- Understanding Penny Stock Screeners

- What a screener helps me identify

- Key Features I Expect in the Best Penny Stock Screener

- Fast, Real-Time Data

- Float, Volume, and Relative Volume Filters

- News and Catalyst Detection

- Custom Alerts

- The Best Penny Stock Screeners I Recommend

- Trade Ideas: My Primary Momentum Scanner

- Thinkorswim: A Free but Capable Option

- Webull & TradingView: Budget Tools That Still Work

- How I Use Penny Stock Screeners in My Trading Routine

- Premarket Routine

- Intraday Use — Finding “The Obvious Stock”

- Filtering Out Bad Setups

- Common Mistakes Traders Make With Penny Stock Screeners

- Mistakes I see constantly

- Conclusion

Watch Full Video Here: How I Find Stocks as a Retail Trader

Trading penny stocks is fast, chaotic, and packed with opportunity if you know where to look. The problem is simple: the best setups move quickly, and without the right tools, you’re always one step behind the traders who caught the move early.

That’s why having the best penny stock screener isn’t optional. It’s the difference between spotting momentum early or chasing it long after the move is over.

Below, I’ll walk through what I look for, the scanners I trust, and how I actually use them in my day-to-day trading.

Understanding Penny Stock Screeners

Penny stocks move differently from large caps, and they move fast. A good screener helps me filter through thousands of symbols to find the handful of stocks that actually have potential. When I’m trading momentum, I’m looking for a very specific set of conditions, and the screener is what narrows the list down.

I always explain this to new traders that I can only trade what I can find, and the screener is what finds it.

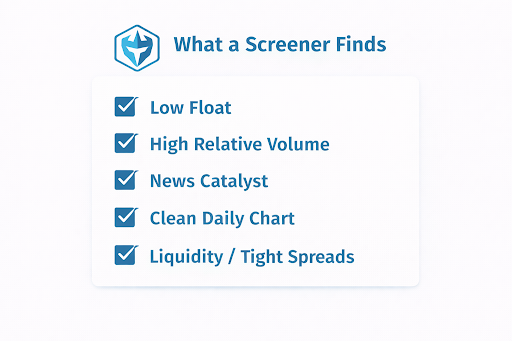

What a screener helps me identify:

- Low float

- High relative volume

- Strong news catalysts

- Clean daily chart setup

- Volatility with enough liquidity to enter and exit

These are the ingredients of “the obvious stock,” the one every trader is staring at in real time. I found the most success trading what I feel is obvious, because obvious setups attract more traders, and that liquidity makes the patterns far more predictable.

Key Features I Expect in the Best Penny Stock Screener

Not every scanner can keep up with the speed of penny stocks. Some refresh too slowly, others miss premarket activity, and many can’t filter float or relative volume cleanly. When I’m trading momentum, those limitations cost real opportunities. A screener has to react instantly, or it becomes irrelevant the moment volatility hits.

Fast, Real-Time Data

Speed is everything. If a scanner refreshes every few seconds, I’m already behind. I need data the moment it changes — quick high-of-day alerts and accurate premarket gap information. Penny stocks move fast, and if the scanner can’t match that pace, the setup is gone before I can act. At the end of the day, it’s the imbalance between supply and demand.

Float, Volume, and Relative Volume Filters

A low float with rising volume is often the first sign that a stock is ready to take off. That’s why I rely on screeners that clearly display float size, current volume, and relative volume. When relative volume spikes, it tells me traders are piling in. A good screener makes that signal obvious.

News and Catalyst Detection

When something starts moving, the first thing I want to know is whether there’s a real catalyst behind it. Strong news paired with strong volume is the foundation of most reliable momentum trades. A screener should surface press releases, filings, and earnings updates immediately so I can decide if the move has substance.

Custom Alerts

I trade best when I’m ahead of the crowd. Custom alerts help me catch early volume surges, fresh highs, unusual volatility, anything that hints at momentum building. When these alerts fire at the right time, I’m able to react quickly and avoid chasing a move that’s already stretched.

The Best Penny Stock Screeners I Recommend

These are the tools I use consistently, built from years of real-money momentum trading.

Day Trade Dash: My Primary Momentum Scanner

Day Trade Dash is the momentum scanner I use every single trading day, and the reason I no longer rely on third-party platforms like Trade Ideas. I built Day Trade Dash to replace those tools with something faster, cleaner, and designed specifically for the way I trade momentum stocks.

Why I trust it:

- Lightning-fast scanners built for momentum and after-hours volatility

- Predefined layouts and indicators that work right out of the box

- Gap and momentum scans designed specifically for day traders

- Clean, noise-free alerts that surface only actionable setups

- Integrated charts and news tailored to small-cap momentum trading

If someone told me I could only use one scanner, Day Trade Dash would be it. It’s the engine behind my momentum strategy and the same toolset Warrior Trading members can access, along with my education and real-time guidance on how to use it effectively.

Thinkorswim: A Free but Capable Option

Thinkorswim isn’t as fast as Trade Ideas, but it’s free with TD Ameritrade and offers customizable scanners.

Good for:

- Beginnings

- Float + volume filters

- Basic premarket activity

Not great for:

- High-speed breakout trading

- Real-time reaction to volume spikes

But if you’re starting with a small account, this is a strong entry point.

Webull & TradingView: Budget Tools That Still Work

Both platforms offer simple screeners with:

- Price filters

- Volume filters

- Basic technical data

Are they the fastest? No. Are they better than scanning manually? Absolutely.

These tools are ideal if you’re on a tight budget or just getting your feet wet.

How I Use Penny Stock Screeners in My Trading Routine

Let me walk you through exactly how I use screeners every day because a screener is only as useful as the trader behind it.

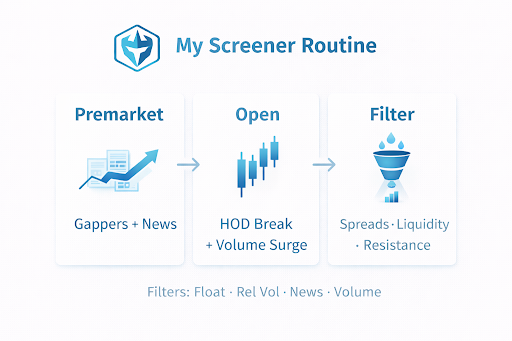

Premarket Routine

I spend more of my day sitting and being patient than I actually spend trading, waiting for a stock to come out with breaking news. A screener helps me spot those catalysts the moment they hit, which is why my morning always starts with the premarket gappers.

I check what’s moving, which stocks have news, and where volume is flowing. Then I cross-check the float, the daily chart, and the catalyst quality to decide whether the stock deserves my attention after the bell.

Intraday Use — Finding “The Obvious Stock”

During market hours, volume shifts quickly. Retail traders rotate from one ticker to another, and I need to know where the crowd is going.

I look for:

- High-of-day breaks

- Surges in volume

- Stocks making the scanner repeatedly

If you want predictable patterns, trade the stocks everyone else is watching.

Filtering Out Bad Setups

A screener can’t stop you from taking a bad trade. That part is on you.

I avoid:

- Low-quality catalysts

- Spreads wider than I’m comfortable managing

- Thick resistance overhead

Trading is about discipline, not just detection.

Common Mistakes Traders Make With Penny Stock Screeners

Traders often misunderstand what a scanner can and cannot do. It’s a tool, not a guaranteed profit machine.

Mistakes I see constantly:

- Chasing % gainers without volume

- Ignoring float

- Trading stocks with no catalyst

- Assuming every alert equals a trade opportunity

The screener finds the stocks. You still have to trade them intelligently.

Conclusion

Choosing the best penny stock screener depends on your experience, your account size, and how aggressively you trade. I rely on Day Trade Dash because it gives me the speed and flexibility my strategy requires. But even the best screener can’t replace judgment, discipline, and experience.

A scanner might show you what’s moving, but it’s still up to you to decide whether the setup makes sense, whether the risk is acceptable, and whether the timing is right. Penny stocks move fast, and the trader who reacts quickest with the right tools is the one who usually gets the best shot at the front side of the move.