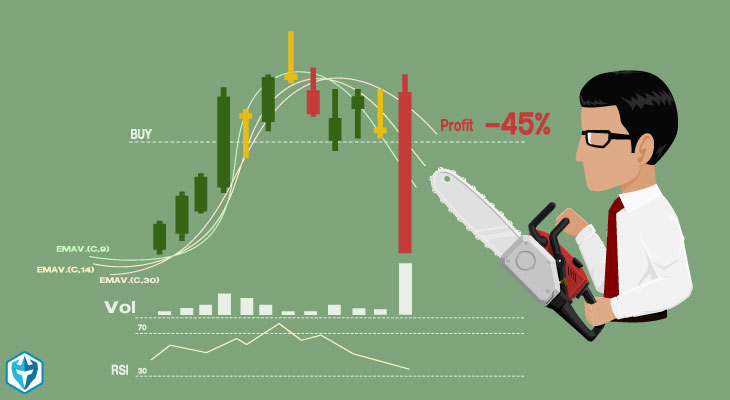

New traders have a lot of things going through their head. Some are necessities, but most of it is noise. Because of this, it is easy to forget about the those things that can cause a trader to be unprofitable and inconsistent.

Risk management is one of those things; to be more specific, stop losses.

The truth is that if you ignore stop losses, you will not have a path to become a consistently profitable trader.

Over the past couple of weeks several traders who I mentor have broken this rule and committed the unspeakable sin of not setting and respecting stop losses so I decided to write a blog on the importance of new and inexperienced traders to use stop loss orders.

Stop Order Explained

So, what is a stop order? It is an order placed with a broker to buy or sell once the stock reaches a certain price. A stop-loss order is designed to limit a trader’s loss on a trade they are in.

Setting a stop-loss order for .20 below or above the price at which you bought or shorted a stock will limit your loss to .20. For example, let’s say you just purchased $CAT at $80.50 per share.

Right after buying the stock you enter a stop-loss order for $80.30. This means that if the stock falls below $80.30, your shares will then be sold at the prevailing market price.

I firmly believe that when you are starting out in day trading, using a stop loss is a must. Before entering a trade, the trader must know when he or she needs to get out if the trade goes against him.

For example, if a trader bases his stop off of a technical level, then that level must be respected. If a trader has a max loss stop to protect their account if the price quickly runs away from him, it must be respected.

A new trader, just like an experienced trader, must be very disciplined about this.

One reason why I like this type of strategy for new traders is because by forcing the trader to place a stop loss order every time after entering a trade, the trader will be building discipline and learning to treat losses just like gains (becoming emotionally detached from the trades).

By physically placing the stop, a trader won’t run the risk of holding a losing position thinking that it will work at some point.

A new trader does not have the skill yet to read price action and determine quickly whether it is ideal to stick with their initial stop or this may be a fake.

It will prevent them from holding their losing trades too long due to the use of discretion or because of fear. For this reason, an effective strategy must be implemented and must be very clear on where stops will be placed to limit a loss.

All traders should learn how to use proper stop loss placement techniques.

Importance Of Stop Orders

Since trading capital is the lifeline of a day trader, he or she must protect every cent of it. The best way to do this is by knowing before entering where the exit points will be, both profit targets and stop loss.

Not only should the trading strategy provide the trader an entry with a higher probability of making money, but also with strategic and specific points to limit losses.

These stops should keep the losses from bad trades at a manageable level and be flexible enough to give winning trades room to grow. These critical skills are taught in day trading courses or better yet, buy your mentor.

I feel the need to address a theory that experienced traders, including myself, subscribe to. You see, when you enter a stop loss order into your trading platform, the order is transparent.

A game that some market makers played (these days, it will be computer algorithms) is “take out the stops,” when the stock is forced low or high enough to trigger a large cluster of stop loss orders (usually at round numbers or well-known support and resistance levels).

After the stock is sold at a popular stop loss price, the stock reverses direction and rallies. I believe this happens, so I always suggest that day traders do not put their hard stops on key technical levels.

Always give some offset so that when the market makers run the stop loss game, you will not be caught!

The biggest problem I see with stop losses is that a trader gives up control of their sell order to the computer. During volatile markets, that can cost you money.

But, as a new trader you must learn discipline and trust your stops. Setting stop orders will go a long way to doing that. I know that one of the largest advantages that we have as day traders is the control that we have over our trading.

But sometimes there must be concessions made for the sake of education and progression. Using stop orders is definitely one of these concessions.

Types of Stop Orders

Stop-Loss Order: If the market price reaches or crosses through the Stop price, your order is sent to the exchange as a market order.

Stop-Limit Order: A Stop-Limit order combines a Stop-Loss order with a Limit Order. To place a Stop-Limit order, you enter two prices: A Stop Price and a Limit Price. If the market reaches or goes through the Stop Price, your order becomes a Limit Order.

Trailing Stop: A trailing stop order is a special kind of sell stop order. Sell stop orders let you say, “If the bid price falls to my trigger price, allow my sell order to execute on an exchange.” The key difference between a traditional stop order and a trailing stop order is that the trigger price in a stop order stays the same as when you enter it, and the trigger price for a trailing stop order can move up when the bid price moves up. In both cases, if the bid price falls to or below the trigger price, your order may execute.

Range Stop Order: Also known as a bracket order. You will put in the High (Stop) price and then the Low price. Once your stock hits the range you designate, it is sent to the exchange as a market order.