-

Value for Investors

-

Value for Day Traders

-

Customer Service

-

Innovation

-

Price

Summary

Tradervue is a great tool for both beginner and experienced traders who want to analyze their trades so they can understand where they need to improve. This is an excellent program and we definitely recommend it.

Tradervue is a social media platform. But it’s not your typical Facebook or Twitter. It’s actually a trading journal where community members can share their trades. It’s also possible to analyze the performance of trades. The company has made improvements to its platform in recent months without raising prices. So it’s definitely worth checking out.

Brief Overview

Founded in 2011, Tradervue is designed to make keeping a trading journal as easy as possible. It doesn’t offer any actual trading services. But trades from an external broker can be imported into Tradervue for analysis. And when I say trades, I’m talking about not just stocks and ETFs, but also forex, futures, and options.

Tradervue was built by Greg Reinacker, someone who has actually spent time day trading. So the platform is designed with the needs of short-term traders in mind.

Services Offered

Tradervue’s platform can be broken down into three main areas:

- Journal

- Analyze

- Share

The three labels are pretty self-explanatory. In the first category, you can keep a very detailed trade journal. It has many tools that we’ll look at shortly.

Tradervue’s analysis tools help clients to see how their trades performed based on a variety of measures. These include liquidity, instrument behavior, and more.

And the share feature adds a really nice social networking dimension to the picture.

Journal

Tradervue’s journaling tools provide users with many ways to keep track of their trades.

Auto Import

You can manually input trades into a Tradervue account, either by importing an Excel file or typing them in. To save a lot of time, you can import trades directly from a broker or trading platform. Tradervue is compatible with many brokers and trading sites. Here’s a brief list:

- Ally Invest

- eSignal

- Fidelity

- com

- Interactive Brokers

- Warrior Trading Simulator

- Webull

Tradervue also recently added Oanda and tastyworks to its long list of compatible brokers. Some platforms, like DAS Trader Pro, offer auto importing.

Trade Notes

At the heart of Tradervue is a note-taking system. To access it, just click on “Dashboard” in the top menu and then click on “New Trade.”

On the next screen you’ll be able to add a ticker symbol and notes. Tradervue’s software saves your notes and keeps them in chronological order. This is a good way to keep track of decisions you made and why.

It’s possible to write notes during the trading day or later. It’s also possible to take down notes on days you don’t make any trades. Besides text, images can be added to a note.

Tagging

It’s possible to tag an order with any imaginable label. Later, you can search by tags. This is a great way to filter through a large quantity of trades.

Chart Analysis

It’s possible to look at multiple charts of different time frames with different technical studies. Tradervue’s software also shows entry and exit points. Comparisons can be made, too.

Profit and loss charts can be used to view P&L over time. It’s also possible to drill down on intraday trades. Individual trades or the day’s total can be analyzed.

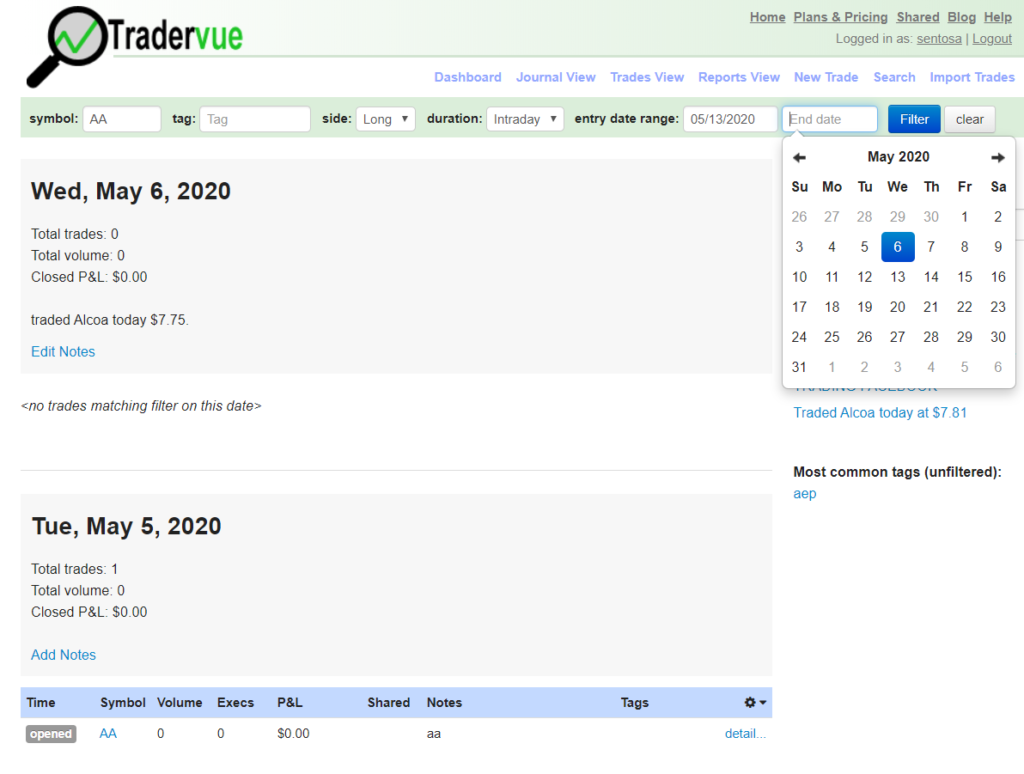

Filtering

This is a really convenient tool that allows the user to filter through all of his trades. Search criteria include:

- Date range

- Symbol

- Tag

- Side

It’s possible to view reports, trades, or notes on a trade.

Coaching and Mentoring

It’s possible to invite coaches and mentors to Tradervue so they can view your trades. Any e-mail address you enter on the system will have access to your trades and notes.

Analyze

When you get ready to scrutinize your trades, Tradervue has several tools to make the investigation easier.

Reports

Several types of reports can be generated on the Tradervue platform based on trades that have been imported. Charts and graphs show daily and cumulative numbers for:

- Volume

- Profit & loss (daily and cumulative)

- Win %

- Losing days

- Number of trades

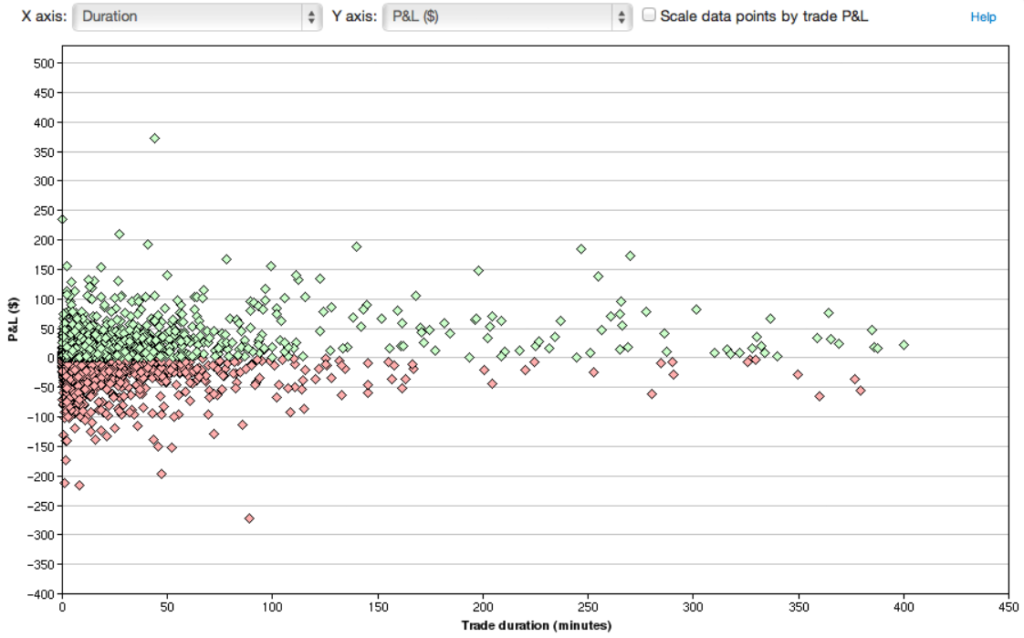

There are advanced reports that plot various trade attributes graphically. A drop-down menu provides many characteristics for the x axis. Another menu can be used for the y-axis. Some examples of data points include volume and gain or loss. There are hundreds of possible combinations.

Risk Analysis

A risk analysis tool examines performance in light of risk. Tradervue’s platform will return a graph that shows risk-adjusted performance.

Liquidity

A final analysis tool I really liked during my investigation was a liquidity report. It is able to examine trading performance in comparison to whether you’re removing or adding liquidity.

Share

Of the three main categories of services at Tradervue, the one I found most rewarding was the sharing feature. This is the social media platform. When you post trades, you can add notes that describe why you took the position you did. Both winning and losing trades can be posted.

Not all trades have to be posted on the Tradervue platform. You’re free to select which trades you want to post and which ones you don’t want posted.

It’s also possible to export trades to other social media sites. Just put a check mark in the “Share trade” square and then click on the appropriate social media site. External platforms include:

- StockTwits

If you do decide to share a trade (either within Tradervue or on an external site) you can first view a preview page. Just click on the “Public trade link.” A printer-friendly page is available, too.

To see a list of other members’ trades, click on the “Shared” link at the top of the website. Here, you’ll see a list of the day’s most recent trades with charts. Click on a tile and you’ll get the trade’s notes plus tags, trade details, and several charts.

It’s possible to export someone else’s post by clicking on a social media icon that’s listed on the page.

A comment box appears at the bottom of a post. Here, you can add your own comments and start a discussion with the original poster or other Tradervue members.

Blog

Tradervue has a blog, located conveniently enough at blog.tradervue.com. The company makes posts on updates it makes to its platform. Multiple tags are included in posts, and it’s possible to search by these tags. It’s also possible to reply to a post.

Customer Service

Tradervue offers support for its services via a Help section on its site. The link is found at the top of the page. There is a lengthy list of FAQs and a few videos on using some tools. There is also a Contact Us form. We did not find a phone number, however.

Memberships and Prices

Tradervue offers three membership levels: Free, Silver, and Gold.

As you might expect, the first plan is free. With this membership, you can post up to 100 stock trades per month. Notice that I said, “stock trades.” Only trades of stocks and ETFs can be posted at this level.

If you want to post trades on forex, options, or futures, you’ll need to upgrade to a Silver plan. This will set you back $29 per month. In addition to more asset classes, you’ll also get an unlimited number of posts.

The Silver plan also comes with a great deal of tools not available on the Free schedule. These include:

- P&L charts

- Interactive drill-down reports

- Advanced reports

- Ability to download data to Excel

- Option to include P&L data with shared trades

- 1 GB of image upload and storage

- Ability to change base currency

For $49 a month, you can get 5 GB of image storage space. The premium plan also provides:

- Liquidity reports

- Commission and fee details

- Exit analysis

- Risk reports and tracking

While the Silver plan only provides around 100 advanced reports, a Gold membership comes with more than 300.

Comparison

The two sites most similar to Tradervue are EdgeWonk and Profit.ly.

Like Tradervue, EdgeWonk has a free trial. Unlike Tradervue, EdgeWonk has a one-time membership fee of $187. There are no on-going fees. Although EdgeWonk has better software than Tradervue, it doesn’t have a social network.

Profit.ly costs between $30 and $75 per month. The company has a greater emphasis on social networking than Tradervue. For example, it’s possible to message other traders and monitor leaderboards.

Final Thoughts

During my inspection, I found Tradervue’s services to be valuable. I really liked the ability to look at other members’ trades and read their justifications. Traders often are so busy with their trading that they have no communication with other traders out there. With Tradervue, it’s possible to keep track of your trades, review them, and even get input from other traders. It adds a new dimension to trading.

Bottom Line

Tradervue has done a good job of adding something more to the experience of buying and selling financial instruments. Its prices are competitive. But it has serious competition from noteworthy rivals, who do offer more in some areas.