Updated: 11/5/2023

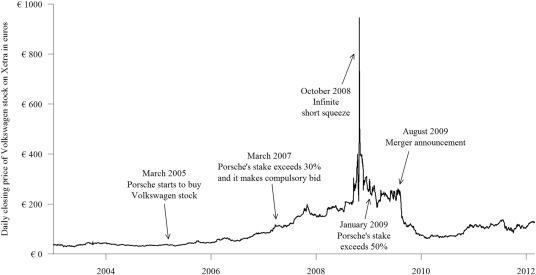

In October of 2008, shares of Volkswagen more than quadrupled in two days, briefly making the German automaker the most valuable company in the world. This has now been recorded as one of the largest short squeezes in modern trading history. It has been reported that hedge funds that held short positions lost over $30 billion on the Volkswagen short squeeze. Comparatively, the GameStop short squeeze of 2021 was estimated to cost short-selling hedge funds approximately $10 billion in losses.

However, much like the GameStop short squeeze, after shares of Volkswagen peaked on Oct. 28, 2008, the price plunged 58% in four days. While short sellers may have been right long term, risk management would not allow them to hold as the stock surged higher. They cut their losses and moved on. Within months, the shares of Volkswagen were down 70% from their top, giving away most of the short-squeeze profits.

Although it has been over a decade since the Volkswagen short squeeze, there are still many lessons that day traders can learn from this particular stock market event.

In order to understand short squeezes, first, we must understand how short selling works.

What is short selling?

Short selling is a type of strategy that traders use to speculate on a future drop in the price of a particular stock instead of buying a stock and profiting if it goes higher. Short sellers sell stock, creating a negative position in their accounts. They must buy back the shares to close their position, and their strategy involves speculating that the stock will decline in value so they can buy back the stock at a lower price. Like any strategy, there is no such thing as success 100% of the time. However, events like Volkswagen highlight the high level of risk short-sellers experience.

The short selling strategy a few simple steps.

Step 1: Borrowing shares

In order to short a stock, a short seller must borrow shares from somebody who currently owns shares and is planning on holding shares for a long time. The owner lends out their shares, and in exchange, short sellers pay a “borrowing fee”. Stock brokers, the intermediaries, keep some of this fee, and the original owner of the shares gets the rest.

The borrowing fee is set by brokers and is not fixed. Borrowing fees change daily based on the demand for shares. This means that a short seller planning on holding a position for weeks could face increased borrowing fees when the stock increases in value. Not only will they lose money as the stock goes up, but they will also lose money to borrowing fees.

Step 2: Selling Shares Short in the Market

When a short seller has borrowed shares, they begin paying borrowing fees immediately. However, they don’t need to take the position. Once they see a technical pattern they like, they can sell shares short and create a negative position.

Step 3: Close the Short Position

If the stock declines in value, they can cover their position at any time for a profit. However, if the stock goes against them, they can lose an unlimited amount of money. This is a unique risk with short selling that doesn’t exist when you trade to the long side.

The reason short sellers have unlimited risk is because once they have a negative position, they MUST close it. They can also be forced to close it if the person who lent them shares calls the shares back in order to close their own position. That means a short seller can get forced to liquidate at any time.

If they are short at $10.00 a share, and the stock goes to $100/share, or even $1,000/share, as was the case for Volkswagen, they have lost 10x or even 100x versus the maximum profit they could have made. The most a short seller could ever make would be if the stock declines to zero, and of course, that happens very rarely.

Short selling example

The best way to understand the Volkswagen short squeeze and short selling in general is by looking at the following example.

Let’s say you do some research and believe that Delta Airlines (NYSE: DAL)’s traffic is on the decline and oil prices are heating up and you think the stock will continue its downward trajectory for at least the short-term. freturn

So, you make an order to short sell 100 shares of DAL and you get filled $20. Your cash balance will increase by $2,000 and the value of your shares will drop by $2,000. You now owe your broker 100 DAL shares.

If your prediction is right – and the price of DAL begins to fall – you can then buy 100 DAL shares at a significantly lower price to replace the ones you borrowed. This is known as “short covering” and you will keep the difference as a good profit on the short sale.

But if should you be wrong and the price of DAL stock moves up, you will be in hot soup and forced to buy the shares at an elevated price like $15 and end up with a $500 loss.

The Short Squeeze Effect

A short squeeze, on the other hand, is when the price of a stock begins to rise rapidly, forcing short-sellers who had bet against the stock to hastily buy the stock back to avoid incurring further losses. This is what happened with Volkswagen and Gamestop. As the stock suddenly began to increase in price, buyers rushed in to trade the trend. Trend trading is a popular momentum day trading strategy.

With a sudden influx of buyers looking to trade momentum and a lack of sellers, short sellers can only exit their position by executing buy orders at the market.

By buying back their short positions, the short-sellers trigger a loop. The rising demand for the stock attracts more buyers, which sends the stock higher. Consequently, this forces even more shorts to cover their positions or buyback.

This is what happened with Volkswagen, and it’s the same thing that happened with GameStop.

In January 2021, shares of GameStop (NYSE: GME), which had been trading around $2.57 per share, suddenly skyrocketed, eventually reaching $483 – when retail traders on Reddit forum Wall Street Bets started buying the stock.

This was bad news for traders who had bet that GME stock would keep falling. When the stock started shooting up, these short-sellers were caught in a short squeeze. And because they had borrowed funds to help them short GME, they now had return the funds by buying the stock at elevated prices.

Or else, stand firm – and risk incurring even more heavy losses.

Now, let’s move on to the VW short squeeze

Why the Volkswagen Short Squeeze Happened

During the global financial crisis of 2008, something strange happened. Volkswagen went through a short squeeze and briefly became the biggest company in the world.

Back then, as most of the world was reeling from the Great Recession, Volkswagen became a target of short-sellers because of its high debt load as well as exposure to the credit and business cycles.

Several factors contributed to the Volkswagen short squeeze. A huge chunk of Volkswagen shares was owned by holding company Porsche SE and the German government also held a relatively big stake.

Therefore, only a small number of shares were available to trade in the Frankfurt stock markets (free float).

Rumors about Porsche planning to raise its stake in VW started swirling, and an army of traders piled into the stock.

Rumors are Confirmed

Porsche confirmed those rumors, saying that on top of the 44% stake it held in Volkswagen, it had acquired another 31% stake using cash-settled call options.

This meant there were less than 6% of VW shares available to trade in the market since another 20% of the stock was held by the German state of Lower Saxony.

The announcement caught many hedge funds and short-sellers betting on a lower price for VW stock. Porsche had cornered the hedge funds since they had borrowed 13% of VW shares and shorted them. This means the hedge funds had to repurchase 13% of the shares and only less than 6% were available.

Their scramble for few remaining VW shares caused the stock to jump from €210 to more than €1,000 in just two days. The massive squeeze forced short-sellers who had placed bets that VW would fall to but the stock at higher and higher prices in a bid to cover their short positions.

Consequently, Volkswagen became the world’s most valuable company as its market capitalization rose to $370 billion in two days.

VW’s hefty market cap exceeded the $343 billion market cap commanded by ExxonMobil (NYSE: XOM), the world’s incumbent top company at the time.

The Slump after the Volkswagen Short Squeeze

The Volkswagen short squeeze did not last long.

After rising more than €1,000, the stock began plummeting following Porsche’s announcement that it would sell up to 5% of its stake (at a decent profit) to make life easier for desperate hedge funds and short-sellers.

Porsche said the move was meant “to avoid further market distortions and the resulting consequences for those involved. However, the company laid the blame for the massive surge in Volkswagen stock squarely with the hedge funds and short-sellers themselves.

The effect was immediate, with Volkswagen stock dropping nearly €350 or 37% to €596 on Oct. 29 compared with the previous day’s closing price of €945.

Several weeks later, the stock was down 70% from its peak. But much of the damage had been done as short-sellers had already incurred heavy losses after closing out their positions at extremely high price levels.

Bottom Line

If a hedge fund or a trader believes that shares of a company are overpriced, they can choose to short the stock. As mentioned earlier, a trader who is short-selling a stock doesn’t own the shares but is promising to return them later to his broker.

So they borrow the shares at a certain price and sell them. When the price falls, they buys them back at the lower price and deliver them back to the lender. This is done automatically by a trader’s broker.

In the case of Volkswagen, the stock did not drop, but hedge funds and other short-sellers had to buy shares at a loss to honor their contract. It is estimated the VW short squeeze cost short sellers about £30 billion ($38.33 billion).