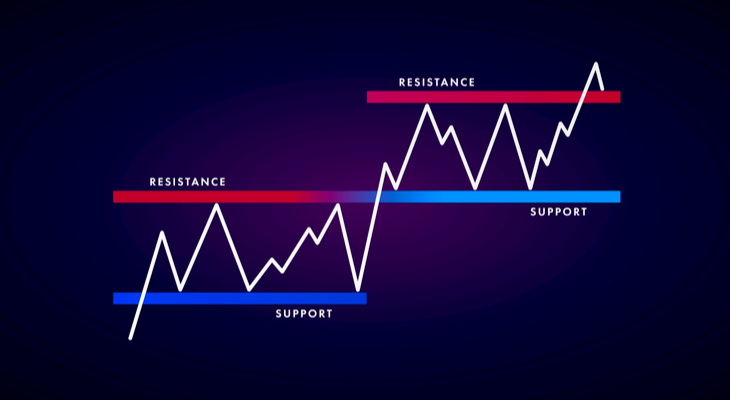

Supply and demand are the underlying forces behind every chart breakout, every failed parabolic move, and each bounce off support and resistance. It’s easy for us to get wrapped in the minutia of the trading world; indicators, backtesting platforms, metrics, etc. But, while these trading tools are undoubtedly useful, they can sometimes serve to […]