- What Is the 1-Minute Scalping Strategy?

- When I Use the 1-Minute Scalping Strategy

- The Rules of My 1-Minute Scalping Strategy

- The Stock Must Already Be Moving

- Wait for the First Micro Pullback

- Enter as the Pivot Reclaims

- Use Tight Stops

- How I Time My Entries on the 1-Minute Chart

- Where I Take Profit on a 1-Minute Scalping Trade

- Half-Dollar Levels

- Whole-Dollar Levels

- Signs of Exhaustion

- Risk Management for Fast Scalps

- Real Examples of the Strategy in Action

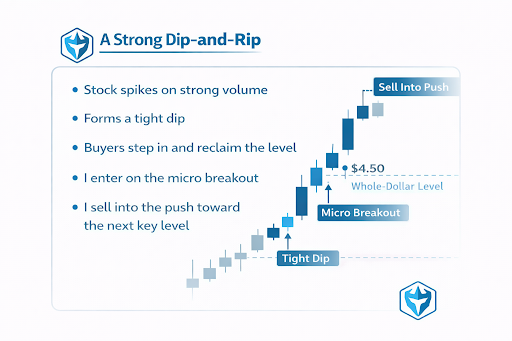

- A Strong Dip-and-Rip

- A Weak Follow-Through

- Final Thoughts

Watch Full Video Here: Day Trading the 1-Minute Dip & Rip Strategy

Scalping on the 1-minute chart has been one of my most reliable ways to capture quick moves in fast-moving markets. When a stock is squeezing on strong news or sector momentum, the window to participate can be incredibly small.

Waiting for slow, traditional pullbacks rarely works. A lot of times, the only way to participate in the move is to jump in relatively quickly.

My 1-minute scalping strategy is built around a simple core idea: buy the dip, sell the rip. It’s a fast, aggressive approach that focuses on capturing the first leg of momentum rather than holding for extended moves.

Whether I’m trading premarket gappers or stocks taking off after the opening bell, this strategy helps me react quickly, manage risk tightly, and lock in gains while the momentum is hot.

What Is the 1-Minute Scalping Strategy?

The 1-minute scalping strategy is a momentum-based approach designed to capture quick bursts of movement on highly active stocks. I look for tiny pauses in momentum, often just a single red candle or a momentary dip, and use those to position myself before the next surge.

In simple terms: I buy the micro dip and sell into the first push toward the next psychological price level.

These psychological levels are almost always:

- Half-dollars (2.50, 3.50, 4.50…)

- Whole dollars (3.00, 4.00, 5.00…)

When a stock is flying, traders naturally gravitate toward these levels, which creates the volume I need to exit safely.

When I Use the 1-Minute Scalping Strategy

I reserve this strategy for stocks that show exceptional early strength. Before I even consider a scalp, the stock needs to check a few boxes:

- A strong premarket gap

- High relative volume

- A clear reason for the move

- A directional chart with clean momentum

If something is choppy, slow, or reversing every other candle, I avoid it.

On extremely strong stocks, especially low-float gappers, the 1-minute chart often provides the only chance to get involved.

The Rules of My 1-Minute Scalping Strategy

Over the years, I’ve refined this into a handful of strict rules. If any of them break, I skip the trade.

1. The Stock Must Already Be Moving

Momentum is the backbone of this trading strategy. I want stocks that are up significantly on the day, showing clear strength, and attracting attention. If the energy isn’t there, the scalp won’t work.

2. Wait for the First Micro Pullback

This is usually:

- A single red 1-minute candle

- A tight consolidation

- A lower wick, showing buyers stepping in

Sometimes, I’ll zoom into a 10-second chart to spot the exact moment selling pressure stops. I’m looking for the dip to weaken, not to collapse. If the pullback is too deep, I walk away.

3. Enter as the Pivot Reclaims

My entry trigger is simple:

- The micro pivot breaks

- Buyers step up on Level 2

- The dip is reclaimed with strength

I’m not trying to time bottoms. I’m waiting for proof that buyers are back in control.

4. Use Tight Stops

With fast scalping, I can’t give a trade room to unravel. My stops are tight, sometimes only a few cents on cheaper stocks. The goal is to be right quickly or get out quickly.

If a scalp hesitates, stalls, or absorbs too much selling, I bail immediately.

How I Time My Entries on the 1-Minute Chart

Timing is the heart of this strategy. I’m watching:

- Tape speed

- Level 2 pressure

- Volume surges

- Micro wicks

- Pivot levels

The exact moment I enter is usually when:

- A micro pivot breaks

- A small red candle turns green

- A sudden wave of buyers hits the bid

On extremely volatile stocks, I’ll use the 10-second chart to refine the entry. It gives me a close-up view of where momentum is shifting.

Where I Take Profit on a 1-Minute Scalping Trade

Profits come fast with this strategy, sometimes within seconds. My first targets are always predictable price levels:

1. Half-Dollar Levels

These often trigger quick liquidity spikes. Lots of traders take profits here, which gives me reliable exits.

2. Whole-Dollar Levels

If the stock has the strength to break through the whole-dollar level, the move can be explosive. But I still take profit into the level rather than assuming a clean break.

3. Signs of Exhaustion

If I see selling pressure hit the tape:

- Heavy offers

- Thick walls on Level 2

- Sudden drops in volume

I get out. I don’t wait for confirmation. Scalping is about catching the front side of the move, not trying to milk every last cent.

Risk Management for Fast Scalps

Scalping moves fast, so my risk management has to be even faster. I keep my size small early in the day, use tight stops, and avoid chasing breakouts that don’t come with a clean dip. If a stock shows thick sellers, choppy action, or hesitation on the tape, I back off immediately.

When I see the price getting heavy on the offer, too many sellers stacking Level 2, or repeated failures at a key level, that’s my signal to step aside. One of the biggest mistakes traders make is forcing trades on stocks that already told them “no.” I’ve learned to walk away quickly to protect the rest of my day.

Real Examples of the Strategy in Action

Here’s what a clean 1-minute scalp looks like:

A Strong Dip-and-Rip

- Stock spikes on strong volume

- Forms a tight dip

- Buyers step in and reclaim the level

- I enter on the micro breakout

- I sell into the push toward the next key level

That entire sequence can play out in under 30 seconds. But when it works, the reward is consistent.

A Weak Follow-Through

Sometimes the setup checks every box, including momentum, volume, and dip, but still fails. When a stock dips too deeply, retraces the entire move, or can’t reclaim a key level, that’s my cue to walk away.

Not every dip leads to a rip, and I never assume a breakout will continue.

Example integration: After buyers stepped in and reclaimed the level, the move took off fast. We got the squeeze through 2.80, 2.85, 2.90, up to a high of about 3.04. That kind of immediate momentum is exactly what I’m targeting with this strategy.

Final Thoughts

The 1-minute scalping strategy is fast, aggressive, and highly effective when applied with discipline. It works best on stocks that are already showing strong momentum and attracting significant attention. My job isn’t to predict the biggest move of the day. It’s to catch the cleanest part of the move while the risk is manageable.

Like I always remind traders: trading carries risk, and no strategy works every time. But if you stay patient, wait for the right dips, and take profits quickly, the 1-minute scalping strategy can be a powerful tool in your playbook.

If you want to dive deeper into strategies like this, check out my trading classes and tools at Warrior Trading — that’s where I teach it all in real time.