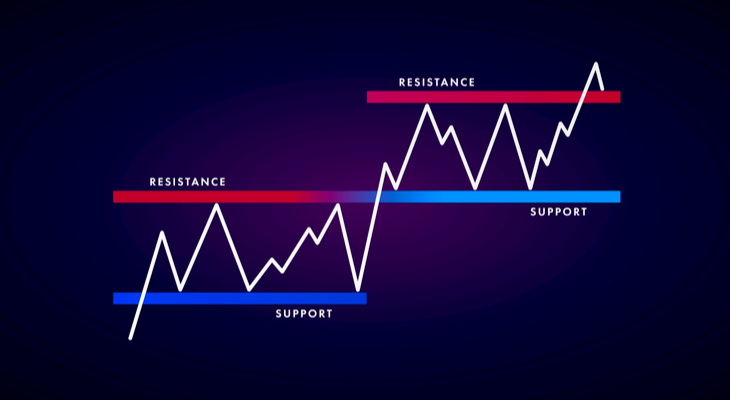

Momentum swing trading strategies are perfect for traders looking to capitalize on strong moves that tend to materialize quicker than other strategies on a higher time frame. The Basics: Momentum Swing Trading Strategies All trading strategies fall into one of two categories: trend-following (you’re trading in the same direction that the market is moving/has […]