Good news! You aren’t alone.

In fact almost all beginner and even intermediate traders will struggle with trading consistency.

As you already know more than 90% of beginner traders will give up before ever finding success in the market.

Despite those statistics, you must be reading this article because you think you have what it takes to be among the 10% who are profitable!

I can tell you from experience, once you adopt a strategy that produces consistent results, you can be extremely successful.

Just last week I made over $13k, and last month I made $34k. I’m not saying this to brag, I’m saying this because I teach a trading strategy that I’ve proven is successful, and it works for our students too!

Read our student testimonials here.

Trading consistency is one of the hardest aspects of trading to become successful at so make sure you are doing everything you can stack the deck in your favor!

What are the secrets to Trading Consistency?

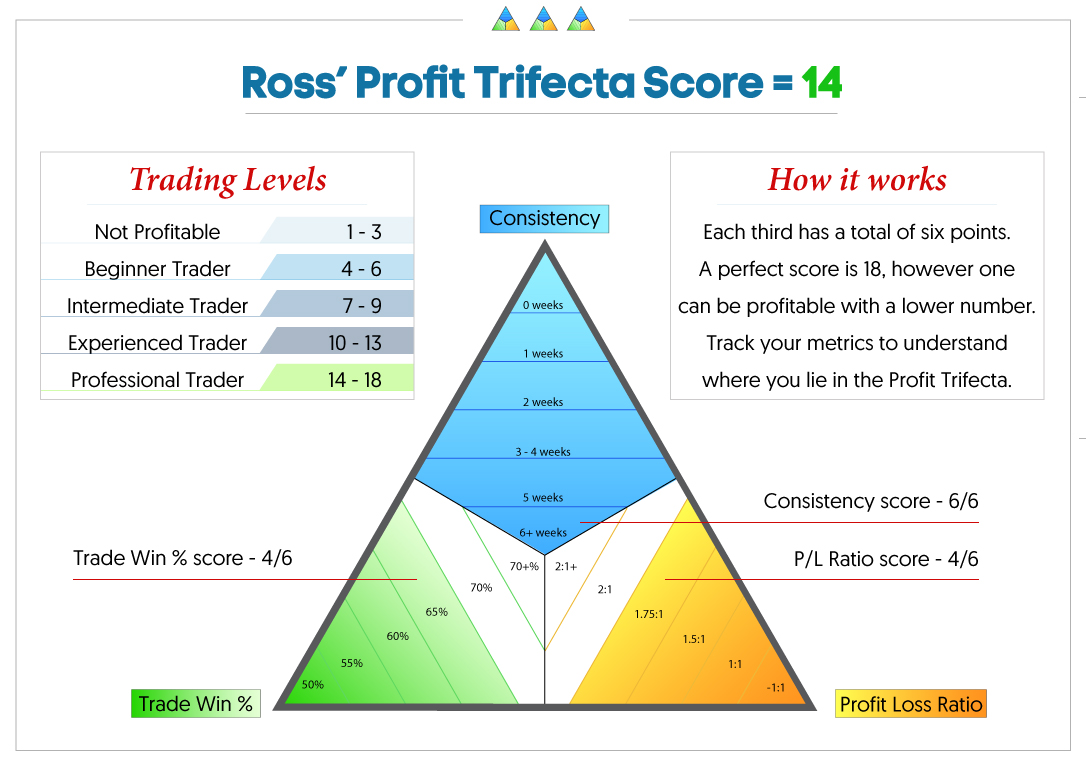

Being consistent means you have a high percentage of success, AND you winners are bigger than your losers on average.

When you meet 60% success with a 1:1 profit loss ratio, or better, you have met the metrics for being a successful trader. Unfortunately 90% of traders will ever get there. So let me help you! Here are my 3 steps to trading consistency.

Step 1: Choose Stocks with Home Run Potential

By only trading stocks with home run potential you are ensuring that every trade has the opportunity to be a big winner. That means I don’t trade most of the large cap stocks like FB, AAPL, or TSLA.

While those are strong stocks for longer term investors, they don’t provide good opportunities for day traders. I only trade stocks with a float of under 100mil shares. The lower float means lower supply, and with strong demand, these stocks can move quickly.

Next I focus on stocks that have breaking news. A news catalyst will give a low float stock extra strength and it’s what will attract retail traders!

Lastly, I look for stocks that have a strong daily chart, meaning they are trading above the 9ema, 20ema, and have room to the 200ema or are above the 200ema.

Step 2: Trade the Best and Leave the Rest!

Only trading the best setups means you may only trade 2-3 times a day. Guess what? That’s OK. You don’t need to trade 20 times a day to make a living. Remember when I said I made 13k last week, that was on only 15 trades, and 14 of them were winners. That’s called precision accuracy!

The best setups include Bull Flags, Flat Top Breakouts, Whole dollar and Half dollar breakouts, and Opening Range Breakouts. We teach all of these strategies in our 15 chapter Day Trading Course. Here is the reality, even A Quality Setups don’t always work.

So what’s the point in trading anything less than the best? If you trade B and C quality setups, your accuracy decreases, you lose money, and you lose confidence. That’s how you fall into a downward spiral.

Instead, focus on trading 4 times a day with accuracy on 3/4 trades. Trade the best and leave the rest!

Step 3: Surround yourself with Like-Minded Traders

You always want to surround yourself with the type of people you want to be like, or that you want to become. That means be around successful traders! Learn everything we are doing to profit from the market.

Ask us questions, find out what we’re trading, and try to understand which strategies we’re using.

I’m an open book, and I teach students all the details of my strategies. If you are in our Day Trading Chat Room, you can learn everyday by watching me trade, and you can surround yourself with over 2000 active traders.

Trading in a bubble can be dangerous, and I’ve seen many traders do it. You need to have a sense of what other traders are doing because crowd mentality can move the markets.

If everyone is scared of the upcoming FOMC meeting minutes, expect volatility in Gold and the VXX.

If everyone is confident that housing numbers will be strong, watch for strength in that sector. I always try to keep an eye on what is moving in the market because I know other big traders will be watching those same stocks.

Make sure you have your fingers on the pulse of the market!