- The Best After-Hours Screeners

- Warrior Trading After-Hours Tools (Day Trade Dash + Chat Room + Education)

- Trade Ideas After-Hours Screener

- TrendSpider After-Hours Screener

- FINVIZ Elite After-Hours Screener

- TradingView After-Hours Screener

- How Do I Choose an After-Hours Screener?

- Comparison Table

- Frequently Asked Questions

- What is after-hours trading, and why does a screener matter?

- How do after-hours screeners differ from regular-session screeners?

- What features should I prioritize in an after-hours screener?

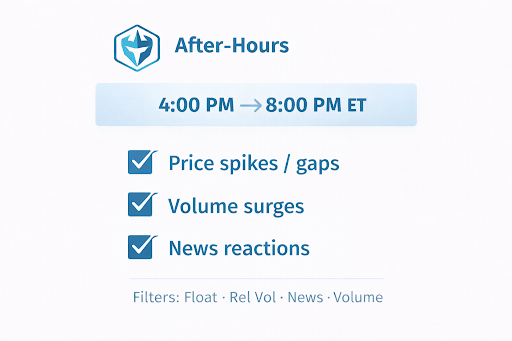

Extended-hours price action often moves quickly and unpredictably, making it difficult for traders to separate meaningful activity from noise. After-hours screeners help identify significant price changes, volume spikes, and news-driven reactions that occur once the regular session has closed.

An after-hours screener is a tool designed to track stock activity between 4 p.m. and 8 p.m. ET. These tools highlight post-market gaps, catalyst-driven moves, and unusual activity that may influence the following trading day. Compared to regular-session stock scanning, after-hours screening depends heavily on real-time data, flexible filters, and layouts built for rapid decision-making during periods of lower liquidity and heightened volatility.

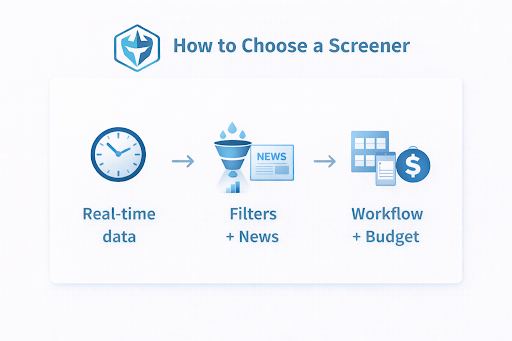

Selecting the best screener typically comes down to real-time accuracy, available filters, news integration, pricing, and the trader’s preferred workflow. Some traders value automation, others prioritize visualization, while others look for fast, minimalistic tools.

The Best After-Hours Screeners

The platforms below offer reliable tools, real-time data, and feature sets designed to help traders analyze market activity that occurs beyond standard trading hours.

1. Warrior Trading Day Trade Dash

Warrior Trading’s Day Trade Dash (DTD) is a purpose-built after-hours trading platform designed by Ross Cameron, the momentum trader who invented Day Trade Dash and uses it daily in his own trading. Built specifically for active day traders, DTD combines fast scanners, clean charts, and relevant news to help traders identify high-quality momentum opportunities when volatility is highest.

Unlike generic platforms, Day Trade Dash works right out of the box. Predefined layouts, indicators, and filters remove unnecessary noise, allowing traders to focus on actionable setups instead of endless alerts or irrelevant headlines. The result is a streamlined experience built for speed, clarity, and execution during extended trading hours.

Through Warrior Trading, traders also gain access to Ross Cameron’s education and resources, including real-time commentary, structured learning, and community support, reinforcing how and why Day Trade Dash is used in live market conditions.

Key strengths of Day Trade Dash:

- Lightning-fast scanners designed for after-hours momentum

- Charts + news layouts created by Ross Cameron specifically for day traders

- Predefined indicators and layouts that require minimal setup

- Noise-reducing filters that surface only relevant opportunities

- Seamless integration with Warrior Trading education + mentorship from Ross Cameron

- Simulator access for practicing extended-hours strategies

Ideal for: beginners and intermediate traders who want a focused after-hours trading tool designed by a proven momentum trader, paired with education and resources from the creator of Day Trade Dash himself.

2. Trade Ideas After-Hours Screener

Trade Ideas is known for its advanced scanning capabilities and automated insights that remain active after the closing bell.

Why traders use it:

- AI-driven alerts through its premium features

- Custom filters for after-hours volume, price %, float, gaps, and volatility

- Rapid, intraday-style data that extends into post-market hours

- Room access for expert demonstrations

3. TrendSpider After-Hours Screener

TrendSpider appeals to traders who want automation to handle the repetitive parts of the job. It identifies patterns and levels even after the market closes.

Key capabilities:

- Automated chart pattern detection during extended hours

- Alerts for C, consolidations, and unusual moves

- Smart trendline recognition to save research time

- Flexible filters for technical analysis fans

Ideal for: tech-heavy traders who want pattern alerts without manually scanning charts.

4. FINVIZ Elite After-Hours Screener

FINVIZ Elite offers powerful real-time scanning with a ton of filter depth. It’s straightforward for intermediate traders who want granular data.

Highlights:

- After-hours quotes, real-time updates, and intraday charting

- 500+ screening filters, including share structure and IPO filters

- Heatmaps for quick visual understanding

- Portfolio tools and backtesting for strategy refinement

Good for: traders who want clean visuals and detailed filtering at a reasonable cost.

5. TradingView After-Hours Screener

TradingView is one of the most accessible screeners for newer traders. Its multi-asset coverage makes it useful for stocks, crypto, and forex traders active after hours.

Strengths:

- Intuitive interface with charting built directly into the screener

- Free version includes technical and fundamental filters

- Massive community and shared scripts

- Works well for beginners who are testing different ideas

Limitations: real-time data and extended-hours tools often require upgrading.

How Do I Choose an After-Hours Screener?

Choosing an after-hours screener depends on trading style, budget, and preferred method of analysis. Technical traders may prioritize automated pattern alerts, while catalyst-driven traders often prefer platforms with strong news integration. Others may value simplicity or filter depth.

To make the decision easier, here’s a quick comparison table summarizing what each platform brings to the table:

Comparison Table

| Screener | Strengths | Weaknesses | Ideal User |

| Warrior Trading | Mentorship, community, fast scanners, simulator | Best features inside ecosystem | New–intermediate traders |

| Trade Ideas | AI-driven alerts, deep filters | Expensive, complex | Active/pro traders |

| TrendSpider | Automated patterns and alerts | Less fundamental data | Technical traders |

| FINVIZ Elite | Filter depth, clean visuals | Free version limited | Intermediate traders |

| TradingView | Easy to use, community tools | Real-time data paywalled | Beginners and cross-market users |

Helpful selection tips:

- Prioritize real-time after-hours data

- Match the tool’s filters to your strategy

- Compare pricing with expected usage

- Test platforms through demos or free trials

- Build structured routines around post-market screening

Traders building a more complete setup can also explore the best tools for day trading to complement their after-hours screening workflow.

For traders who want guidance while learning, Warrior Trading’s ecosystem is especially useful. The stock scanners, chat room, and daily commentary help reinforce decision-making so extended-hours movement becomes part of a structured process.

Frequently Asked Questions

What is after-hours trading, and why does a screener matter?

After-hours trading happens from 4 p.m. to 8 p.m. ET, when price discoveries continue even though the main session is closed. A screener is important because it identifies unusual price changes, volume spikes, and catalyst-driven activity that might influence the next trading session.

How do after-hours screeners differ from regular-session screeners?

They’re optimized for lower-volume, higher-volatility environments. These tools focus on real-time extended-hours data, specialized filters, and rapid updates that are often not included in standard session screeners.

What features should I prioritize in an after-hours screener?

High-quality after-hours screeners typically include real-time quotes, customizable filters for price and volume changes, integrated news sources, alert systems, and a layout that supports fast analysis during rapidly shifting conditions.