-

Value For Investors

-

Value For Active Traders

-

Reliability

-

Platform & Tools

-

Commissions & Fees

Summary

Kinfo is a new trading analysis and social networking platform that allows you to connect to your broker so you can import your trades. It’s a unique idea but has some room for improvements.

Pros

- Several trade performance tools

- Multiple time frames

- Social networking features

- Thousands of brokers can be linked

- Service is completely free

- User-friendly mobile app

Cons

- Website is very minimalist

- No trading capability

- Many analysis tools are missing

- Website is buggy on Chrome

- Educational materials are minimal

- Underdeveloped customer service

Brief Overview

Kinfo is a new trading analysis and social networking platform headquartered in Stockholm, Sweden.

Despite its location, the company focuses on the U.S. markets. Its digital tools help users analyze their past trades and connect with other traders. The company was founded in 2017 and only has a few hundred users.

So clearly, it’s a work in progress.

Services Offered

The Kinfo platform delivers digital tools for analyzing past trades. It is not a brokerage firm, so it doesn’t offer any actual trading capability. This of course is its major weakness.

But it is possible to connect a brokerage account to Kinfo and import trades and current positions. Kinfo is compatible with thousands of US brokerage firms. During my testing of the service, I was not able to connect my TradeStation account.

So there may be a few bugs in the system.

Here are a few examples of brokers that Kinfo can link with:

- TD Ameritrade

- Robinhood

- Fidelity

- Ally Invest

- TradeZero

- Webull

- Apex Clearing

- Interactive Brokers

Although Kinfo’s platform is compatible with brokers that offer forex, Kinfo itself does not offer currency analysis. It provides analysis on these assets:

- Options

- Futures

- Stocks

- ETFs

- Mutual funds

Besides trade analysis tools, Kinfo also provides a social networking platform. With this feature, you can view holdings of top traders who have a proven track record at Kinfo.

Pricing Schedule

Currently, Kinfo charges nothing for any of its services. It does state on its website that it may roll out some premium services in the future.

These presumably would be connected to a monthly subscription fee. But as of now, everything is free.

Software

The first thing I have to say about Kinfo’s software is that it is pretty basic. There aren’t a lot of sophisticated features, and in fact, there are no charting tools at all. But this makes everything pretty easy to use.

Here are the details:

Website

At the top of the Kinfo website, you’ll find the menu. There are only three choices:

- My Portfolio

- Leaderboard

- Settings

Obviously, there are many potential tools that Kinfo isn’t offering right now. The trade analysis tools are under the first tab, My Portfolio.

Before jumping into trade analysis, you’ll probably want to connect your brokerage accounts. So first, head over to Settings.

Under this tab, you’ll be able to add your investment accounts.

Just click on the Broker Connections tab. Some brokers are already prominently displayed. If you don’t see yours, there’s a search feature.

Mobile App

Some of the same tools on the website (but not all) will be found on the mobile app.

It’s compatible with Apple and Android phones and tablets. The mobile platform has one feature not found on the website: Achievements.

Achievements

Tapping on the Achievements icon on the mobile app produces a page with the following awards:

- Trader: Awarded after you have five trades

- Winner: You’ll get this one after your winning trades make up at least 55% of total trades

- Profiteer: Garnered after achieving three winning trades

- Gainer: This one is for averaging a 2% or higher gain on every trade

- Streaker: For accomplishing three winning trades in a row

Trade Analysis

For analyzing trades, Kinfo offers these tools:

Performance

Located on the My Portfolio screen on the website, this analysis tool displays pie charts for the following issues:

- Average gain (%)

- Average gain ($)

- Profit

- Winning trades

The time frames for all four of them can be changed. The available choices are 1 month, 3 months, 1 year, and all time. Failures are shown in red, while successes are in green.

The most recent trades from your linked brokerage accounts will also be displayed on this page.

Gain and loss on each position are shown (in dollar and percent terms). Tags and descriptions can be added to each entry.

Profit

The profit tool displays a chart with a cumulative gain/loss total. A blue line shows what the average trader on Kinfo has done. This of course is part of the company’s social networking mission.

The same time frames for performance are available for profit.

Journal

Despite the name of this tool, I did not find any journaling capability. Instead, this section shows a running list of trades on each asset listed.

Trades can be displayed for one day or one month. For the monthly choice, Kinfo’s software shows the month’s total gain or loss, the percent of winning trades, and many other metrics.

Positions

This section shows holdings sorted by long and short positions. Gains and losses can be shown in either dollar or percent terms. Clicking on an entry produces a new page with a chart with a comparison to the S&P 500.

One month is the shortest time frame available, which obviously is a major weakness for day and swing traders.

A security’s position page also has a Financials tab. When I clicked on it, the website displayed no information.

Trades

This last resource shows purchases and sales for individual securities by date. Unfortunately, the time of the trade is not shown. It is possible to type notes about trades for a particular security.

Social Networking

The one great advantage of Kinfo’s site is the social networking feature. But this, too, is very flawed at the moment. The company is only reporting a few hundred customers at this point.

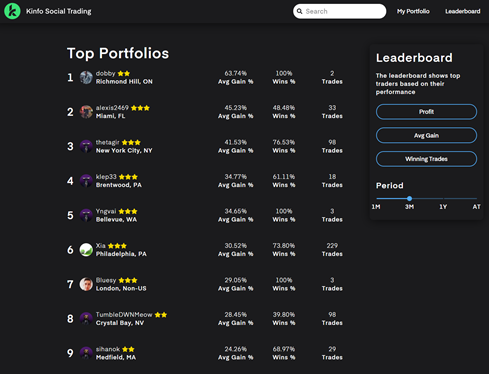

There is a leaderboard that shows the top traders on Kinfo’s platform. They can be sorted by average gain, profit, or percent (not number) of winning trades.

The same time frames Kinfo uses elsewhere make another appearance (1 month, 3 months, 1 year, and all time).

What I really liked about the leaderboard was the ability to click on entries and read through other users’ trades. This feature allows you to see what top traders are buying and what they’re selling.

There’s a Follow button on each user’s profile, so it’s really easy to bookmark your favorite traders.

In the settings menu, it’s possible to limit what you want displayed on your profile. You can turn off dollar gains/losses, percent gains/losses, or both. In the same menu, you can link a Twitter account and automatically tweet closed trades.

Research and Education

Despite Kinfo’s emphasis on analysis, it doesn’t offer much in terms of security research.

Neither its website nor its mobile app has a stock screener. An asset’s chart can be accessed on the website by clicking on its ticker symbol under the Positions menu.

But just about every charting tool you can think of is missing. Although Kinfo’s site has a search bar at the top, it can’t look for securities by ticker symbol.

A security’s profile has vital stats like volume and market cap. But when I did my research, the fields were blank.

Customer Support

Kinfo doesn’t publish a phone number on its website, nor does it hold any regular customer support hours. The website has an online chat feature. When I tried it out, no one answered. You can leave an e-mail address to get a response later.

The company does have a customer service e-mail address ([email protected]). The company’s founder, Karl von Döbeln, promises a response.

Comparison

It’s hard to complain about anything that’s free, but Kinfo falls short compared to Tradervue.

Tradervue offers much better software and journaling tools.

Plus, it has a free subscription plan that comes with social networking features. For $29 per month, users get forex support, risk tracking and reporting, intraday P&L charts, and much more.

Bottom Line

Kinfo has basic tools for trade analysis. But better resources are available elsewhere at little to no cost.