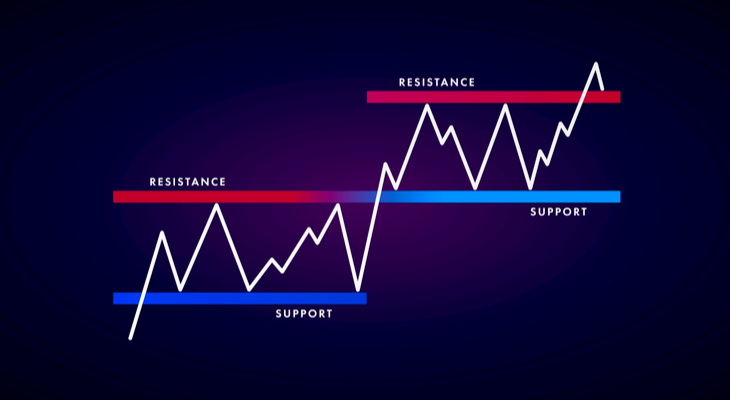

If you are going to actively trade stocks as a day trader, then you need to know how to read charts. Charts are the primary tools for technical analysis. They conveniently visualize the price action by plotting the historical market data of the underlying financial instrument on a graph. This visual representation allows for quicker identification […]