If you utilize margin in your trading, you need to understand how margin works, how much it works, and how it can work against you. In this article we’ll talk about how margin rates affect buying power.

What is Margin?

Margin is credit that your broker extends to you to trade.

For example, in a $10,000 trading account, you might be able to utilize up to $20,000 in buying power for overnight trades and $40,000 for intraday trades.

In the United States, there are regulations on how much margin you can utilize within a standard brokerage account.

These are typically double your account equity for overnight trades and quadruple your account equity for intraday trades.

However, most brokers offer clients with more than $125,000 in account equity a more fine-tuned margin structure, called portfolio margin, enabling clients to use much more margin than would be allowed in a standard brokerage account.

When you trade on margin, you’re not trading with your own money, which makes it inherently riskier.

Beyond the fact that margin multiplies both the size of your losing and winning trades, it also reduces your trades’ expected value because you’re paying interest on your margin.

In order to trade with margin, you need to open a margin account with your broker. This typically involves answering some suitability questions and signing risk disclosures.

Brokerage Margin Rates Updated for 2021

Most retail brokerages charge very high margin rates.

At the time of writing, most charge around 7%, meaning that if you held the position for a year, it would cost you 7%. That’s pretty steep, considering that’s close to the historical annual return of the S&P 500.

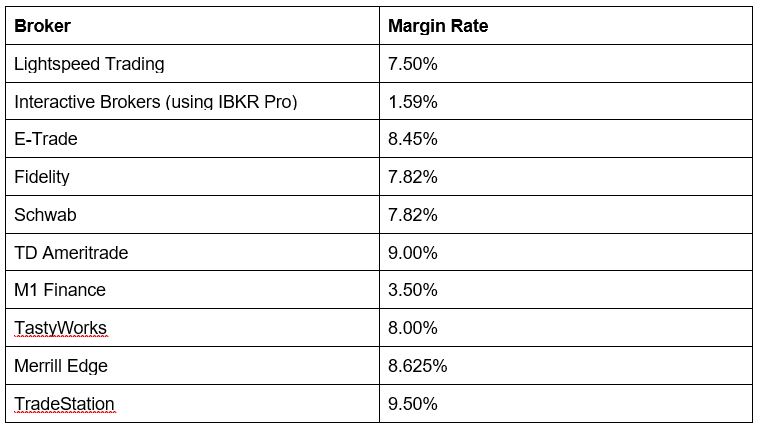

Here’s a table of margin rates for some of the top discount brokerages.

We’ll use each firm’s highest posted margin rate. Note that these are all subject to change at any given time, so keep updated with each respective broker’s website.

Note that low margin rates are one of Interactive Brokers‘ key offerings. Their margin costs just a fraction of the rest of the industry. Traders utilizing a high margin level are probably best suited to an IBKR Pro account.

The saved costs in margin would far outweigh the commission costs that IB charges, especially since you’ll probably realize better execution due to IB’s direct market access.

But cheap margin loans aren’t the sole reason to use a broker. This is what makes the discount brokerage industry so interesting right now. The competition is fierce as brokers race to differentiate themselves among an industry-wide consolidation into the larger players.

While some of the brokers on the higher end of the above table have very expensive margin, they also have terrific offerings besides that.

TradeStation, for example, has probably the strongest free active trading platform, while TastyWorks has an extremely intuitive options trading platform.

The Risks of Using Margin

Of course, all margin trading heightens risk because you’re increasing exposure and using someone else’s money to do it. However, most people know that. We’re going to highlight a risk of trading on margin that most traders don’t fully appreciate.

We’ll say it for the third time: when you’re trading on margin, you’re partly trading with someone else’s money–specifically, your broker’s money. And they dictate the terms. This means that if they feel like the securities you’re trading are too risky.

They can alter the margin requirements of securities at any given time and issue you a margin call, forcing you to either liquidate your position or give your broker more collateral.

You’re basically “signing your life away” with most margin account contracts, giving your broker massive leeway over how they treat your margin.

Many traders learned this for the first time throughout last week’s short squeeze mania. There were reports that brokers began liquidating positions in stocks like GameStop (GME) and Koss Audio (KOSS) without their clients’ permission. In the majority of these cases, the traders were likely utilizing margin.

The drawbacks of utilizing margin, magnified losses, potential margin calls, and paying interest are stark reminders that there’s no free lunch in the financial markets.

How Margin Rates Affect Buying Power

The influence margin has on your buying power depends on a few things:

- Your region. Each country has different regulations or lack thereof with regard to how much margin retail traders can use.

- Your account equity. In the US, brokers can offer you portfolio margin if you have a minimum account size of $100,000. However, many brokers have higher requirements or don’t offer the service at all.

- Your account type. You must have margin enabled to utilize margin. Cash accounts, of course, cannot use margin.

- Your level of risk. Brokers can decide not to extend you margin if your trading is too risky.

The everyday small brokerage account with less than $100,000 in the United States has pretty uniform margin standards:

- 2:1 overnight margin (meaning if you have $10,000, you can access up to $20,000)

- 4:1 intraday margin (for trades opened and closed within the same session)

It gets more complicated when you look into different countries. Seek out information from your local securities market regulators.

If a broker raises margin rates then you will have to pay more in interest for borrowing those same funds to purchase stocks. A higher rate also means you may have less buying power since you will have to pay more in interest and won’t be able to buy as much stock.

Keep in mind that if you day trade a stock on margin, you don’t have to pay margin interest. Only if you hold the stock over night using margin will you then have an interest payment deducted from your account.

What is Portfolio Margin?

Once your account reaches $100,000, your options expand.

The first thing to determine is whether portfolio margin fits your needs as a trader/investor, then check if your broker even offers portfolio margin because many do not.

Then, you need to figure out their minimums for portfolio margin consideration. Interactive Brokers offers it at as low as $110,000, while Lightspeed Trading requires a heftier $250,000 minimum.

If you apply for portfolio margin, your broker will check your suitability through various background checks like your trading history and your trading knowledge.

So what are the benefits of portfolio margin?

They’re twofold.

The headline is that your broker will extend you much more margin, up to 6x for overnight stock positions. But the more interesting aspect of portfolio margin is that your broker judges the risk of your positions on a portfolio level, rather than on each individual position.

This comes in handy for more complicated arbitrage strategies.

Perhaps you’re pairs trading, and you’re using options to create synthetic short positions in one stock, while going long outright shares of another related stock.

This might be a situation where your buying power requirements would be much lower than a traditional Regulation T margin account, because your broker can see that the overall strategy’s risk is low, even though the exposure is high.

Bottom Line

For the right strategy, margin can boost profits without creating catastrophic risk.

However, we traders tend to underestimate our strategies’ worst-case scenario, so make sure you fully understand how margin works and how margin rates can affect buying power.

Also, remember by using margin, we give up certain aspects of control over our trades. If things go haywire, our broker has the right to liquidate our positions without consulting us.