Merger are deals that unite two separate companies into a single new company. There are a number of different types of mergers, and a number of different reasons for companies to go through one.

The most common type is the uniting of two completely separate companies into a single new company with a new name.

They are most commonly performed to expand the reach of a company, increase market share or expand into new segments of the market, all of which are done to increase shareholder value and meet other executive goals.

In 2016 there were 17,369 deals with a total combined value of 3.2 trillion US dollars.

Merger Types

The five most common types of mergers are

• conglomerate: the companies do not need to share any common features or markets.

• horizontal: the companies are from the same industry, and the purpose of the merger is consolidation.

• market extension: the companies sell the same type of products, but in different market segments.

• product extension: the companies share complementary products.

• vertical merger: the companies make parts for the same final product.

Merger Arbitrage

Arbitrage involves trading the stocks of companies that are engaged in a merger. When a potential merger’s terms are released to the public, the trader will buy the shares of the company being acquired and sell the shares of the acquiring company.

The price of the acquisition target’s stock should rise to meet the agreed acquisition price while the share price for the acquiring company should drop as a reflection of what that company is paying as a premium in the deal.

The bigger the spread or gap between the current market prices of the two companies and the expected value of their stocks as a result, the greater the potential returns from the merger arbitrage trade.

Trading Terminology By Warrior Trading

Search our Archives of Trading Terminology

How To Read Level 2 Market Data

Table of Contents What Is Level 2 Trading? What Is the Level 2 Window? How To Use Level 2 To Make Trading Decisions What Are Some Advanced Techniques for Level 2 Data? Routing Orders Dark Pools Time and Sales Data What Are Some Common Mistakes To Avoid? What Are Some Additional Tips for Level 2 […]

What Is a Stop Order? Definition and Types

Table of Contents What Is a Stop Order? Why Use a Stop Order? What Are the Types of Stop Orders? Stop-Loss Orders Buy-Stop Order Sell-Stop Order How Do Stop Orders Work? What Are the Advantages of Using Stop Orders Stop Order vs. Stop Limit Order: What’s the Difference? When to Use a Stop Limit Order […]

What Is a Short Squeeze? [Examples and How To Trade]

Table of contents What Is a Short Squeeze? How Does a Short Squeeze Work? What Triggers a Short Squeeze? What Are Some Real-Life Examples of Short Squeezes? GameStop (GME) AMC Entertainment Volkswagen (2008) How To Trade a Short Squeeze What Are Common Mistakes in Short Squeeze Trading? What Are Some Tips for Success With Short […]

What Is Shorting a Stock [and Why I Don’t Short Stocks]

Updated January 9, 2025 – Written by Ross Cameron Table of Contents What Is Shorting a Stock? How Shorting Works Example Why Do Traders Short Stocks? Real-Life Example Risks and Challenges of Short Selling Unlimited Loss Potential Short Squeeze Margin Requirements Borrowing Costs Why I Don’t Short Stocks Personal Experience Challenges of Switching Biases Why […]

Odd Lot Trade: What Does It Mean For Stocks?

In the stock trading world, a lot refers to the standardized number of units of a stock or security being traded. An odd lot is when a trader buys or sells shares in increments less than a hundred. Often, the actual value of a stock or security means that buying or selling just a […]

How to Use the Negative Volume Index (NVI) Indicator

In the stock market, trading volume refers to the number of shares/contracts of a stock that have changed hands over a given period of time. Volume plays a critical role in technical analysis and is recognized as an indispensable indicator that helps confirm trends and patterns. If the price of a stock with a […]

Year Over Year (YOY): What it is and How it Works

The year over year calculation is a great way to compare how a company is performing on an annualized basis. What is Year Over Year (YOY) Year over- year (YOY) is a method that is often used when making financial comparisons. It can also be described as a mathematical procedure of evaluating a statistic for […]

Current Ratio Definition: Day Trading Terminology

What is the Current Ratio? The current ratio can be termed as the efficiency and liquidity ratio that measures an enterprise’s capacity to pay off its short-term obligations using its current assets. It is a fundamental assessment of liquidity owing to the fact that interim liabilities are due within the following year. Financial liquidity refers […]

Bag Holder Definition: Day Trading Terminology

A bag holder in regards to trading is someone who holds onto a position when it goes against them for an extended period of time causing large losses. This typically happens when a trader enters a position and it goes quickly against them and they freeze like a deer in headlights. When this happens, beginner […]

Private Equity Definition: Day Trading Terminology

Private equity refers to a range of financial firms that restructure companies privately before selling them. While private equity firms may or may not buy and sell public companies, the companies are private entities during the restructuring process. Private Equity, Buyouts and Leverage Private equity firms have developed a somewhat notorious reputation for buying vulnerable […]

Debt Definition: Day Trading Terminology

A debt in financial terms is a legal arrangement that outlines a specific lending and repayment procedure for a given amount of some asset, most often cash. Most debts will carry a fixed or variable interest rate or payment to compensate the lender for the absence of their asset and the counterparty risk from putting […]

U.S. Treasury (T-bills) Definition: Day Trading Terminology

UST is the colloquial trading acronym used for United States Treasury Bills, or ‘T-Bills’. UST are short-term debt securities (less than one year) issued by the federal government to finance their operations and existing obligations, and come in a range of maturities and discount prices sold in denominations of $1,000 each. Discounts Vs Interest UST […]

Allocation Definition: Day Trading Terminology

Allocation in finance is the process where an individual or entity assigns portions of it portfolio across the major asset classes according to its appetite for risk, its investment goals and its relevant time horizons. Since different asset classes have different general performance features, the allocation process can theoretically create quite nuanced and sophisticated portfolios […]

Money Market Definition: Day Trading Terminology

Money market is the term for the various markets where short term debt instruments are traded. Money market instruments have maturity dates ranging from overnight to just under 1 year. Shape of the Money Market The money market is intended for institutional investors that need to make wholesale trades to cover inflows and outflows of […]

Duration Definition: Day Trading Terminology

Duration is a complex measure of a bond’s price sensitivity to interest rate changes. Investors who simply intend to hold a bond until maturity will have little concern for its duration, but investors who may wish to resell the bond before maturity or whose decision-making is affected by their current portfolio value will be interested […]

Credit Default Swap Definition: Day Trading Terminology

A credit swap is the colloquial term for a credit default swap or CDS, which is a credit derivative where the buyer pays a premium to the seller in exchange for the seller’s promise to pay out a given amount to the buyer if the underlying credit instrument fails to meet one or more outlined […]

Municipal Bond Definition: Day Trading Terminology

Muni bonds is the colloquial term for municipal bonds, which are credit instruments offered by cities, states, counties and other government entities smaller than the federal level for use in capital expenditure projects, such as the building of roads, schools and hospitals. Muni bonds stand out for their federal tax exemption, and their exemption from […]

Collateralized Debt Obligation (CDO) Definition: Day Trading Terminology

CDO is the acronym used for a collateralized debt obligation, which is a synthetic investment product made up of a range of income-generating assets that is divided into tranches with different risk profiles and repayment priorities. Breaking Down CDO While CDOs may seem complex at first glance, they are actually reasonably simple to understand, even […]

Intercontinental Exchange (ICE) Definition: Day Trading Terminology

ICE is the acronym used for the Intercontinental Exchange, which is an electronic exchange platform designed originally for the trading of energy related products, but which has expanded to offer trading in other commodities, foreign exchange and interest rate products and equity index futures. ICE is now the parent company of a wide range of […]

Risk/Reward Profile Definition: Day Trading Terminology

A risk/reward profile is the ratio of risk to reward in any given trade as determined by the target closing price and the set stop-loss order. Risk/Reward Profile Example Suppose that a day trader buys 1 share of Company A at $20. The day trader expects the price of the shares to rise to $30 […]

Hidden Seller Definition: Day Trading Terminology

A hidden seller is a seller who is using the capacity to hide sell orders provided by their broker. Hidden sellers can employ 3 separate functions that can help to mask their trade and minimize its impact upon the market. The Purpose of Hidden Sellers Hidden sellers attempt to mask the size and/or origin of […]

Ethereum Definition: Day Trading Terminology

Ethereum is one of the world’s most popular cryptocurrency platforms, with a special focus on creating a universal distributed digital system for transactions. Bitcoin Vs Ethereum Ethereum is often touted as an improvement upon the original cryptocurrency, Bitcoin. However, it is more accurate to say that Ethereum is a 2nd generation cryptocurrency with a special […]

Individual Account Definition: Day Trading Terminology

An individual account is a type of trading account offered by brokers to day traders. Individual accounts are contrasted with a variety of alternative account types. Individual Account Features An individual account with a broker is one where only the named individual has access to the account, a right to trade using the account and […]

Thick Market Definition: Day Trading Terminology

A thick market has a high number of buyers and sellers, which means that there is a high volume of trade and a low level of price volatility. Thick Market Features The high number of buyers and sellers in a thick market means that it has certain resulting features. A thick market tends to have […]

Intraday Definition: Day Trading Terminology

Intraday refers to any market activity that takes place within one day’s trading session. Intraday is most often used with respect to intraday trading, where securities are bought and sold within one trading session. Intraday and Investing The concept of intraday is important in investing because most investors take a long term view based on […]

Liabilities Definition: Day Trading Terminology

A liability is a legal obligation that an organization or individual owes to another organization or individual. In accounting liabilities make up the right side of an organization’s balance sheet, and include loans, mortgages, accounts payable, accrued expenses and deferred revenues. Liabilities in Business Accounting Liabilities and their counterpart assets form the foundation of all […]

Accredited Investor Definition: Day Trading Terminology

An accredited investor is an individual or organization that can deal in unregistered securities or investment products by satisfying one or more criteria that qualify it for exemption from the regulations intended to protect less sophisticated investors. There are five qualifying criteria of an accredited investor. They are net worth, income, professional experience, governance status […]

Market Sentiment Definition: Day Trading Terminology

Market sentiment represents a number of technical indicators that use price action to attempt to gauge the attitude of investors toward a security, sector or market. Market Sentiment in Trading Market sentiment is meant to capture the intangible psychological effects that the feelings and attitudes of investors have on the price action of securities. For […]

Gross Domestic Product (GDP) Definition: Day Trading Terminology

Gross domestic product, or GDP, is the total monetary value of all goods and services produced within a set geographical area, usually a country or state, within a given time period, usually over the span of one year or one quarter. Gross domestic product is composed of consumption, investment, government expenditures and the balance of […]

Scaling In/Out Definition: Day Trading Terminology

Scaling in/out refers to the process of entering (scaling in) or exiting (scaling out) an increasingly favorable trading position. Scaling In/Out Example Suppose that a day trader wishes to buy 100 shares of Company A. He expects the shares to drop around $5 per share over the course of the trading day, but is […]

Acquisition Definition: Day Trading Terminology

An acquisition occurs when one company purchases 50% or more of another company’s shares, thereby making it the dominant shareholder and giving it a controlling stake in the acquired company. Purpose of Acquisitions Acquisitions can be undertaken for a number of different reasons, the main ones being to expand market share, reduce costs, create synergies, […]

Federal Reserve Definition: Day Trading Terminology

The Federal Reserve is the central bank of the United States of America, and is tasked with overseeing monetary policy and regulating the financial system. Purpose of the Federal Reserve The Federal Reserve has 5 main duties: conducting monetary policy, regulating banks, monitoring and protecting consumers’ credit rights, providing financial services to the federal government […]

Emerging Markets Definition: Day Trading Terminology

An emerging market is a national economy that is in the process of becoming an advanced capitalist economy, but whose institutions are not yet fully developed. Contemporary Emerging Markets Depending on the classifying body, there are approximately 20-25 current emerging markets spread around the globe. There are currently 16 national economies that are considered emerging […]

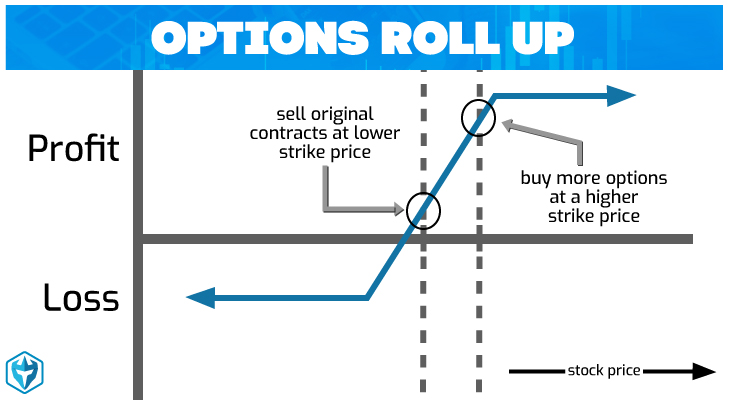

Options Roll Up Definition: Day Trading Terminology

An options roll up is the act of closing a position in an option contract while simultaneously opening a new position in the same option with a higher strike price. The opposite of an options roll up is an options roll down, where the existing position is closed at the same time that a new […]

At the Money Definition: Day Trading Terminology

An option is at the money when its strike price is equal to the underlying security’s current market price. At the Money Example Suppose that an investor purchases a call option for the stock of company A with a strike price of $75. If and when the market price of the shares of company A […]

Box Spread Definition: Day Trading Terminology

A box spread is an options trading strategy that uses a bull call spread and a bear put spread with the same strike prices to profit from arbitrage. When the available options for the box spread are priced favorably, a day trader can achieve a risk-free profit from the use of the box spread options […]

Hanging Man Candlestick Definition: Day Trading Terminology

The hanging man candlestick is a chart pattern used in technical analysis. The hanging man candlestick is used to identify potential downturns in uptrends, as it signals bull exhaustion in fighting a growing bearish sentiment. Hanging Man Candlestick Example The hanging man candlestick gets its name from its appearance as a small body positioned above […]

Yield Curve Definition: Day Trading Terminology

A yield curve is a chart that plots the relationship between maturity and yield for bonds of equal face value and creditworthiness but different maturity dates. Yield Curves in Financial Theory Generally bonds of otherwise equal face value and creditworthiness with later maturity dates will require a higher yield to compensate for the greater uncertainty […]

Hidden Order Definition: Day Trading Terminology

Hidden orders are an order option that some brokerages offer to mask the true size of an order. While not actually ‘hidden’, the brokerage will use various tactics to minimize the potential impact of a hidden order on the market, generally through breaking the order up into smaller pieces and using advanced algorithms to place […]

Order Imbalance Definition: Day Trading Terminology

An order imbalance occurs when there are not enough buy or sell orders on the market to meet the demand for the opposite order type. Order Imbalances in the Market Order imbalances usually occur as a result of the release of important information, which drastically alters the market’s perception of a security and leads […]

Treasury Stock Definition: Day Trading Terminology

What is Treasury stock? A company’s treasury stock is any shares that have been previously issued by the company that are now held by the company itself, usually through share buybacks on the open market or through a structured repurchase scheme. Treasury Stock Example Suppose that a new company creates and publicly issues 1,000 shares […]

Shareholder Definition: Day Trading Terminology

Shareholders, also known as stakeholders, are any individual or institution that holds one or more shares in a company. Shareholders are the owners of the company for which they hold shares, and these shares confer certain rights and privileges to the shareholders, as well as a chance of return on equity. Example of Shareholders Suppose […]

Digital Asset Definition: Day Trading Terminology

A digital asset is any information that is stored digitally and has value. This can include, but is not limited to, videos, software, data and graphics. Issues surrounding the legality of the ownership and use of digital assets have grown exponentially alongside the importance of computing and the Internet. In the financial world, issues with […]

Diversification Definition: Day Trading Terminology

Diversification in finance describes the process where a portfolio of correlated assets is built in such a way that produces a better risk/return profile than would be achievable with only one asset or with a basket of unrelated assets. Diversification in Contemporary Finance The concept of diversification is based on modern portfolio theory, which is […]

Andrews’ Pitchfork Definition: Day Trading Terminology

Andrews’ Pitchfork is a technical indicator that is used to identify support and resistance levels during a medium to long term price trend that is either increasing or decreasing. Traders can use the trend-lines generated by the Andrews’ Pitchfork to make a variety of trades based on resistance and support from the upper and lower […]

Capitulation Definition: Day Trading Terminology

Capitulation is a colloquial market term describing a pattern of strong selling, where powerful psychological and market forces have led to market participants liquidating their positions at any price. Capitulation is usually driven by a combination of fear-induced panic-selling and the forced selling of margin calls. Identifying Capitulation While there is no strict measure […]

Price Rate of Change (ROC) Definition: Day Trading Terminology

Price rate of change, or ROC, is a technical indicator used to signal the momentum of a price’s current trajectory. Price rate of change comes from a class of technical indicators known as momentum oscillators, which are employed in a variety of ways in momentum or trend investing. The formula for calculating the price rate […]

Linear Regression Definition: Day Trading Terminology

Linear regression is a form of statistical analysis that attempts to identify a relationship between an independent variable and one or more dependent variables. Generally linear regression is aimed at causal relationships, where a change in the independent variable causes a predictable change in the dependent variable. Linear regression forms the basis of much of […]

Net Income Definition: Day Trading Terminology

Net income is a company’s earnings after all expenses are paid. Net income is more commonly known as ‘profit’, but ‘net income’ is the proper accounting term and the term that is used on a company’s financial statements. Net Income Example Suppose that a company has revenues of $100, production costs of $50, depreciation costs […]

Fixed Income Definition: Day Trading Terminology

Fixed income describes all the securities that are considered to be debt rather than equity. This means that fixed income securities provide no ownership of the issuing organization, but rather a right to a contracted payment structure for interest and principal payments, as well as collateral in the case of default and priority in the […]

Spinning Top Definition: Day Trading Terminology

A spinning top is a candlestick pattern used in technical analysis that indicates significant indecision on a trading day, and which can be a signal of a trend reversal when it occurs during an uptrend or a downtrend. A spinning top is formed when the real body of the candlestick (the opening and closing prices) […]

Direct Access Routing Definition: Day Trading Terminology

Direct access routing offers traders direct access to the market where the actual trades take place. Direct access routing is contrasted with using an online broker, where the broker acts as the middleman and places the order on behalf of the individual trader, usually bundled together with a number of different orders. Not only […]

Convertible Bonds Definition: Day Trading Terminology

A convertible bond is a hybrid security that acts like a traditional bond until it is converted into equity in the issuing company according to the terms of the bond. Example of Convertible Bonds A company issues a $1,000 10-year bond paying 4% annual interest that can be converted into shares in the company at […]

Insider Trading Definition: Day Trading Terminology

Insider trading is the act of trading a security related to a public company using non-public information, such as information about a company that only employees of that company have access to. Insider trading is generally illegal, as it weakens the overall sense of trust and fairness that underpins the operations of modern capital markets. […]

Junk Bond Definition: Day Trading Terminology

Junk bond is a colloquial investing term for non-investment grade bonds. These bonds carry a rating or BB or less from Standard & Poor’s or Ba and below from Moody’s. Junk bonds typically offer a higher yield as compensation for their higher default risk. Otherwise there is no fundamental difference between a junk bond and […]

Market Index Definition: Day Trading Terminology

A market index is a basket of securities that is intended to represent the value of some specified market or market sector. Investors and financial professionals can then use this representative index to gauge the overall state of that market or market sector. One of the most widely-known examples of a market index is the […]

Futures Definition: Day Trading Terminology

Table of contents Futures in Contemporary Markets The Difference Between Futures and Options Trading Futures Final Thoughts Futures are financial instruments that obligate the seller of the futures contract to sell the underlying asset and the buyer of the futures contract to buy that underlying asset at the contract price and date. Futures specify the […]

Financial Industry Regulatory Authority (FINRA) Definition: Day Trading Terminology

The Financial Industry Regulatory Authority, or FINRA, is the independent regulatory body that oversees all business conducted between investors, brokers and dealers. The Financial Industry Regulatory Authority regulates the major U.S. exchanges and is the highest authority involved in the education and certification of all financial professionals who operate in the securities industry (brokers and […]

Hedging Definition: Day Trading Terminology

Hedging is the act of taking out an opposing position to one or more existing positions that will offset these positions in the event of a loss. A hedging position will almost invariably be smaller than the main position, but a hedge can sometimes make a failed trade profitable if the hedging position was acquired […]

Liquidity Definition: Day Trading Terminology

Liquidity describes the state of the market for an asset in terms of how quickly that asset can be traded without affecting its price. Markets for assets that can be sold quickly with little or no impact on the price of the asset are said to feature high liquidity, while the opposite features in a […]

Alpha Definition: Day Trading Terminology

Alpha is an investing performance measure that tracks the return of a position or portfolio relative to some representative benchmark. For example, the benchmark for a portfolio of U.S. equities may be the S&P 500, and any return above or below that of the S&P 500 for that year would be considered the portfolio’s alpha […]

Common Stock Definition: Day Trading Terminology

A common stock is a security unit that represents a share of ownership in a corporation. The owners of common stock exercise their control over the corporation by electing its board of directors on a pro rata basis. Holders of common stock are the last to receive their share of remaining corporate assets in the […]

Financial Markets Definition: Day Trading Terminology

A financial market is any marketplace where investors trade securities or commodities on an open exchange with transparent orders and transactions. Financial markets generally offer low transaction costs and high trading volumes. Financial markets mainly trade in equities, bonds, commodities, foreign exchange and derivatives, among other financial instruments. A financial market is contrasted with financial […]

Security Definition: Day Trading Terminology

A security is a financial instrument that is both fungible and negotiable. It is a legal contract that represents the rights of ownership of either some portion of a publicly-traded company, some quantity of credit to a business or government body, some quantity of physical good or commodity, or a derivative instrument. Equity and Debt […]

Dragonfly Doji Definition: Day Trading Terminology

The dragonfly doji is a candlestick pattern used in technical analysis to signal a likely positive reversal in a preceding downward trend. A dragonfly doji occurs when the high price, open price and closing price are all the same, generally at the top of a significant downtrend throughout the day’s trading. The return of the […]

Double Top Reversal Trading Guide

The double top reversal is a chart pattern that indicates an upcoming price reversal for a security. The defining feature of the double top reversal is the two peaks with a moderate trough between, the second of which will be followed by a sharp downtrend that reverses all the gains leading into the price peaks, […]

Money Flow Index Definition: Day Trading Terminology

The money flow index, or MFI, is a momentum indicator that measures the flow of money in and out of a security over a specific time period. The money flow index is similar to the relative strength index, or RSI, but it adds the trade volume to the RSI’s price action analysis. Calculating the Money […]

Volume Rate of Change (VROC) Indicator Definition: Day Trading Terminology

What is the volume rate of change? The volume rate of change, or VROC, is a technical indicator used to measure the rate of change in the trade volume of a security. Volume is an important component of virtually every trading strategy based on technical analysis, and is a key indicator for many strategies. Therefore, […]

National Association of Securities Dealers (NASD) Definition: Day Trading Terminology

The National Association of Securities Dealers, or NASD, was the regulatory agency charged with overseeing the operation of the NASDAQ stock exchange and various over-the-counter (OTC) markets. The National Association of Securities Dealers also oversaw the examination and licensing of various investing professionals, such as the series 7 exam. In 2007 the National Association of […]

Stockbroker Definition: Day Trading Terminology

A stockbroker is a licensed financial professional who executes securities trades, primarily equities, on behalf of clients for a fee or a commission. Stockbroker Education While there are no strict educational requirements for stockbrokers, most stockbrokers tend to have at least a bachelor’s degree in finance or business administration. Stockbrokers are expected to have knowledge […]

Out of the Money Definition: Day Trading Terminology

The term out of the money refers to a strike price on a vanilla equity option that is above the current market price for the underlying stock in the case of a call option and below in the case of a put option. Out of the money options have no intrinsic value, as they are […]

Fiduciary Definition: Trading Terminology

A fiduciary is a person or organization that owes a client or customer a duty of trust when dealing with their financials. A fiduciary’s duty to their client is a legal and ethical requirement to act in the best interest of their client when making decisions or offering advice on their behalf. While a fiduciary […]

Modern Portfolio Theory Definition: Day Trading Terminology

Modern portfolio theory is a financial theory that describes how investors can construct a portfolio of assets that maximizes the expected return for any given level of risk or minimizes the level of risk for any given rate of expected return. Modern Portfolio Theory Basics Modern portfolio theory is based on a few foundational ideas […]

Red Herring Definition: Day Trading Terminology

A red herring is a preliminary report associated with an upcoming initial public offering (IPO) that is filed with the SEC. The report contains important details about the business, but does not contain specific details about the IPO itself, such as proposed share price and number of shares for sale. Red Herrings and the IPO […]

Sharpe Ratio Definition: Day Trading Terminology

The Sharpe Ratio is an asset’s average excess rate of return above the risk-free return rate per unit of volatility. The risk-free rate of return is the rate of return on an investment that is considered to be ‘risk-free’, for which the rate of return on U.S. Treasury bills is used. Therefore, any return on […]

Syndicate Definition: Day Trading Terminology

A syndicate is a temporary alliance of financial services firms or businesses that is formed to complete one or more specific financial deals, transactions, or joint business efforts. Syndicates can have various structures of an organization but are primarily either composed of primaries and secondaries, with associated rights and responsibilities, or of equal partners to […]

Financial Advisor Definition: Day Trading Terminology

A financial advisor is any professional who provides products or services to clients concerning investments, taxes, properties and estate planning. Most financial advisors focus on a specific area of advisory services, though some do offer comprehensive services or are members of a firm that provides comprehensive services collectively. Examples of Financial Advisors Some common examples […]

Venture Capital Definition: Day Trading Terminology

Venture capital is a form of financing provided by specialized firms to startup companies and small businesses. While a financial investment is involved in virtually every venture capital deal, many deals also include advisory services provided by the venture capital firm to the company that they are investing in. Venture Capital Investment Theory Venture capital […]

Investment Banker Definition: Day Trading Terminology

An investment banker is a banker who works on large and complicated transactions and financial systems in the investing world. Investment bankers are contrasted with traditional bankers, who are associated with traditional savings and loan banks, and perform more mundane banking duties, such as mortgages and small business loans. Investment Banking Investment banks are at […]

Prospectus Definition: Day Trading Terminology

A prospectus is a formal legal document that provides details about a public investment offering. It is a legal prerequisite for a public investment offering in all advanced modern economies and needs to be filed with the appropriate regulatory body or bodies. Prospectus Types While there are a large variety of prospectus types, they generally […]

Underwriter Definition: Day Trading Terminology

An underwriter is a financial intermediary that takes on some of the risk of another financial actor for a commission, fee, interest payment, spread or some other special privilege. Underwriters are prevalent in a wide variety of financial sectors, primarily insurance, equities, mortgages and credit securities. The Role of the Underwriter Underwriters are essentially the […]

Blockchain Definition: Day Trading Terminology

Blockchain is the technology that underpins the operation of all cryptocurrencies, as well as a variety of other cryptographic processes. Blockchain works as a distributed ledger system that is generated independently by a number of uncoordinated participants, which means that no one individual or organization can tamper with the generation of the distributed ledger. Blockchain […]

Parity Definition: Day Trading Terminology

Parity is a financial term that has a variety of uses, but generally describes situations where two or more objects or individuals are considered equal in some way. Underlying this concept of parity is the idea that one or more different objects are equal or relatable in one or more ways. Parity and Convertible Bonds […]

Book Value Definition: Day Trading Terminology

Book value refers to the accounting value of an asset or company. The book value of an asset is its cost minus any depreciation. The book value of a company is the total value of all its physical assets, which excludes any intangible assets, minus its liabilities. In both cases, the book value is essentially […]

New York Mercantile Exchange (NYMEX) Definition: Day Trading Terminology

The New York Mercantile Exchange, or NYMEX, is the largest exchange for physical commodity futures in the world. The NYMEX has been part of the Chicago Mercantile Exchange Group, or CME, since 2008, and offers global benchmarks for key derivatives areas, including energy, agricultural products and metals. The NYMEX is overseen by the Commodity […]

Wealth Definition: Day Trading Terminology

Wealth is the total assets minus the total liabilities of an individual, organization or government. Wealth is effectively the sum of resources available for disposal at any given time. Wealth is calculated according to current market rates, or appraised estimates when an effective market pricing mechanism does not exist. The Significance of Wealth Wealth is […]

Capital Expenditure (CapEx) Definition: Day Trading Terminology

Capital expenditure, or CapEx, is the money spent by a company on buying, improving and maintaining physical assets, including buildings, machinery and property. CapEx is often a major component of a company’s expansion efforts, though large companies with existing businesses may also have substantial capital expenditures strictly from the maintenance and upgrading of their existing […]

American Stock Exchange (AMEX) Definition: Day Trading Terminology

The American Stock Exchange, or AMEX, is the 3rd biggest exchange by volume in the United States. The AMEX is headquartered in New York City, and currently handles approximately 10% of all the securities traded in America. While the AMEX was originally envisioned as a competitor to the dominant NYSE in American equity trading, it […]

Asset Definition: Day Trading Terminology

An asset is any resource that is considered to have economic value and has a clearly defined legal ownership. An asset can be tangible, such as a factory or precious metal, or intangible, such as a patent or logo. The Making of an Asset The key defining feature of an asset is its exclusive ownership […]

CUSIP Number Definition: Day Trading Terminology

A CUSIP number is the unique registration number given to every publicly traded equity share and bond in the United States and Canada. The CUSIP system is overseen by the Committee on Uniform Securities Identification Procedures. Purpose of the CUSIP System The CUSIP system was created by the American Bankers Association and Standard & Poors […]

Securities Fraud Definition: Day Trading Terminology

Securities fraud is a variety of activities that are considered to undermine the integrity and efficiency of the securities markets. Securities Fraud Enforcement Securities fraud can fall afoul of one or both of civil regulators and criminal enforcement bodies. Civil infractions are generally regulated by the Securities and Exchange Commission, while criminal infractions are enforced […]

Iron Condor Definition: Day Trading Terminology

The Iron Condor is an options trading strategy that relies on low volatility to create a non-directional position with limited risk and limited profits. Establishing an Iron Condor An options trader establishes an Iron Condor position by selling an out of the money put option, buying an out of the money put option with an […]

Option Greeks Definition: Day Trading Terminology

The Greeks are a set of statistical measures used in options trading that are each represented by a letter from the Greek alphabet. Since options are priced based on the projected potential future price action of the underlying security, these statistical measures are essential to understanding the price of options. While many options traders use […]

Compound Interest Definition: Day Trading Terminology

Compound interest is the additional interest payment that is accrued based on the addition of past interest payments onto the original principal amount. Compound interest is considered to be one of the most important features of finance, as even small initial principal amounts can grow exponentially over many compounding periods. Similarly, the contrast between a […]

Churning Definition: Day Trading Terminology

Churning is a regulatory term that describes excessive trading by a broker for a client account that is unnecessary for meeting the client’s investment goals. Brokers accused of churning are assumed to be conducting excessive trading with a client’s account to produce unnecessary commissions. Churning is illegal and the SEC will prosecute suspected cases of […]

Contango Definition: Day Trading Terminology

Contango occurs when the future spot price of a commodity is expected to be below the current spot price and the price of futures contracts are above the expected spot price on their expiration dates. Contango results in an upward sloping futures curve, as the premium for future delivery increases with the expiration date of […]

Securities and Exchange Commission (SEC) Definition: Day Trading Terminology

The Securities and Exchange Commission, or SEC, is the federal regulatory body tasked with overseeing the American securities markets. Role of the Securities and Exchange Commission The Securities and Exchange Commission has a wide variety of roles in the US securities markets, which can be summarized under three official mandates: the protection of investors, the […]

Chinese Wall Definition: Day Trading Terminology

The Chinese wall is made up of the formal and informal barriers within a company that limit the information shared between different divisions that might cause a conflict of interest. Example of a Chinese Wall For example, the wealth management division of a bank will not have access to the content of on-going mergers and […]

Commingling Definition: Day Trading Terminology

Commingling is the act of combining separate assets into one financial entity, of which the asset holders then own a proportional share. The most common example of commingling is in the case of mutual funds, where investors pool their personal resources into one shared fund that trades securities on their behalf according to an agreed-upon […]

CBOE Definition: Day Trading Terminology

The Chicago Board Options Exchange, or CBOE, is the world’s largest exchange for the trading of options contracts. The Chicago Board Options Exchange acts as a clearing house for options on a very large number of companies, indices and exchange-traded funds (ETFs). The CBOE is also the owner of the CFE, which pioneered the volatility […]

Painting the Tape Definition: Day Trading Terminology

Painting the tape is a form of securities fraud where participants create a false appearance of trading activity for a security by buying and selling the security among themselves. Painting the tape can attempt to artificially increase or decrease the price of a security through coordinated trading, or merely give the impression of a high […]

Blue Sky Laws Definition: Day Trading Terminology

Blue sky laws are state laws focused on preventing securities fraud. While blue sky laws vary from state to state, they generally require a high degree of disclosure for any securities traded in the state and for any broker-dealers operating in the state to be registered and regulated. Purpose of Blue Sky Laws Most state […]

Block Trade Definition: Day Trading Terminology

A block trade or block order is a large order usually placed by a hedge fund or large institutional investor. Mechanics of a Block Trade While direct block trades between buyers and sellers do occasionally occur, most block trades take place using a specialist intermediary known as a block house. The block house has traders […]

In The Money Definition: Day Trading Terminology

In the money is a term from options trading used to describe an option that would create value, but not necessarily profit, if exercised. It is not necessarily profitable because a trader needs to account for the premium spent to purchase the option, which being in the money has no bearing on. It just means […]

Ratio Spread Definition: Day Trading Terminology

A ratio spread is an options trading strategy that is used when a trader expects a low level of volatility in a security and their target strike price is unlikely to be exceeded by a significant degree. This expectation allows the trader to sell options with a different strike price to recoup a premium which […]

Delta Neutral Definition: Day Trading Terminology

A position is delta neutral when the change in the value of one or more securities is exactly offset by a corresponding change in the value of the associated derivatives within the position. Traders use delta neutral positions either as a hedge in securities trading or as a strategy to profit from alternate sources of […]

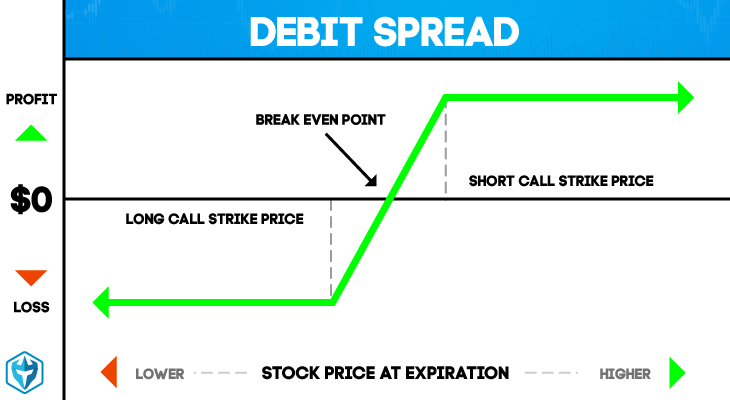

Vertical Spread Definition: Day Trading Terminology

A vertical spread is an options trading strategy that involves the matching sale and purchase of options of the same type and with the same expiry date, but with a different strike price. The idea behind a vertical spread trade is to create a small window of unprofitability, the spread, between two profitable outcomes. Vertical […]

Volatility Skew Definition: Day Trading Terminology

Volatility Skew Definition: Day Trading Terminology Volatility skew is the graphical representation of the implied volatility of a set of options for a security at various strike prices or expiration dates. While implied volatility, which is based on the underlying security, should be the same for all options at the same strike price, in reality the […]

Piercing Pattern Definition: Day Trading Terminology

Piercing Pattern Definition: Day Trading Terminology A piercing pattern is a reversal signal used in technical analysis to identify a potential shift from a downtrend to an uptrend. The pattern involves a large red bar on the first day and a similar-sized green bar on the next day that initially gaps lower yet closes somewhere […]

Harami Candlestick Pattern Definition: Day Trading Terminology

Harami Candlestick Pattern Definition: Day Trading Terminology The Harami candle pattern is a reversal pattern used in technical analysis to predict an upcoming change in price trends. Harami candle patterns can be either bullish or bearish as reversal indicators, since they always involve a large candle on the first day followed by a small opposite […]

Dark Cloud Cover Definition: Day Trading Terminology

A dark cloud cover pattern is a candlestick pattern used in technical analysis to identify the peak of upward price trends, but what does it look like? This pattern typically appears on a stock that has had a recent upward trend with a gap up that is sold off and closes below the previous days […]

Cost of Capital Definition: Day Trading Terminology

Cost of Capital Definition: Day Trading Terminology Cost of capital is a benchmark rate of return that any project must meet or exceed to justify the internal investment in a company. The exact make-up of the cost of capital measure will vary from company to company, but is usually generated as a weighted average cost […]

Central Bank Definition: Day Trading Terminology

Central Bank Definition: Day Trading Terminology A central bank is a modern national institution that oversees some combination of currency management, monetary policy and banking regulation. The exact role and structure of a central bank varies from country to country, but the general purpose of economic and financial management and oversight is the defining characteristic. […]

Dividend Reinvestment Plan (DRIP) Definition: Day Trading Terminology

Dividend Reinvestment Plan (DRIP) Definition: Day Trading Terminology A dividend reinvestment plan, or DRIP, is a broad category of special arrangements for the reinvestment of equity dividends back into the issuing company. Most DRIPs are issued by the relevant company, and contain additional restrictions and benefits beyond owning regular shares. However, many brokers also offer […]

Hyperinflation Definition: Day Trading Terminology

Hyperinflation Definition: Day Trading Terminology Hyperinflation is a loose term describing a sustained period of extremely rapid price inflation in one or more national currencies. It is the product of the mismanagement of a fiat currency and/or national finances that causes a widespread loss of faith in the national currency. The rapidly increasing prices then […]

Mortgage-Backed Security (MBS) Definition: Day Trading Terminology

A mortgage-backed security, or MBS, is any security whose underlying value is based on one or more property mortgage loans. The mortgage-backed security, almost always in the general structure of a bond, is a synthetic financial product that aims to to repackage real estate loans made by banks into something that can be traded more […]

Preferred Stock Definition: Day Trading Terminology

A preferred stock is an ownership stake in a public company, which unlike common stock, has a higher claim on its earnings and assets. Stakeholders of preferred stock can, therefore, benefit by receiving high dividends during the good times when the corporation has made huge profits and decides to distribute the excesses to its shareholders. […]

Extrinsic Value Definition: Day Trading Terminology

Extrinsic value is a term from derivatives trading that measures the difference between the market price of an option and its intrinsic value. Because options are most often priced directly on mathematical models of the underlying stock’s current and historical price (the intrinsic value), the extrinsic value is a measure of the decay in value […]

Fiat Currency Definition: Day Trading Terminology

Fiat currency is any government-backed legal tender that is not backed by a physical commodity. The term comes from the fact that the currency is given value based on the dictate, or ‘fiat’, of a government, and not based on some intrinsic value recognized by those who use it. Most national currencies are based on […]

Elliott Wave Definition: Day Trading Terminology

Elliott Wave Theory is a technical analysis approach that is based on the belief in cycles in the mass psychology of investing. According to Elliott Wave Theory, financial markets follow a familiar pattern of successively smaller 5-3 waves, with the 5 on-trend waves being interspersed with 3 opposite-trend counter-waves. Within each wave of the larger […]

Commodity Definition: Day Trading Terminology

A commodity is a loose term that describes a set of primary goods with shared features. Commodities are usually natural products that are used as first-stage inputs into more complex manufactured goods. Commodities are generally seen as interchangeable within their sub-class and grade. For example, copper is one of the world’s most widely used commodities. […]

Forex Definition: Day Trading Terminology

Forex is the abbreviation for foreign exchange, which is the informal market for currency trading. There are no centralized currency exchange markets, but rather a loose collection of primary and secondary currency dealers that trade in an over-the-counter (OTC) market according to both national rules and international standards and conventions. Anyone can trade in the […]

Revenue Definition: Day Trading Terminology

Revenue is the amount of money earned by a business from the sale of goods and services to individuals and other businesses. It is recorded in the income statement as sales. Revenue can also be earned through the use of capital or assets that are associated with the organization’s main operations before expenses and other […]

Market Breadth Definition: Day Trading Terminology

Market breadth is a concept from technical analysis that uses various comparison measures of advancing and declining company stock prices to gauge overall market sentiment. The degree to which companies are advancing relative to companies that are declining is seen as a measure of current market trends. The Theory of Market Breadth The use of […]

Market Cycle Definition: Day Trading Terminology

A market cycle is any process related to securities that is perceived to operate on a somewhat predictable and repetitive pattern. A market cycle could be related to a specific industrial sector, a subset of stocks or an interrelationship between commodities, among many other possible examples. The most well-known and accepted market cycle is the […]

Dow Theory Definition: Day Trading Terminology

Dow theory is a theory related to the general business cycle that uses Dow Jones compiled averages to interpret the strength of any proposed expansion or contraction of the market. Under this theory, if both the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) are crossing new highs or lows, then […]

Mining Rig Definition: Day Trading Terminology

A mining rig is any computer that is used to process the distributed digital ledger at the core of a cryptocurrency. Some mining rigs are dedicated computers designed to maximize the return on the purchase price and running cost, while other mining rigs are merely used casually or part-time when they are not performing other […]

Cold Storage Definition: Day Trading Terminology

In the cryptocurrency sector, cold storage is the act of storing cryptocurrency ID keys somewhere that is inaccessible through the Internet. Cold storage is intended as a means of protecting the ownership of coins from malicious hacking. An ID Key For Every Cryptocurrency Coin Cryptocurrencies are a digital form of currency, so there is no […]

Proof Of Work Definition: Day Trading Terminology

Proof of work is a cryptographic term describing a system or function that requires work or effort on the part of a user. It is essential to the mining process that drives a cryptocurrency, where the distributed digital ledger at the core of a cryptocurrency is updated by users who are required to perform costly […]

Fork (Cryptocurrency) Definition: Day Trading Terminology

A fork is a cryptocurrency term that refers to a division of one cryptocurrency format into two or more successor cryptocurrency formats, where one of the successor formats may or may not remain the same as the original. Forks in a cryptocurrency occur when there is a disagreement within the largely decentralized governance of a […]

Altcoin Definition: Daytrading Terminology

Altcoin is a colloquial term used in finance to describe any of Bitcoin’s successor and competitor cryptocurrencies. While there is no hard rule for what defines an altcoin, they generally have the same features as Bitcoin (peer-to-peer exchange, mining, etc), while also purporting to improve on one or more of Bitcoin’s suggested shortcomings. Some examples […]

Initial Coin Offering (ICO) Definition: Day Trading Terminology

An initial coin offering (ICO) is a form of business financing based on the creation and distribution of a new cryptocurrency. Initial investors in a new business or venture, almost always related to the cryptocurrency or blockchain sector, are given a new cryptocurrency coin in exchange for their funding. The intended use of these coins […]

American Depository Receipt (ADR) Definition: Day Trading Terminology

An American depository trust or American depository receipt (ADR) is a negotiable certificate that represents a specified number of shares of a stock listed on a foreign exchange that are held by a U.S. financial institution. American depository trusts offer all the benefits of conventional stock ownership, such as dividends and shareholder rights, but with […]

P/E Ratio Definition: Day Trading Terminology

The P/E ratio, or the price to earnings ratio, is one of the simplest and most popular metrics for evaluating stocks. The P/E ratio compares the stock’s current market price with its most recently reported earnings per share. The price of the stock is then evaluated as a multiple of the earnings that each share […]

PEG Ratio Definition: Day Trading Terminology

The PEG ratio, or the price/earnings to growth ratio, is a stock’s price to earnings ratio divided by its earnings growth rate over a defined period of time. The PEG ratio is a metric used by traders to complement or supplement the classic P/E ratio by incorporating a measure of a company’s expected future earnings. […]

Alternative Minimum Tax (AMT) Definition: Day Trading Terminology

The alternative minimum tax, or AMT, is a tax regulation intended to limit the ability of wealthier taxpayers to avoid paying a proportionate share of taxes as a result of their greater opportunity to use tax breaks and exemptions to reduce their tax burden. Calculating Alternative Minimum Tax Calculating the alternative minimum tax is a […]

Amortization Definition: Day Trading Terminology

Amortization is an accounting term that describes the method used for allocating the capital costs of intangible assets over time. It is also often used as a method for creating fixed payments on a loan or bond with a rate of interest so that the payments stay the same for the entire duration of the […]

Bitcoin Cash Definition: Day Trading Terminology

Bitcoin Cash is a cryptocurrency that split from Bitcoin Classic in a ‘fork’ event, where holders of the original Bitcoin were allowed to exchange their units for new Bitcoin Cash units. The split from which Bitcoin Cash emerged was driven by a disagreement among Bitcoin stakeholders about altering the code of Bitcoin to allow it […]

Ad Valorem Tax Definition: Day Trading Terminology

An ad valorem tax is any tax that is based on the assessed value of an asset or set of assets. Ad valorem taxes are a method of periodically taxing assets and properties, as opposed to a transactional tax that only taxes a good or service once at the time of exchange. Ad valorem taxes […]

Basket Trade Definition: Day Trading Terminology

A basket trade is any trade that is performed for a set of 15 or more different shares or other securities, usually as a set proportion of those shares. Basket trades are most commonly used by institutional investors to maintain a proportionate portfolio of different shares or to purposefully alter the proportion of the shares […]

Contrarian Trader Definition: Day Trading Terminology

Contrarian traders base their trading strategies on the underlying principle that the market tends to overreact at both extreme highs and lows. Contrarian traders see these extremes as opportunities to profit from sharp reversals that can occur when the market corrects from a recent overreaction. However, contrarian trading strategies are more complex than simply betting […]

Wash Sale Rule Definition: Day Trading Terminology

The wash sale rule is an IRS taxation regulation governing the use of investment losses in capital gains tax. The wash sale rule prohibits the investor from claiming any sale of a security as a loss if a similar security is purchased within 30 days of the sale. The wash sale rule also applies to […]

Bull Trap: How to Avoid the Fake Bounce

What is a Bull Trap? A bull trap is a trading term that describes a false signal to bulls that the price is going higher, but really is just a fake move before going lower. The increase has to be just enough to lure the bulls in, only for the stock to sink again, […]

Bear Trap Explained For Beginners

Table of contents What is a Bear Trap Example of a Bear Trap How to Avoid a Bear Trap Updated 10/25/2023 What is a Bear Trap? Bear traps most often occur in strongly trending stocks. A bearish catalyst, usually supported by bearish short-term price action, suggests that a trend reversal is imminent, prompting bears to […]

Strangle (Options) Definition: Day Trading Terminology

A strangle is an options trading strategy that uses a put and call on the same underlying security with the same expiration date to bet on a substantial price move in either direction. Strangles are most often used in situations where the trader expects a substantial price move, but is unsure of the direction. Strangles […]

Mark To Market Definition: Day Trading Terminology

Mark to market refers to an investment measure or accounting tool used to record an asset’s value to reflect the market value of the security rather than its book value. The tool is commonly used on futures accounts and helps to ensure that all margin requirements have been completed. When it comes to mutual funds, […]

Thin Market Definition: Day Trading Terminology

A thin market refers to a market characterized by a minimal number of buyers and sellers plus high price volatility. Also referred to as a narrow market, it is also characterized by high bid-ask spreads and low trading volume. This type of market does experience lots of drastic swings thus making it difficult for traders […]

Cash Settled Options Definition: Day Trading Terminology

Cash settled options refer to options that carry the cash settlement feature. As a result, they deliver profits in form of cash and not as a physical asset. The reason why investors choose cash settled options is because they eliminate the high cost of transporting the physical asset and takes the place of indices that […]

European Option Definition: Day Trading Terminology

A European option is an options contract that can only be exercised on the expiry or expiration date. European options are contrasted with American options that can be traded at any time on or before their expiry or maturity date. European Options in Trading Despite the name, the use of European options in trading is […]

American Option Definition: Day Trading Terminology

An American option is an options contract that can be exercised on or before the expiry or maturity date. American options are contrasted with European options that can only be exercised on their expiry or maturity date. American Options in Trading Despite the name, the use of American options in trading is not a matter […]

Calendar Spread Definition: Day Trading Terminology

Calendar spread is an options strategy that allows traders and investors to enter long and short positions simultaneously for the same underlying and strike price but different expiration dates. Option traders can utilize calendar spreads as a way to get into a long position at a cheaper price by selling the other leg and bringing […]

Day Trader Definition: Day Trading Terminology

A day trader is a trader whose time horizon for trades is intraday, often for as little as a few seconds, but generally anywhere from a few minutes to an hour. Day traders attempt to capitalize on significant intraday price movements and volatility by executing multiple quick trades that capture some part of the overall […]

Volatility Crush Definition: Day Trading Terminology

Volatility crush is a term used in options trading to describe the swift reduction in implied volatility of an option after the underlying stock’s earnings are announced or some other major news event. A volatility crush occurs because the implied volatility of options will rise before an earnings announcement when the future price path of […]

Private Placement Definition: Day Trading Terminology

Private placement refers to a method of raising capital where select investors are invited through the offer of equity shares. Unlike an IPO where shares are made available on the open market, a private placement involves select investors like large banks, mutual funds, insurance companies and pension funds. Furthermore, the capital raising event does not […]

Option Class Definition: Day Trading Terminology

An option class is the set of all call or put options for sale for a given security, including every expiration date and strike price combination. Option Class in Trading The option class for any security is used as a broad metric for gauging the relative interest in that security. For example, a high volume […]

Option Series Definition: Day Trading Terminology

Option series refers to a group of options belonging to the same security and characterized by the same price and expiration month. It can also be defined as a set of option contracts that belong to the same class and possess the same expiration date and exercise price. A good example of an option series […]

Put-Call Ratio Definition: Day Trading Terminology

The put-call ratio is the ratio of total trading volume of put options divided by the total trading volume of call options. For example, if the total trading volume of put options was 4 and the total trading volume of call options was 2, then the ratio would be 2. Put-Call Ratio in Trading The […]

Intrinsic Value Definition: Day Trading Terminology

In option trading, intrinsic value (I.V.) refers to the difference between the exercise price (strike price) and the market value of a security. Professor Benjamin Graham from Columbia is credited for having conceptualized the margin of safety concept. This happened in 1934 and resulted in the good professor introducing the idea of calculating the I.V […]

Quadruple Witching and How It Impacts Stocks

What Is Quadruple Witching? Quadruple witching is a market event where several derivatives contracts expire on the same day. The simultaneous expiration of all of these hedging products creates tons of order flow and repositioning, resulting in significant volatility and market whipsaws. It’s called quad witching because these four types of contracts expire on […]

Vega Definition: Day Trading Terminology

Vega or Option Vega refers to the measure of an option’s sensitivity brought by changes in volatility affecting a particular security. As part of the option Greeks, it expresses the changes in an option price brought about by every 1% shift in volatility. As you already know, volatility measures the amount and speed of price […]

Technical Indicator Definition: Day Trading Terminology

A technical indicator is a resource that utilizes technical analysis to study trends and moves of major securities. It can also refer to data points obtained through the application of a formula to a specific security price data. The price data can include open, close, high or low and is usually derived over a specific […]

Fill Price Definition: Day Trading Terminology

Fill price is a term referring to the act of fulfilling an order for a particular financial instrument. As a trading term, it is used to describe the action of transacting financial instruments like stocks, bonds and others. It is important to understand that when an order is complete, savvy traders refer to this process […]

Gamma Definition: Day Trading Terminology

Gamma is one of the major ‘Greeks‘, ancient Greek letters that are used to signify key option trading metrics. An option’s gamma is the derivative of its delta, which itself is a measure of how quickly the option’s price changes relative to the price changes of the underlying security. Therefore, it is a measure […]

Stock Borrowing Definition: Day Trading Terminology

Stock borrowing is the act of receiving a number of shares as a loan from another financial entity. This loan is generally backed up by collateral for the total or partial value of the loaned shares and is accompanied by a rate of interest on the borrowed value. Stock Borrowing in Trading While there are […]

Spread Definition: Day Trading Terminology

Buying a stock is not the same as buying something from the supermarket. Instead stocks are bought and sold according to the bid/ask spread, which is the difference between the highest bid, or the highest price that someone is currently willing to buy at, and the lowest ask, or the lowest price that someone is […]

Scalping Definition: Day Trading Terminology

Scalping involves making a number of very quick trades in order to take advantage of price fluctuations with positions often lasting less than 5 minutes and occasionally counted in seconds. Most scalping strategies use low time frames like the 1 and 5 minutes charts. The idea behind scalping is to take a number of small […]

Call Option Definition: Day Trading Terminology

A call option is a derivative contract that gives the holder the right, but not the obligation, to buy an underlying security at a specified price on or before a specified date. What is a Call Option There are a wide variety of uses for the purchase and sale of call options in contemporary […]

Put Option Definition: Day Trading Terminology

A put option is a derivative contract that gives the holder the right, but not the obligation, to sell an underlying security at a specified price on or before a specified date. What is a Put Option There are a wide variety of uses for the purchase and sale of puts in contemporary trading. […]

Long Sided Trading Definition: Day Trading Terminology

A long position is a trading term that defines the purchase of a security for example stock or option by a trader or investor with the goal of earning profits thanks to the security’s rise in value. Also referred to as long trading, it pertains to the act of an investor buying a position long. […]

Price Averaging Definition: Day Trading Terminology

Price averaging is the act of extending an existing position in a stock by buying or shorting additional shares at a different price than the current entry price of the position, which alters the average price of the position as a whole. For example, suppose that an investor buys 1 share of company A at […]

Buy To Cover Definition: Day Trading Terminology

Buy to cover is an order type made against a stock with the purpose of closing an existing short position. Traders are required to place the buy order with a broker so as to fulfill the requirements of a margin call or to close a position for a profit. Short selling is the process of […]

Pink Sheets Definition: Day Trading Terminology

Pink sheets refer to a daily list of bid/ask quotations for over-the-counter (OTC) stocks compiled by the National Quotation Bureau. Companies that trade on the pink sheets do not need to meet the stringent requirements for trading on a stock exchange, and the trading of pink sheet stocks is much more lightly regulated than trading […]

Russell 2000 Definition: Day Trading Terminology

The Russell 2000 refers to an index that measures the performance of approx. 2000 small cap companies. As a small cap stock market index, it is maintained by the FTSE which is a subsidiary of the London Stock Exchange Group. It is one of the most common benchmark for mutual funds and the most quoted […]

Price Action Definition: Day Trading Terminology

Price action is a broad term meant to indicate any movement, or lack thereof, in the price of a stock that is the product of some technical or fundamental factor, or both, as opposed to merely the product of randomness or ‘noise’. The concept of price action is extremely important to all traders, as everyone […]

Bar Chart Definition: Day Trading Terminology

A bar chart is a graph characterized by a vertical bar and it’s used by technical analysts to learn more about trends. In trading, a single bar is used to represent a single day of trading. As one of the most popular chart type aside from candlesticks, it represents price activity within a given period […]

Net Asset Value (NAV) Definition: Day Trading Terminology

Net asset value, or NAV, is the present value of a share of a mutual fund or exchange traded fund (ETF). The net asset value is calculated by taking the total value of all assets that make up the mutual fund or exchange traded fund, deducting the total value of all liabilities, and then dividing […]

Reversal Definition: Day Trading Terminology

A reversal is any substantial price movement that occurs against the prevailing trend. Of course this makes any reversal very much in the eye of the beholder, without any strict absolute or proportionate requirements for a price movement to be defined as a reversal, but the general principle of a significant movement against a recognized […]

NASDAQ Definition: Day Trading Terminology

NASDAQ or National Association of Securities Dealers Automated Quotations is an electronic marketplace that allows buying and selling of securities. Today, this organization also acts as a benchmark index for US technology securities. As an American Securities exchange, it is considered as the second largest marketplace by market-capitalization meaning it trails behind the NYSE. History […]

NYSE Definition: Day Trading Terminology

As one of the largest marketplace in the world, the NYSE allows traders and investors to purchase corporate stocks and other securities. As a security exchange, it lists 82% of S&P 500, 90% of Dow Jones industrial Average and 70 corporations. It is the biggest equities-based marketplace according to total market capitalization for all listed […]

Line Chart Definition: Day Trading Terminology

A line chart is the most basic type of trading chart created through the connection of a series of data points with unbroken line(s). It is used in trading and finance to display a series of past and present prices for a single stock symbol or more. A line chart is important to traders and […]

Margin Rate Definition: Day Trading Terminology

Margin rate is the interest charged by brokers when traders purchase financial instruments like stock on margin and hold it overnight. It may also refer to a fee charged above and beyond the broker’s call rate. In trading, it is common for a trader purchase shares of stock on margin which means they are borrowing […]

Rights Offering Definition: Day Trading Terminology

A rights offering is an opportunity offered to the shareholders of a company to purchase additional shares typically below the market price and at no cost. In essence, this is a cash call made by the issuer to its existing shareholders thus giving them an opportunity to buy additional shares at a particular share price. […]

Share Buyback Definition: Day Trading Terminology

A share buyback refers to a process where a company initiates the purchase of its shares thus reducing the outstanding shares in the open market. Also referred to as repurchase, it is a program whereby a company purchases its shares from the marketplace since the management has found out that the shares are undervalued. The […]

Inverted Hammer Definition: Day Trading Terminology

An inverted hammer is a technical indicator that is used to identify potential bottoms to downtrends that promise a quick turnaround in the near future. It is the opposite of the widely used hammer indicator, which is employed to identify the top of trends and follows the same basic reasoning. Inverted Hammer Details The inverted […]

CFD Account Definition: Day Trading Terminology

CFD account or Contract for Difference refers to an agreement provided in a futures contract which stipulates how differences in a settlement should be completed that is via cash payments and not through delivery of goods or assets. It is considered as one of the easiest methods of settlement since gains and losses are […]

Pump And Dump Explained For Beginners

Updated January 10, 2025 – Written by Ross Cameron Table of contents What is a Pump and Dump Stock Promoters Chinese Pump and Dumps OTC Pump and Dumps What is a Pump and Dump? A pump and dump takes place when insiders of a company make false and overly promotional statements about the company in […]

Doji Candle Definition: Day Trading Terminology

Doji refers to a candlestick pattern that opens and closes at or near the same price with shares typically moving above and below the opening price to form wicks on either side. The pattern commonly appears at the bottom and at the top of trends. As such, it is used to signify the possibility of […]

Partial Fill Definition: Day Trading Terminology

A partial fill is a trade execution where some but not all of a trade order is filled at the desired price. Partial fills occur when using limit orders, as these orders will only execute when the price is within the defined range, and the price may only enter that range for too low a […]

Hammer Candlestick: Day Trading Terminology

A hammer candlestick is a chart pattern used in technical analysis to identify a potential reversal in a security that has been in a downtrend. The hammer candlestick is generally seen as a short term technical indicator, and is most often used by active traders. Hammer Candlestick Components The hammer candlestick gets its name from […]

Good Till Canceled (GTC) Order: Day Trading Terminology

According to the SEC, a Good Till Cancelled order refers to a buy or sell request designed to last until the order is canceled or executed. The order can be made by an investor looking to purchase or sell a security at a certain price. This type of order has been found to offer an […]

Dollar Cost Averaging Definition: Day Trading Terminology

Dollar Cost Averaging or DCA is a technique used in investment that allows traders and investors to purchase fixed dollar amounts of a specific investment vehicle. In this case, it is common for the trader to purchase a large quantity of shares when the prices are low and lesser shares when the price is higher. […]

Fill Or Kill (FOK) Definition: Day Trading Terminology

A fill or kill, FOK, order is a type of execution order that can be placed with a brokerage for the buying or selling of a security. When the brokerage receives the order, it either executes the order for the entire quantity at the desired price (or less) or it cancels the order completely without […]

LEAPS Definition: Day Trading Terminology

LEAPs are a type of option that stands for Long-term Equity Anticipation Securities. In practice LEAPS are simply vanilla equity options with an expiration date of more than one year. While most equity options are set to expire in 3 months or less, with a smaller market for up to 6 months, LEAPS are an […]

Black Scholes Definition: Day Trading Terminology

Black Scholes model is a price disparity formula used to determine European call options price. Also referred to as Black-Scholes-Merton model, it takes into account that investors have an alternative to investing in securities earning risk free interest rate. Basically, this formula is used to acknowledge that an option cost is a function of stock-price […]

Assignment Definition: Day Trading Terminology

If you are new to options trading, then you probably have a lot of questions. There are many different terms out there and many of them are difficult to understand. One of those terms is an assignment. If you have never heard of the term before and you want to trade options, it’s a good […]

Rho Definition: Day Trading Terminology