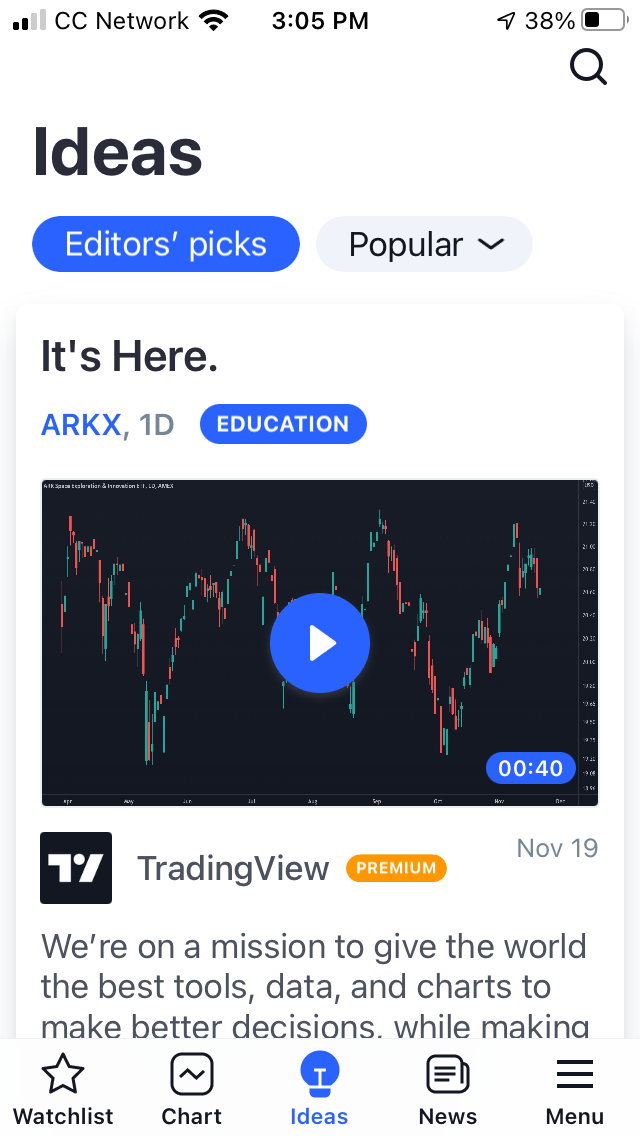

Mobile App

Besides its browser and desktop platforms, TradingView also delivers a mobile app. Compatible with both Android and Apple tablets and phones, the app delivers:

- News articles from many sources

- Watchlists

- Social networking

- Vertical and horizontal charts with many tools

- Simulated trading

The main menu sits at the bottom of the screen. An Ideas tab here is where you’ll find trending trade possibilities, some of which are in video mode. Some videos are from TradingView, while others are from traders. It’s possible to like and comment on these posts.

Research

On all three platforms, it’s possible to research potential trades. The mobile app unfortunately doesn’t have any screeners. The desktop and browser systems do have screeners for stocks, currencies, and cryptocurrencies. During my testing, I found them very effective with many search criteria. They include:

- All Time High

- 3-Month Low

- Average Day Range (14)

- Number of Shareholders

- Recent Earnings Date

- And many more

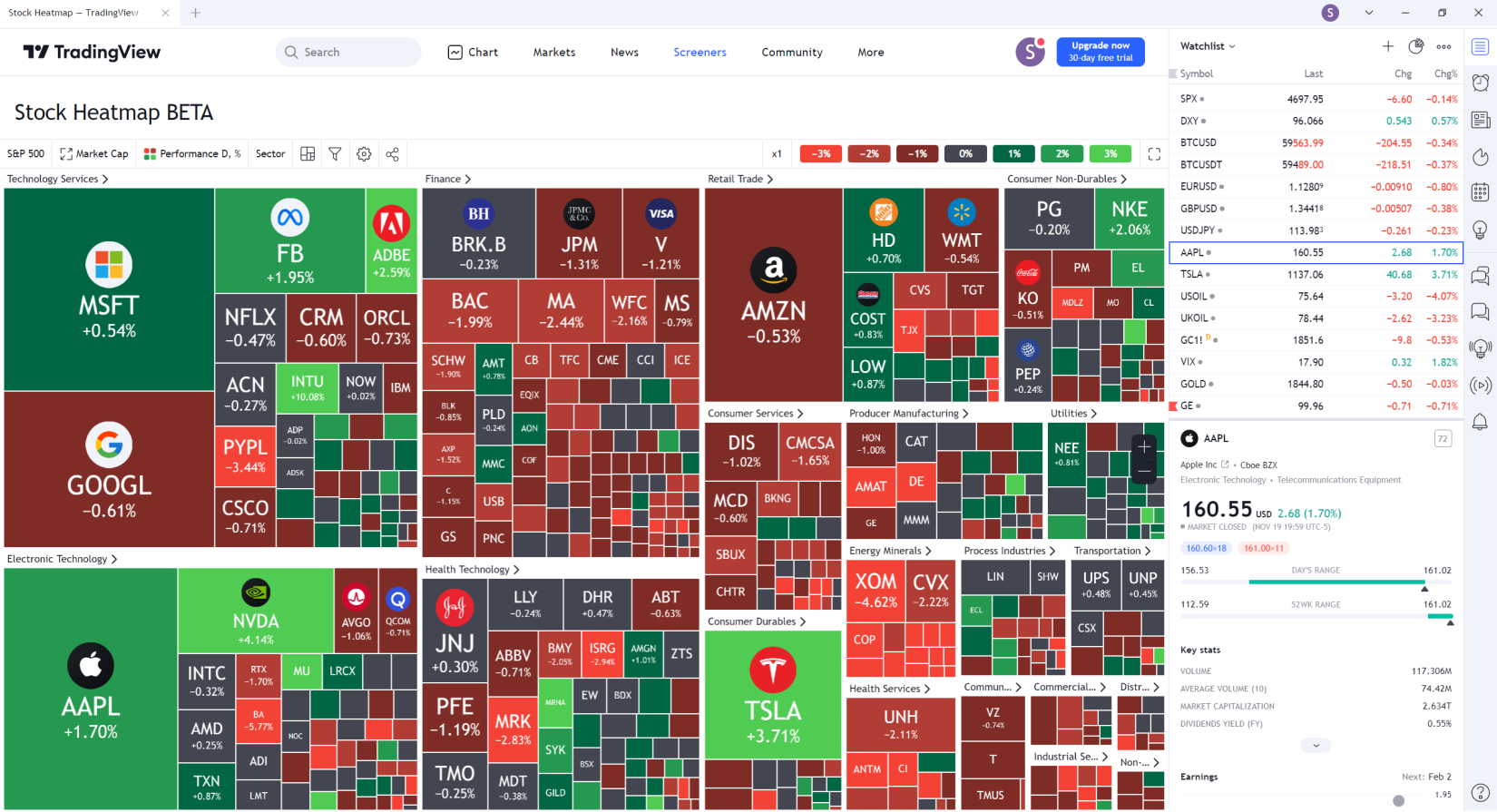

On the browser and desktop platforms, heat maps will be found for both stocks and cryptos. Just look under the Screeners tab. The Community tab is where a lot of trending ideas on potential trades are discussed. And of course, the News and Markets tabs are great resources for researching markets and assets.

Social Networking

As I have already mentioned, TradingView is a community of traders. The social networking features include the ability to follow other traders and message them. You can like posts, comment on them, share them, and save them for later. Using the Community tab on the desktop and browser systems, it’s possible to search for trade ideas.

There is a public chat room on the TradingView platform that allows traders to connect with each other. The relevant icon is in the right vertical menu. Pro+ and Premium members can create chat rooms. It’s possible to link to a specific room and create notifications for a room.

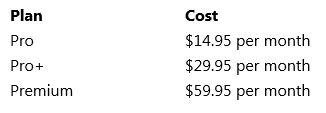

Subscriptions

With so many fantastic resources, you didn’t think TradingView would be free, did you? Well, some parts are free. These lie in the basic plan. Features include charting with one graph per tab and one alert per asset. If you want more, a subscription will be required. Here are the plans:

The Pro plan gets rid of ads that occasionally appear on TradingView’s free charts. It also offers enhanced watchlists and allows up to 5 indicators to be placed on a chart. With the Pro+ subscription,

the number of technical studies on a chart increases from 5 to 10.

The Premium plan permits up to 20,000 bars to be shown on a graph. It also allows users to publish invite-only indicators. Premium customers get alerts that don’t expire, and they can use 25 indicators on a single chart.

Bottom Line

TradingView is a great place to go for charting and social networking. But the lack of a connection to many brokers will be a turn off for some traders.