If you’ve been reading all my previous blog posts (link to them here) you’ll notice that this one is a little different. As I love writing more about trading psychology and making some trades recap from time to time you may already know I like trading regular stocks (mostly picked from the S&P 500). But there is an area that is attracting many traders and also tons of “self-made” investors lately, which is the cryptocurrency market.

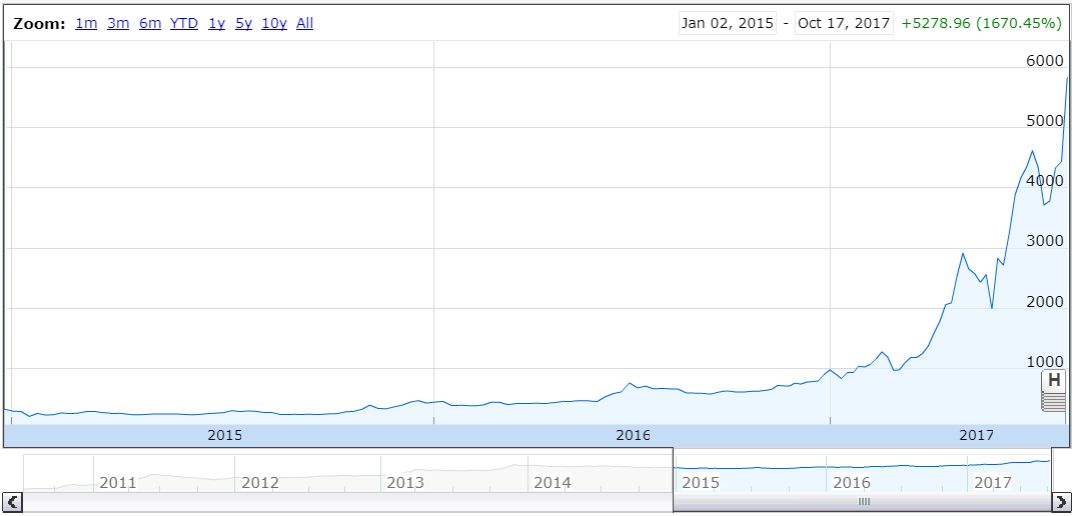

In particular, we all happen to hear a lot about Bitcoin, even if we don’t have much interest. That is because of all the noise coming from the revolutionary concept of this digital currency and also because of the huge returns it has been given early investors. In fact, just below here, you can find out more about this massive 1670% return in just about 3 years or so.

Here I am trying to distinguish between how much this can have an actual impact in the real world versus being an actual investor in the currency itself. I see way too many people confusing these two notions and I consider it to be a potential costly mistake.

The fact that crypto-currencies have a high chance to succeed doesn’t mean that Bitcoin is a good investment right now. In order to prove what I am saying and to warn you from jumping in for a long-term investment, here I am using a parallel that will hopefully make you think twice before putting a single dime into it.

The Dot-Com Internet Bubble vs Bitcoin Parallel

In order to do this efficiently, we need to get back in time. About seventeen years ago to be exact. It was March 2000 and everybody, really everybody was just getting excited about the potential this relatively new “tool” called the Internet could have in the economy and the impact it could have in the lives of billions of people.

On the peak of this excitement, this is what the Nasdaq index chart looked like. Look, everyone was convinced that it was just the beginning of a totally new world. The index went up about 1700% over fifteen years and almost nobody would have imagined what was about to happen.

On one hand, everyone was right. What I mean by that is the fact that the Internet did actually change the world. As I am writing this, the top five companies by market capitalization listed into the S&P 500 are Apple (AAPL), Alphabet (GOOGL), Microsoft (MSFT), Facebook (FB) and Amazon (AMZN). And these companies are all part of the Nasdaq index.

Now, do you see any similarities between these two charts (Bitcoin vs Nasdaq)? Would you have been an investor in the Nasdaq knowing that later on the top five companies would have lead the way in the whole S&P 500? It sounds like it would have made sense to do so, right? But if your answer is yes, I am asking you to take a look at the following chart.

On March 10, 2000, the Nasdaq Composite peaked at 5,132.52, but fell to 3,227 by April 17th and in the following 30 months fell 78% from its peak. It took fifteen years (March 2015) for the index to get back to the previous highs. So, if you happened to be an investor in the Nasdaq on March 2000, you would have lost money by closing the position at any time during those fifteen years.

And this is without even taking into account the effect of inflation and assuming you were smart enough to invest into an ETF that tracks the Nasdaq index. Because if you would have invested the same money in one of those tech companies listed into the Nasdaq back in early 2000, odds are that those companies went bankruptcy resulting into the loss of the entire investment.

Sure enough, it was a bubble and, in hindsight, it is quite easy to recognize that. Am I saying that exactly the same thing is about to happen into the crypto-currency market (and with bitcoin too)? Listen, nobody has the crystal ball but what I can quietly confirm is that it is very likely to happen since a very similar situation is presenting itself.

It may not happen today, tomorrow or even in some months but the likelihood for this bubble to burst are increasing over time since the technical chart is shouting the fact that its evaluation is over extended by every possible measure. I just want to warn you that if the price of Bitcoin would take a nosedive, this would come with no surprise to me.

Again, the key point here is that it’s not about being a believer or not in the digital currency idea. The whole concept that I’ve just demonstrated to you is the fact that Bitcoin may become the next “big thing” (remember, this is the best-case scenario for a potential investor) doesn’t make it a good investment right now. Wouldn’t it be frustrating to have the right idea and then to have to wait fifteen years just to break-even? From a technical standpoint, this move is way over-extended and in investing, just like in trading, technical and timing matter.

In the game of probability, an investment in Bitcoins right now doesn’t have the risk/reward ratio anywhere close to represent a safe bet. And since we’re investors, traders and not gamblers, no one should confidently put a dime on it long-term at this time (Bitcoin is trading at around $6000 as I’m writing this article).

Moreover, the risk of investing into Bitcoins vs Nasdaq into early 2000 is even higher. Indeed, the Nasdaq is an index which tracks the trend of a large number of stocks and, so, investing in it would mean to diversify the risk in multiple companies. On the other hand, by choosing to invest into Bitcoins only would be like picking just one stock among the ones that form the index. And diversifying is the best way to go for investing. What if Bitcoin fails to be the digital currency of the future in favor of another one already in the market or never heard of as we speak?

I’ll be very curious to visit this article in the future, even many years from now. If you know me well enough already, I never like to be too much biased on anything when it comes to planning my trade (and as a matter of fact, I do not have any personal interest on Bitcoin prices going down) but I felt the need to share my thoughts about this phenomenon and, hopefully, to help save money of the wise people that are thinking to invest their money in Bitcoin right now.

“People are chasing cash, not happiness. When you chase money, you’re going to lose. You’re just going to. Even if you get the money, you’re not going to be happy.” – Gary Vaynerchuk

See you in the chat room.

Trade safe,

Roberto Barbaro