- What Is Paper Trading?

- Why Paper Trading Matters for New Traders

- How Paper Trading Works

- Choose a Platform

- Trade With Real-Time Data

- Place Orders Like the Real Market

- Test Your Strategies Safely

- Build Confidence Before Going Live

- Pros and Cons of Paper Trading

- Tips for Making the Most of Paper Trading

- Treat It Like Real Money

- Keep a Journal

- Stick to One or Two Strategies

- Aim for Consistency

- Transitioning From Paper Trading to Live Trading

- Conclusion

Watch Full Video Here: Max’s Experience Learning to Trade with Warrior Trading

I get asked all the time, “What is paper trading, and do I really need to start with it?” If you’re just starting out, you’ve probably heard people say you should begin with a simulator instead of putting real money on the line. And they’re right.

Paper trading is where every trader should begin. It’s the safest way to build experience, learn strategies, and make mistakes without the financial pain.

In this article, I’ll walk you through what paper trading is, why it matters, how it works, and the right way to use it before transitioning to live trading.

What Is Paper Trading?

Paper trading is practice trading. Think of it like a flight simulator for pilots. You get real-time market data, the same charts, the same tools, but you’re trading with fake money.

This lets you experience the ups and downs of the market without putting your account at risk. Trading is risky. Paper trading gives you the chance to make mistakes without paying the price. By starting in a simulator, it’s okay to lose because the emotions don’t get that high, and you’re able to build experience.

If you’re testing a new strategy, learning hotkeys, or just trying to understand how order execution works, paper trading is the perfect training ground.

Why Paper Trading Matters for New Traders

When I started trading, I made a lot of mistakes. I chased bad setups, I didn’t have a solid strategy, and I let emotions take control. Those mistakes cost me real money that I could’ve saved if I had begun in a simulator.

The truth is, jumping straight into live trading is dangerous. You’re dealing with emotional stress, fast-moving stocks, and the possibility of wiping out your account before you even get your footing.

Paper trading matters because it gives you room to:

- Build confidence without pressure.

- Understand order routing and execution.

- Focus on strategy instead of the P&L.

The most important thing is that you’re building habits. Paper trading lets you focus on the process, not the money.

How Paper Trading Works

Paper trading is designed to look and feel just like live trading. The process is simple, but each step helps you prepare for the real market. Here’s how it works:

Choose a Platform

Most brokers — and platforms like Warrior Trading’s simulator — offer a paper trading account. You’ll usually start with a fake balance, often $25,000 or $100,000, to practice.

Trade With Real-Time Data

The simulator mirrors the real market. You see live charts, level 2 data, and volume. The only difference is that the money isn’t real, so there’s no financial risk.

Place Orders Like the Real Market

You can enter trades using the same hotkeys, order types, and routing you’d use in live trading. The fills are simulated, but the mechanics feel identical.

Test Your Strategies Safely

If you want to test a bull flag breakout, you can take that setup in the simulator a hundred times before risking your money. By the time you go live, you know exactly how to execute it.

Build Confidence Before Going Live

When I was learning, trading simulators weren’t readily available. I wish I could have avoided many of the losses I incurred from trading with real money too soon. At Warrior Trading, we encourage traders to use the simulator before stepping into a real account to build the foundation of confidence and discipline before trading with actual cash.

Pros and Cons of Paper Trading

Like everything in trading, paper trading has pros and cons.

Pros

- Risk-free practice: You can test strategies without losing money.

- Learn the tools: Get comfortable with your platform, hotkeys, and order types.

- Track performance: Build a trading record you can review later.

Cons

- No emotional impact: Losing fake money doesn’t sting the same way real losses do.

- Overconfidence risk: Some traders do well in simulation but crumble when real money is on the line. It’s important to start with a small share size when transitioning to real money for this reason.

- Bad habits: Without consequences, it’s easy to overtrade.

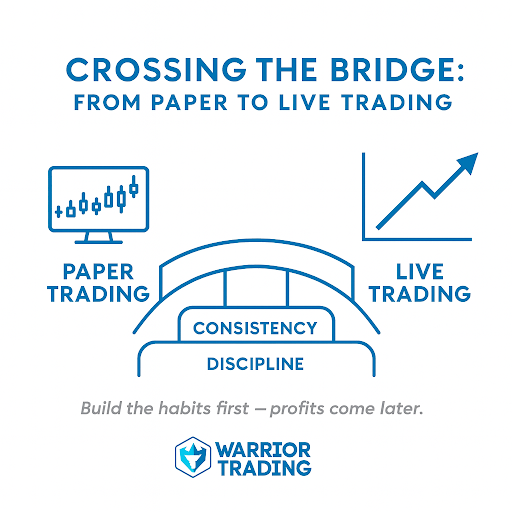

I always tell students that paper trading is essential, but it’s just the first step. The goal isn’t to stay in the simulator forever. The goal is to use it as a bridge to live trading.

Tips for Making the Most of Paper Trading

Paper trading only works if you take it seriously. Here are some tips that have helped traders in the Warrior community:

Treat It Like Real Money

Don’t take trades you wouldn’t in a real account. Every decision should mimic how you’d trade with actual cash.

Keep a Journal

Write down every trade: the setup, entry, exit, and what you learned. Reviewing your journal builds discipline and shows patterns in your behavior.

Stick to One or Two Strategies

Focus on mastering the basics before jumping around. It’s better to get really good at a couple of setups than to spread yourself too thin.

Aim for Consistency

It’s not about big wins, it’s about repeating good habits day after day. Small, consistent gains show you’re ready to move forward.

When paper trading, track every trade in a journal. That discipline can carry over when you go live and help you navigate life as a trader. That discipline carried over when I went live, and it made all the difference.

Transitioning From Paper Trading to Live Trading

So, when should you move from paper trading to live trading? You’re ready when you can:

- Trade consistently in a simulator.

- Execute your strategies with confidence.

- Show emotional discipline even when it feels boring.

Spend as much time as you need in a simulator. It’s better to feel bored than to feel broke.

If you’re forcing trades or still making impulsive mistakes, you’re not ready yet. Give yourself time. The market isn’t going anywhere.

Conclusion

Paper trading won’t make you rich. But it will save you from losing money too soon. It’s the best way to learn, practice, and build confidence before stepping into the real market.

Start with a simulator, take it seriously, and focus on building habits. When you transition to live trading, you’ll be prepared.

Paper trading won’t make you money, but it will save you from losing it too soon. Use it to sharpen your skills, and when you step into the real market, you’ll be ready.

Ready to practice without the risk? Start with the Warrior Trading Simulator and build your skills today.