What is a SPAC?

SPAC stocks is a Special Purpose Acquisition Company.

They’re essentially shell companies that raise money, go public, then use the funds to buy a company and bring it public.

You can think of them as publicly-traded venture capital firms that only ever make one investment with a specific deadline to make said investment. Most of the time, the deadline is two years.

SPACs are referred to as “blank check companies” because investors give the SPAC sponsors a bunch of money without knowing what they’re going to buy with it.

The sponsors can now go out and try to pursue a takeover of a private business to bring it public.

Here’s the rough timeline for a SPAC:

- Form a shell company and prepare for an IPO. This includes raising funds from investors, drafting a prospectus, and other administrative tasks.

- Once the SPAC IPOs, they start searching for a deal. Typically, a SPAC has two years to find a deal, but because mergers can take several months to complete, most find deals well before the two-year mark.

- Execute the transaction. They agree to a price with their target company and complete the merger upon a successful shareholder vote.

Here’s how it works for you, the investor:

- A SPAC IPO offering is made available. You can read the prospectus (S-1) and do other due diligence to see if it’s a good opportunity.

- If your broker has an allocation available, you can buy shares of the SPAC. Almost every SPAC IPOs at $10 per share for the sake of tradition. Sometimes warrants and other securities are offered to sweeten the deal.

- If you purchase shares, your money is used by the sponsors to buy a private company and bring it public.

- When the SPAC managers purchase a company, your SPAC shares are converted into shares in the acquired company.

Why Are SPACs Suddenly Popular?

We’re seeing several billionaires like Bill Ackman, Chamath Palihapitiya, and Reid Hoffman all entering the SPAC space over the last few years, so it’s clear the payoff for running a successful SPAC is huge.

Fees generated by a SPAC vary but generally are around 2% of the SPAC value, plus $2 million, SPAC operator Troy Steckenrider told TechCrunch, although legendary managers can demand a premium.

According to Harvard, SPACs raised more money in 2020 than they did in the entire preceding decade. Below is a chart from SPACalpha showing the precipitous growth of SPACs in 2020:

The most significant catalyst for the sudden SPAC popularity is likely Chamath Palihapitiya, who, in 2017, brought Virgin Galactic (SPCE) public through his first SPAC, Social Capital Hedosophia.

Chamath is very passionate about SPACs because to him, only wealthy Silicon Valley venture capitalists have access to the best deals on the private market, and retail investors only get access once these companies are mature.

He sees SPACs as a way to democratize access to earlier-stage moonshot companies.

The Role of Retail

SPACs are responsible for taking retail darlings like Virgin Galactic (SPCE), DraftKings (DKNG), and Nikola (NKLA) public.

All three were wildly successful in their first few months of trading, even if they’ve retreated gains since then.

Couple retail enthusiasm for new and exciting industries like space exploration and electric vehicles with the pandemic-driven stock trading boom, and you have a SPAC craze.

Among many other things, 2020 was the year of the SPAC on Wall Street, with a considerable portion of the volume coming from price-agnostic retail traders.

Here’s a chart from the Why Axis on Substack displaying the number of new brokerage accounts added in Q1 2020:

These new traders are happy to take massive risks because of their small average account size, hoping to multiply a few thousand dollars into several thousand. So they traffic in volatile small-cap stocks and weekly options on high-momentum stocks.

Of course, they love SPACs, which, to them, represent venture capital-like opportunities.

Matt Levine, who writes the daily Bloomberg newsletter Money Stuff, coined the “Boredom Market Hypothesis,”

He explains that heaps of ordinary people started trading stocks because they were bored during the pandemic.

Under normal circumstances, they might be going to events or socializing with friends, but they’re stuck in their house, so they start trading stocks to pass the time.

SPACs vs. IPOs

The IPO is the traditional way to go public. You talk with a prestigious investment bank like Goldman Sachs for months, then you get to cash out and ring the bell on the New York Stock Exchange.

However, the IPO is far from the only way for a company to go public. There are reverse mergers, direct listings, and now, the SPAC has entered as an acceptable alternative even though it’s been around since the 1990s.

So why would a company choose to go public through a SPAC rather than an IPO?

Growth Stage

The big banks like Goldman Sachs and JP Morgan hold the keys to the IPO.

If they think the risk of dealing with your company is too high, they won’t do business with you. Up until recently, they’ve been de-facto gatekeepers of financial markets, for better or worse.

IPO candidates are mostly late-stage growth companies. They’ve matured from their early venture capital funding rounds and have a clear path to profitability and continued sales growth.

Recent examples are Snowflake (SNOW) and Asana (ASAN).

But what if a more speculative, early-stage firm wants to access the public markets? The big underwriters like Goldman probably don’t want to put their name on that. Going public through a SPAC presents a viable alternative for these types of companies.

Pricing Mechanism

SPACs and IPOs reach their valuation very differently.

With an IPO, you and the underwriters deliberate over market research and financial projections for months before heading out to roadshows to feel out investor sentiment.

From there, the company owners and underwriters try to reach a price that will meet the perceived supply and demand and make the owners happy.

There’s a problem with the IPO pricing mechanism, however. IPOs are structurally underpriced. Many smart people believe that underwriters underprice IPOs intentionally to offer allocations to high-value clients.

This transfers wealth from private holders to those who get IPO allocations. Venture capitalist Bill Gurley is among those smart people, and he expanded his thinking in this Twitter thread.

SPACs reach a price through negotiation.

The SPAC managers are trying to buy for the lowest price, and the company owners are trying to sell for the lowest price.

Because there’s plenty of PE firms, SPACs, etc., out there competing for company attention, it’s not unreasonable to believe that this is a more efficient pricing mechanism, as a real market is made.

Incentives

When you IPO, you typically pay the underwriters in cash rather than equity. Ultimately, they probably don’t care too much about the stock price’s success after the IPO is complete.

On the other hand, SPAC managers receive most of their compensation through equity. So they have an interest in the success of the company.

The Effects of SPAC Stocks Popularity

The last decade or so has seen all of the best, highest-growth deals privately financed by venture capitalists and private equity. Only when those deals mature past their hockey stick-growth phase, do the insiders decide to go public to liquidate.

So we investors and traders are left with a poorer set of opportunities due to circumstances we can’t control. If we want the best deals, we would need to become angel investors.

SPACs create an incentive for people like Bill Ackman and Chamath to make millions while also providing the public markets with potential moonshots.

Tanay Jaipuria posted an excellent chart displaying this shift in favorability away from public markets. All of the value creation now happens privately:

Beyond good opportunities, the increase in SPAC popularity will increase the number of public companies overall, which is always a good thing for traders and investors.

SPAC Statistics

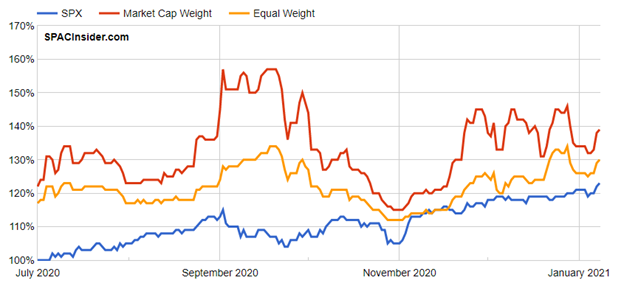

SPAC Insider, a blog tracking SPAC performance, publishes a “SPACDex,” which compares the performance of all SPACs to the S&P 500.

Over the trailing six months, SPACs have steadily outperformed the index from both market cap-weighted and equal-weighted points of view.

If you look further in the rear-view mirror, the picture isn’t as rosy.

WSJ reports that SPACs have historically underperformed the S&P 500 by 3%. The improvement in SPAC performance recently is probably a result of lots of really competent people like Ackman and Chamath entering the space.

Still, the time horizon is too short to make any real determination.

SPACs are also getting better at finding deals as of late. A McKinsey report found that more than 90% of post-2015 SPACs completed their merger, compared with 80% of pre-2015 SPACs.

They attribute this to SPACs becoming a more acceptable capital source for companies wanting to go public, driven by high-profile investors and executives entering the space.

SPACs also made up a huge portion of 2020 IPOs, according to McKinsey:

“…as of August 2020, SPACs that were actively seeking business combinations held about $60 billion of capital (across more than 100 SPACs) and made up 81 out of 111 US IPOs.”

Where To Find Data on SPACs

To find a list of publicly traded SPACs, Barchart.com has a list that, at the time of writing, has over 400 tickers.

Many SPAC bloggers and reporters have also propped up as a result of the increase in activity. Two of the more popular sources are SPACalpha and SPACinsider.

Bottom Line

While SPACs present potentially great opportunities to retail investors, remember that there’s never a free lunch in the financial markets. Especially when you hear about it all the time in the press.

Harvard struck a cautious tone when discussing the deal SPAC shareholders get in their report titled A Sober Look at SPACs, with their chief complaint being the dilution that SPAC shareholders suffer.

As always, don’t get caught up in moonshot hype without performing your own rigorous due diligence on the situation.

Everyone has the same access to information as you, so if something seems too good to be true, it almost always is.